Pound-Canadian Dollar Upturn Supported by BoE’s Tentative Lead Over BoC

- Written by: James Skinner

- GBP/CAD’s upturn supported by BoE’s rate outlook

- 2022, 2023 rate assumptions see BoE ahead of BoC

- After July’s BoC points to 2023 before cash rate lifts

- CA’s horsepower may see BoC leading BoE thereafter

- GBP/CAD could make further attempts on 1.75 ahead

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7392

- Bank transfer rates (indicative guide): 1.6783-1.6905

- Money transfer specialist rates (indicative): 1.7235-1.7270

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar rate was buoyant near 1.74 in the penultimate session of the week and might now find itself better supported in the months ahead after the Bank of England (BoE) has unambiguously signalled that it could lift interest rates before the Bank of Canada (BoC).

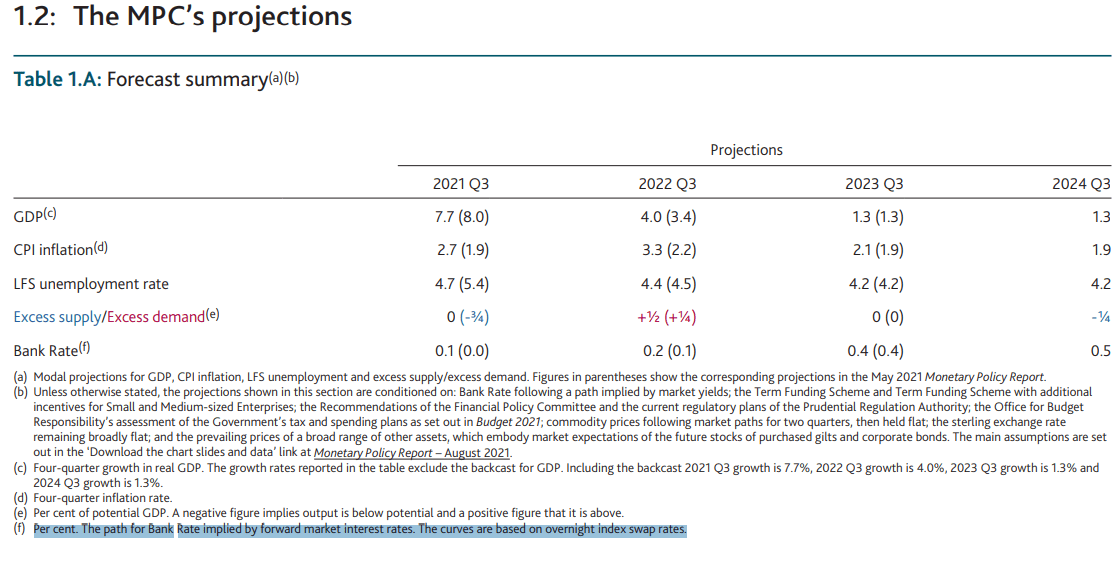

Thursday’s monetary policy decision from the BoE was most notable for the currency market because for the first time in as long as the author remembers the Monetary Policy Committee went out of its way to draw attention to the fact that its forecasts for inflation and other economic variables are built upon the assumption that Bank Rate will eventually rise in line with market expectations.

Expectations are this August for a 0.1% increase that takes Bank Rate to 0.20% by the third quarter of 2022, with this move followed by a total additional increase of 0.20% by the third quarter of 2023 before a final incremental 0.10% increase takes Bank Rate up to 0.50% in 2024.

“The Committee’s updated projections for activity and inflation are set out in the accompanying August Monetary Policy Report. They assume that, despite the spread of the Delta variant, the impact of Covid on the UK economy fades further over time. They are also conditioned on the market path for interest rates,” the BoE says in its summary of Thursday’s monetary policy decisions.

“UK GDP is expected to have risen by 5% in 2021 Q2, leaving it around 4% below its pre-pandemic level and slightly stronger than expected in the May Report,” the BoE later added.

Above: Bank of England economic forecasts from August Monetary Policy Report.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The projections suggest the BoE intends to lift its interest rate in increments of only 0.1% coming out of the crisis - much smaller than the 0.25% increments typically used before the coronavirus came along - while the decision to draw attention to these assumptions may have been intended as a not-so-subtle hint if not an elbow in the ribs of market commentators.

An overwhelming majority of those have suggested and assumed in their own forecasts of late that the BoE is unlikely to indulge overnight-index-swap (OIS) market expectations for the coming years, with many forecasting Bank Rate would remain at 0.10% until 2023 or even later, though all were given reason to be dissuaded of those views this Thursday.

“While the MPC’s policy statement sent a signal that higher interest rates are on the horizon, we still think it’s more likely that the MPC continues to sit tight until the middle of 2023 before tightening policy,” says Ruth Gregory, a senior economist at Capital Economics.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“We think inflation will be a bit lower next year than the Bank expects, which suggests policy won’t be tightened until mid-2023, rather than the mid-2022 date priced into the markets,” Gregory explains.

Driving the BoE’s decisions and the market’s assumptions is the outlook for UK inflation, forecasts for which were upgraded almost across the board by the BoE on Thursday, with the four-quarter measure of the main inflation rate now expected to reach a peak of 3.3% in third-quarter of next year 2022..

Some forecasters including those at Capital Economics doubt that inflation will rise that far or be sustained near to the BoE’s 2% target in the medium-to-longer term, which determines the difference between their expectations for Bank Rate and those of the BoE and market.

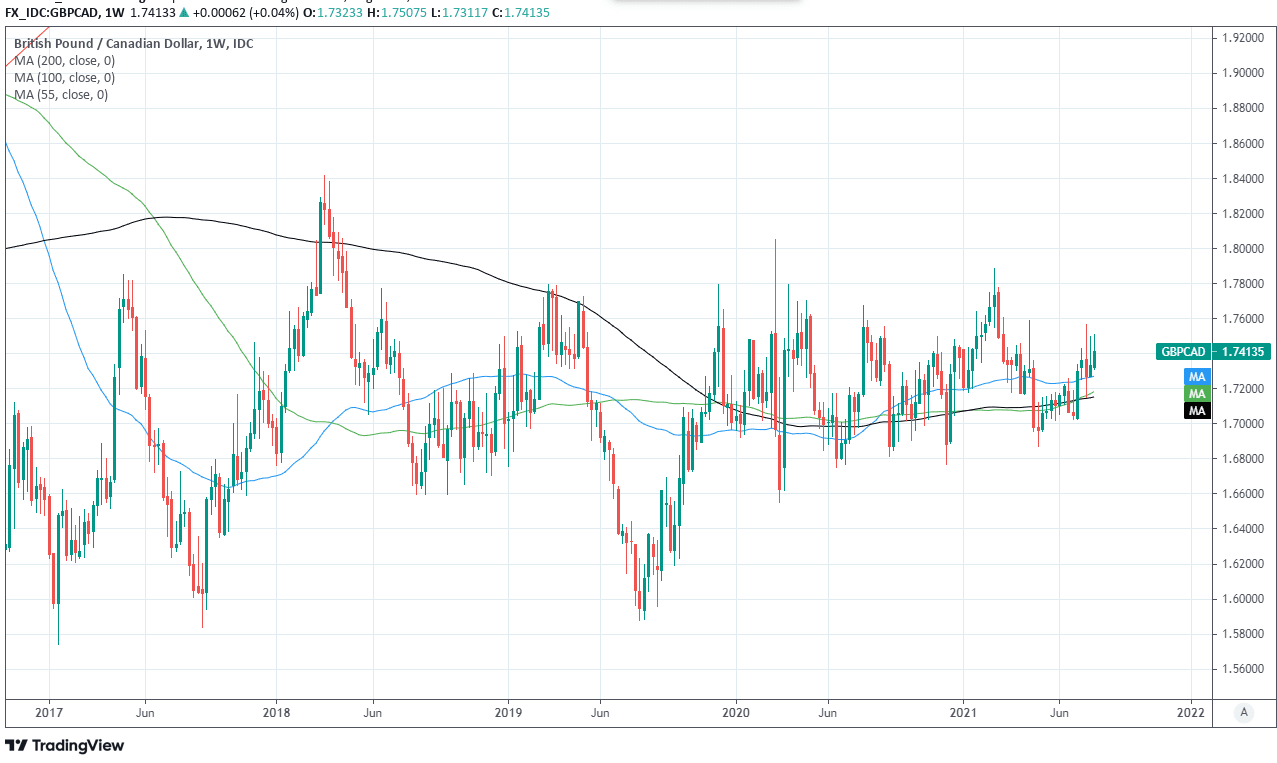

Above: Pound-to-Canadian Dollar rate shown at daily intervals with 200-day moving-average (MA) and USD/CAD.

It’s inflation which central banks are seeking to manage when they tinker with interest rates and other monetary policy tools like quantitative (QE) policies, all of which were left unchanged on Thursday with a total of £895BN worth of government and corporate bonds still the BoE’s QE target, and with Bank Rate remaining at 0.10%.

"The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In our projection, this does not happen until into 2023," the BoC said in July.

The BoE’s forecasts are potentially supportive of the outlook for GBP/CAD because when combined with July’s guidance from the BoC, they suggest that UK interest rates could begin rising sooner than those in Canada.

They also suggest some scope for the BoE and BoC to have matching interest rates for a period of time in 2023, though much depends here on how fast the BoC raises its 0.25% cash rate after beginning the lift-off process.

The BoC could quickly pull ahead of the BoE once lift-off begins because it assumes that Canada’s economic horsepower is such that generally higher levels of interest rates are necessary over the medium-to-longer term to keep inflation around the 2% target.

“We like GBP higher as we push towards the fall. Yet it is likely to hold 1.40 now, arguing to buy the dips rather than chase the move,” says Mark McCormick, global head of FX strategy at TD Securities, referring to the main Sterling exchange rate GBP/USD.

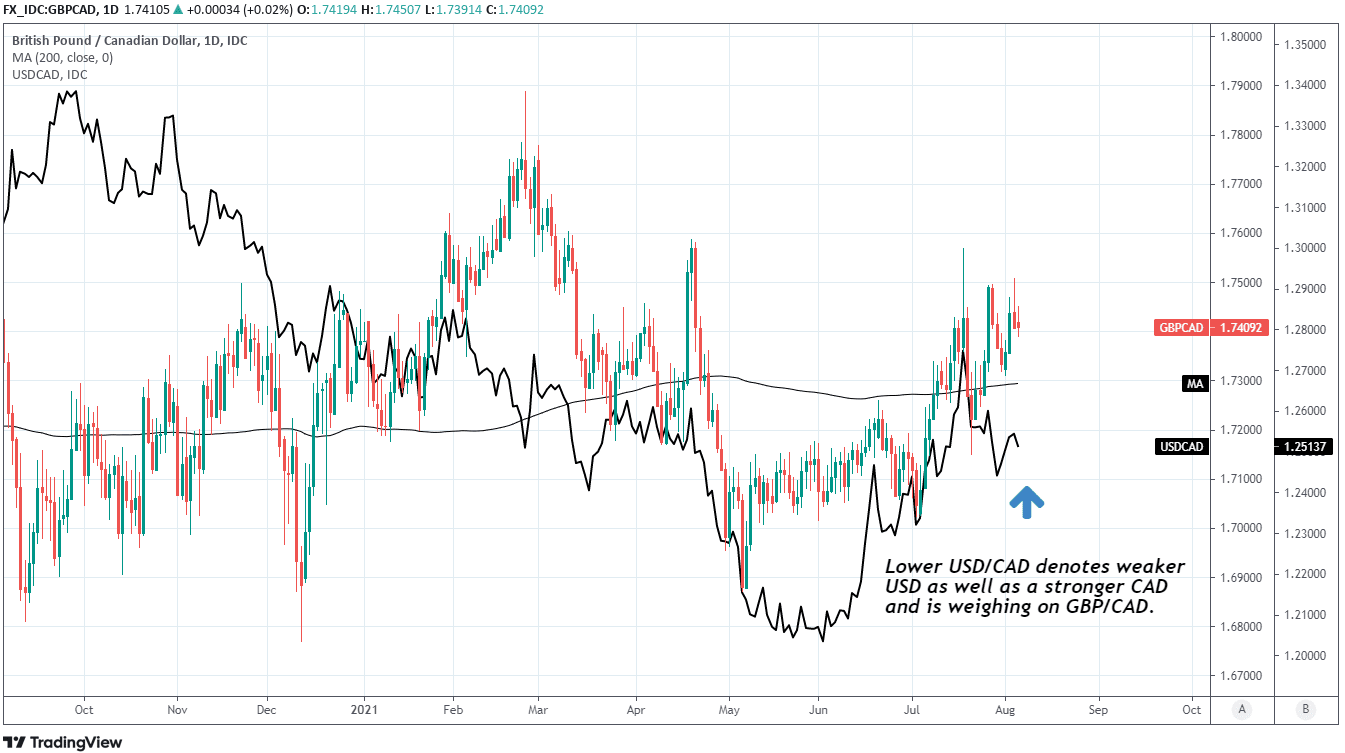

The Pound-to-Canadian Dollar rate closely reflects relative price developments in GBP/USD and the main Canadian exchange rate USD/CAD so would have scope to further test the 1.75 level over the coming weeks if TD Securities is right about GBP/USD targeting 1.40 and if, at the same time, the Loonie struggles to push USD/CAD below 1.25.

TD Securities favours a lower USD/CAD rate however, and that implies plenty of pushback from the Canadian Dollar and little, if any scope for GBP/CAD to get much above 1.75.

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with various major moving-averages.