Pound-Canadian Dollar Week Ahead Forecast: Struggling Above 1.72 after BoE Stymies Breakout

- Written by: James Skinner

- GBP/CAD finding footing but BoE’s patience limits upside

- Risks condemning GBP/CAD to range-bound consolidation

- Canadian GDP and U.S. economic data in focus this week

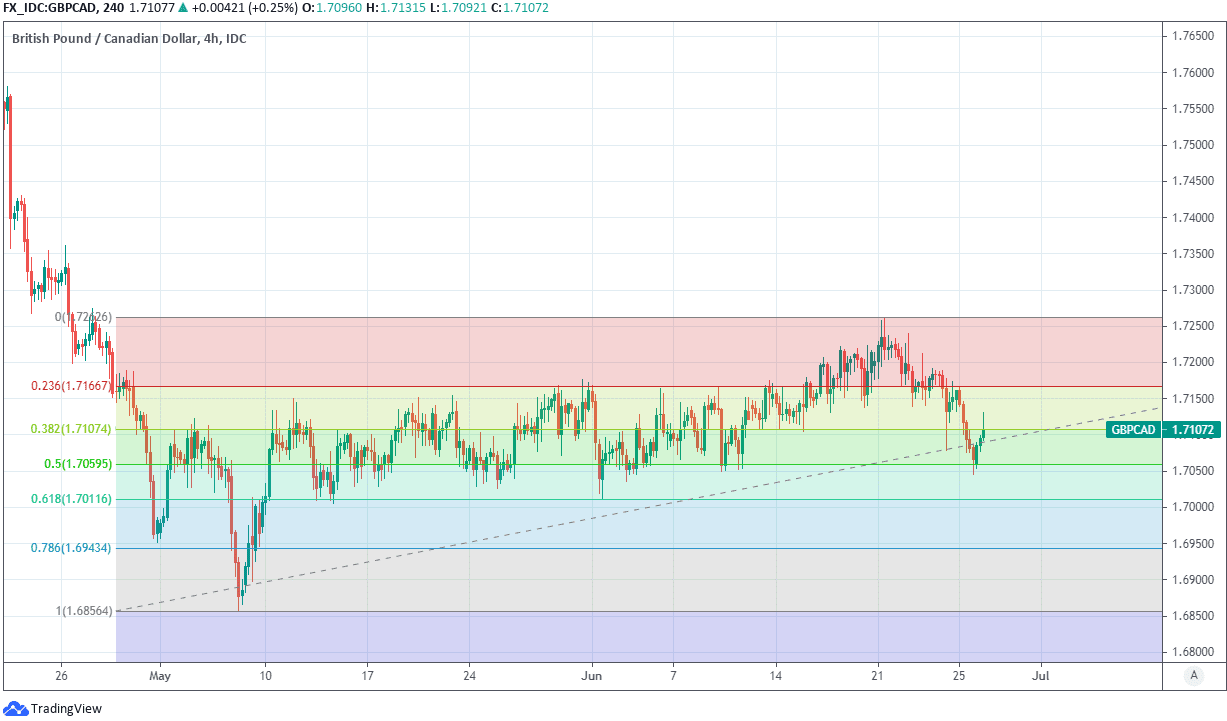

- GBP/CAD supported at 1.70 but may struggle above 1.72

Image © Bank of Canada

- GBP/CAD reference rates at publication:

- Spot: 1.7111

- Bank transfer rates (indicative guide): 1.6512-1.6630

- Money transfer specialist rates (indicative): 1.6957-1.6990

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Pound-to-Canadian Dollar exchange rate risks being condemned to a consolidative range this week in which it could struggle to sustain moves above 1.72 after the Bank of England (BoE) deprived Sterling of a pretext for extending its earlier recovery any time soon.

Sterling entered the new week seeking to recover the 1.71 handle after being much reduced from last Monday’s opening above 1.72, a level that Sterling could now struggle to hold above if reclaimed over the coming days following June’s policy decision from the BoE.

That saw the BoE give short shrift to the market's idea that "transient" increases in inflation might see UK interest rates rising from the middle of 2022, even suggesting in minutes of its meeting that such expectations could ultimately lead to an “unwarranted tightening of financial conditions” and hamper the recovery it’s hoping to cultivate.

The Bank remained upbeat on the outlook for the economy but showed little inclination to gamble with it when expressing a 'wait and see' kind of mood that effectively poured cold water over any suggestions that it might have been close to becoming ‘hawkish' in its policy stance, which was one of the popular reasons given in arguments for a higher Pound-to-Canadian Dollar rate.

“The subsequent market reaction demonstrates that market pricing is sufficiently aggressive, such that even the lack of a policy shift was enough to weigh on the currency,” says Michael Cahill, a G10 FX strategist at Goldman Sachs.

Above: GBP/CAD at 4-hour intervals with Fibonacci retracements of May recovery.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Given that, and considering our economists’ expectation that the Bank will likely update its planned exit sequencing at one of its upcoming meetings to start balance sheet runoff prior to hiking, it seems likely that monetary policy will remain a headwind for Sterling in coming months,” Cahill says.

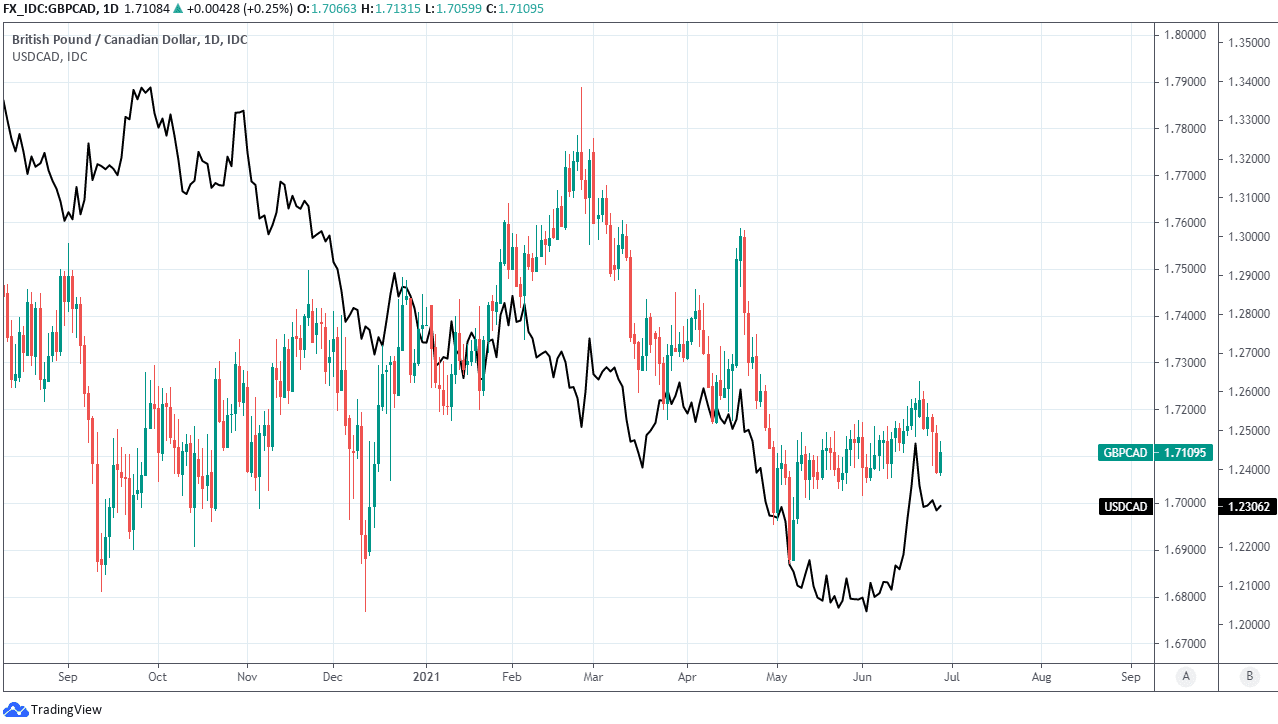

This BoE’s patient stance is potentially a headwind for GBP/CAD given that the Bank of Canada (BoC) hasn’t yet said or done anything much to discourage the market of the notion that it might be minded to begin gradually lifting Canadian borrowing costs some time in late 2022.

The BoC is also tipped by many analysts as likely to further wind down its quantitative easing programme later this year, which could mean less pressure on Canadian government bond yields and potentially provide support to the Loonie during the months ahead.

“With markets already heavily pricing in the likelihood of BoC tightening in the coming years, risks to the CAD look more asymmetrically skewed to the downside, in our view,” says Parisha Saimbi, a G10 FX strategist at BNP Paribas.

“We continue to favour holding long GBP and short CAD exposure in our model portfolio via short EURGBP and long USDCAD ideas,” Saimbi says.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

For now the BoC and Canadian Dollar are a step ahead of Sterling along the path toward normalisation of central bank policies, which is part of why GBP/CAD fell back below 1.72 in April and has struggled to sustain attempts at recovering the level for weeks now.

However, the market’s optimistic view on the outlook for BoC policy also implies scope for disappointment and a possible uplift to GBP/CAD in the weeks ahead if in its next decision on Wednesday 14 July the BoC does something similar to the BoE by taking issue with expectations for rate rises next year.

That would potentially help to free GBP/CAD from the rough 1.70-to-1.72 range that may continue to confine the exchange rate this week and through a period in which both UK and Canadian economic calendars are devoid of major events with only April GDP data from Canada at 13:30 on Wednesday.

“These are likely to have been heavily impacted by Covid-19 containment measures enforced in most of Canada at the time. We think markets may disregard a disappointing read as an outdated piece of information,” says Francesco Pesole, a strategist at ING.

“A continuation of the rebound in the loonie in the coming days will likely be more dependent on external factors (global risk appetite and oil market developments) rather than domestic ones,” Pesole says.

Above: Pound-to-Canadian Dollar rate shown at daily intervals with USD/CAD.