Pound-Canadian Dollar Recovery Stifled after BoE Elects to ‘Wait and See’

- Written by: James Skinner

- GBP/CAD briefly cedes 1.71 after BoE’s balanced assessment

- Wait-and-see stance turns GBP back from near 2-month highs

- BoE to keep eyes on medium-term inflation & economic prizes

Image © Adobe Stock

- GBP/CAD reference rates at publication:

- Spot: 1.7125

- Bank transfer rates (indicative guide): 1.6526-1.6645

- Money transfer specialist rates (indicative): 1.6970-1.7000

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

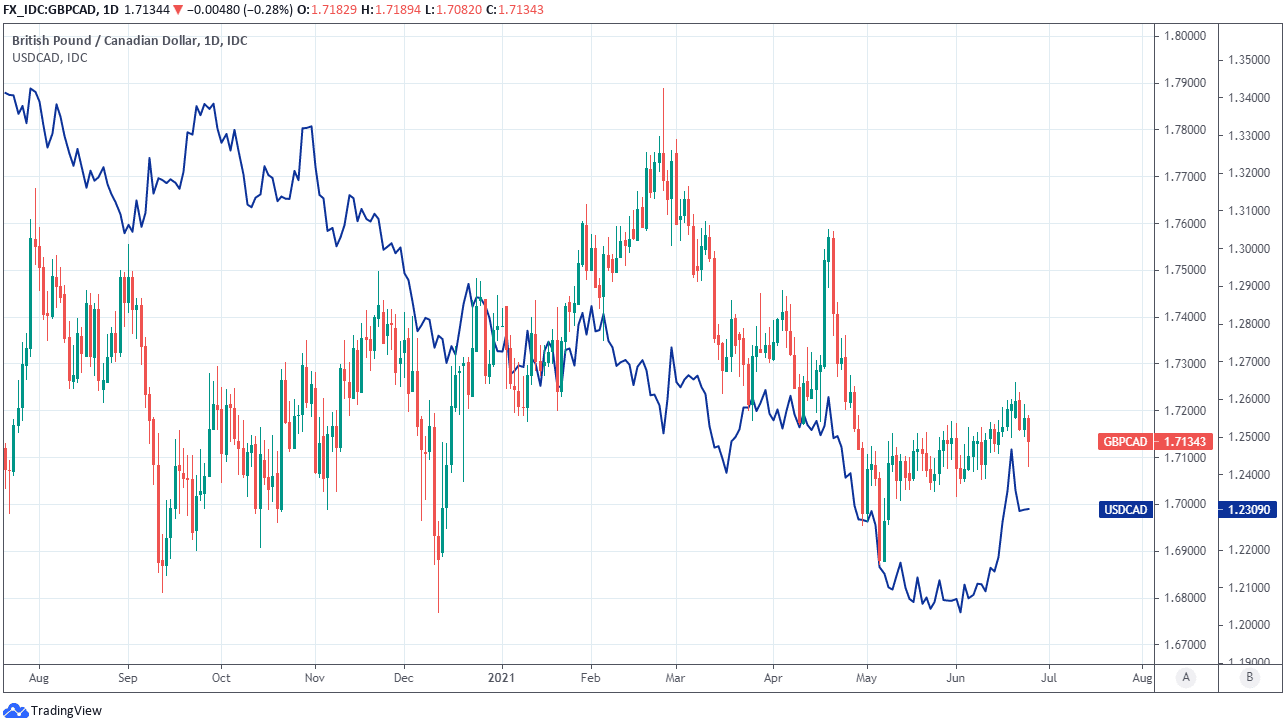

The Pound-to-Canadian Dollar rate turned further away from near two-month highs Thursday after the Bank of England (BoE) gave a balanced assessment of the UK economic outlook when announcing its June decision to wait-and-see a while before making any adjustments to its monetary policies.

Pound Sterling was knee-deep in the red against all major counterparts on Thursday after the BoE erred on the side of caution in its monetary policy decision for June, emphasising downside risks to the economic growth and inflation outlooks while deeming as “transient” the recent sharp increase in inflation that lifted the consumer price index a short distance above the BoE’s 2% target in May.

The Pound-to-Canadian Dollar rate fell more than half a percent for the session, taking it back below the 1.71 handle for the first time since in around a fortnight while closing the gap between Sterling and GBP/CAD’s June low just beneath the 1.7050 level although price action did not appear to endanger the narrow range that has seen the Pound-to-Canadian Dollar rate confined mostly to the space between 1.70 and 1.72 for the almost two-months since the early days of May.

“Generally, the Committee’s central expectation was that the economy would experience a temporary period of strong GDP growth and above-target CPI inflation, after which growth and inflation would fall back. There were two-sided risks around this central path,” minutes of the BoE’s meeting revealed.

“Policy should both lean strongly against downside risks to the outlook and ensure that the recovery was not undermined by a premature tightening in monetary conditions,” the minutes later stated.

The BoE upgraded its second-quarter GDP growth forecast on Thursday and said the government’s recent decision to delay the removal of its last remaining restrictions on activity and social contact would likely have direct implications that are “relatively small compared with the impact of previous stages.”

This month’s delay is one reason why the BoE may have emphasised downside risks to its economic forecasts on Thursday.

Above: Pound-to-Canadian Dollar rate shown at daily intervals alongside USD/CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Risks to economic outlook may crystallise in the months ahead if UK government ministers and advisers were right when warning recently that they could seek further restrictions this autumn if vaccines fail to sufficiently reduce the threat posed by the coronavirus, which would risk taking the BoE and HM Treasury back to square one and ground zero when it comes to monetary and fiscal policies.

But the bank otherwise mostly kept its eyes on a very much medium-term prize of “eliminating spare capacity” in the economy and “achieving the 2% inflation target sustainably,” this Thursday, after leaving Bank Rate unchanged at 0.10% and deciding to continued with a £150bn addition to its now-£895bn quantitative easing programme that was announced in November 2020 and is expected to be completed around year-end.

“The Committee now expects CPI inflation to exceed 3% for a temporary period toward the end of this year, following the upside surprise in May’s data and the further increase in commodity prices in recent weeks. But it emphasised that it will "as always, focus on the medium-term prospects for inflation”, which it continues to believe will be shaped most of all by developments in the labour market,” says Samuel Tombs, chief UK economist at Pantheon Macroeconomics.

“The economic recovery will have to be flawlessly strong for markets’ expectation that Bank Rate will rise to 0.25% in just 12 months’ time to be realised. We continue to expect the MPC to wait until the second half of 2023,” Tombs adds.

Much like others including the Bank of Canada (BoC) the BoE is facing a difficult situation in which it must balance on the one hand the risk that inflation remains above the 2% target for longer than anticipated - potentially necessitating a conversation about higher interest rates - while on the other hand balancing the downside risks posed to the inflation target by government actions in relation to the pandemic and more ordinary uncertainties around expectations of economies.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Those usual uncertainties are higher than normal currently because of the unprecedented nature of the economic closures seen in the last year, which have made economic barometers more difficult to predict and could further explain the BoE’s caution about the medium-term trajectory of an inflation rate that it’s charged with shepherding toward and around the 2% level over an ever-evolving and multi-year forecast horizon.

“There are upside risks to the BoE’s current economic projections, and we agree with the view that the BoE will likely hike rates around mid-2022 by 15bp and then by a further 50bp in 2023. That leaves the CS House View very modestly more hawkish than current market pricing,” says Shahab Jalinoos, head of FX strategy at Credit Suisse.

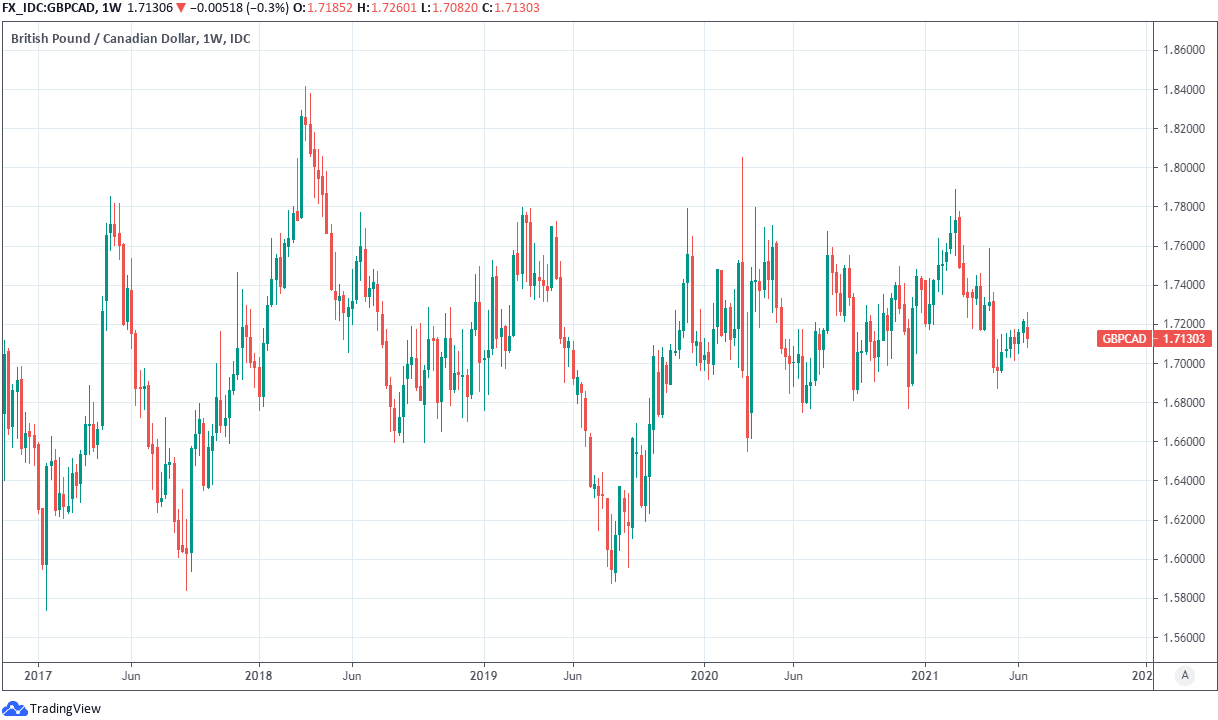

The decision and policy position set out by the BoE on Thursday leaves little which the market could use to distinguish between Sterling and the Loonie, which is one reason why the Pound-to-Canadian Dollar rate has been well confined to a narrow range in recent months, as the BoC’s winding down of its own quantitative easing programme is expected by many analysts to be completed around the same time as the BoE’s bond buying scheme expires naturally.

Recent commentary and current forecasts from each of the central banks Meanwhile, neither central bank is expected to raise interest rates before the second half of 2022 and each could easily be given in the months ahead plenty of reasons to delay an eventual normalisation of monetary policy until long after next year, though some analysts see risks to these assumptions.

“We expect some sterling appreciation followed by range trading, as the economy should continue to exhibit a robust recovery. We also expect the BoE to move in line with the Fed and slowly signal some monetary policy normalisation. However, we see a risk of GBPUSD coming under pressure if we observe earlier tightening of monetary policy from the Fed not matched by the BoE,” says Marek Raczko, a strategist at Barclays.

Above: Pound-to-Canadian Dollar rate shown at weekly intervals.