Canadian Dollar Outlook: Good News is in the Price say Analysts but Multi-month Gains are Still in the Pipeline

- Written by: Gary Howes

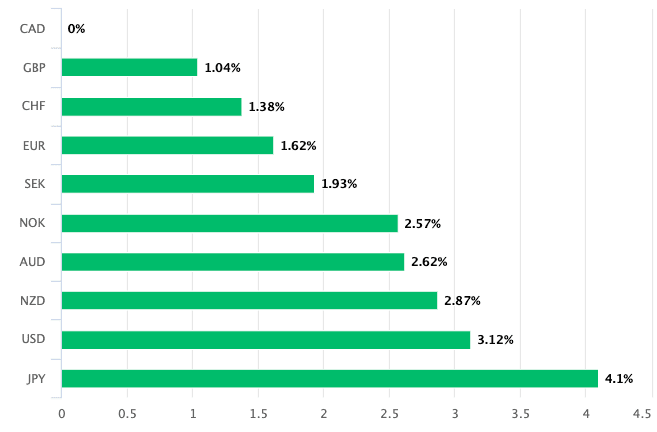

- CAD sits atop the 1-month leaderboard

- But CAD bulls might have had their fill

- "Upside risks to our CAD outlook" - Credit Agricole

- Commerzbank says market "overly optimistic"

Image © Adobe Images

- GBP/CAD reference rates at publication:

- Spot: 1.7128

- Bank transfer rates (indicative guide): 1.6529-1.6648

- Money transfer specialist rates (indicative): 1.6748-1.7000

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Canadian Dollar's stellar run could be due to fade, although analysts at a couple of investment banks we follow say the longer-term outlook still remains resolutely constructive and weakness is likely to be shallow.

The calls come amidst a period of outperformance for the Canadian Dollar which has appreciated in value against all its peers in the G10 complex over the past month:

Above: CAD is the best performer of the past month.

For those watching this currency the question is whether it is prudent to bide time for further near-term gains or act on the current purchasing power.

With this question in mind we note foreign exchange analysts at Commerzbank say they are expecting to see the Canadian Dollar's run of outperformance come to an end shortly.

"A lot of positives are likely to be priced in already, we see the risk of a downward correction," says You-Na Park-Heger, FX and EM Analyst at Commerzbank.

The bout of Canadian Dollar strength leaves the Pound-to-Canadian Dollar exchange rate close to the multi-month lows of 1.69 which were seen earlier in May. The pair is presently seen at 1.7120.

The U.S. Dollar-Canadian Dollar exchange rate is meanwhile reflecting Canadian Dollar strength in a more obvious way: USD/CAD on Tuesday reached its lowest levels since September 2017 at 1.2013.

The technical outlook favours further USD/CAD downside given the strong trend signals in place, but analysts looking at fundamental drivers are now more willing to warn that the trend of Canadian Dollar appreciation is due a period of cooling off.

"At current levels the question now is whether the FX market is not taking a somewhat overly optimistic view," says Park-Heger.

Commerzbank warn that the Bank of Canada (BoC) could soon start acting in ways to cool the Canadian Dollar, given the currency's recent rise puts its exporters at a disadvantage and this could work against the Canadian economic rebound.

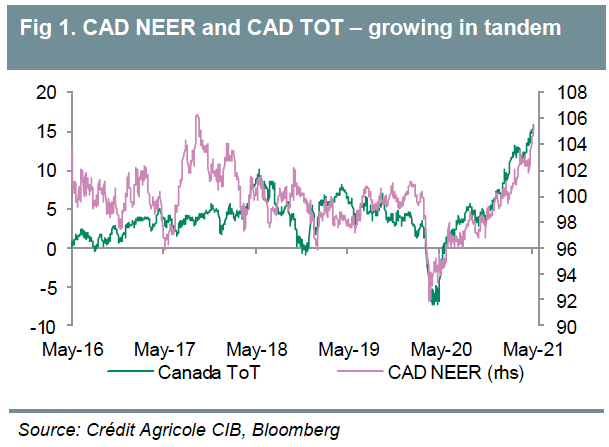

Above: Terms of Trade are supportive of CAD.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Indeed, BoC governor Tiff Macklem last week warned that any further meaningful gains by the currency would risk voiding the ‘hawkish’ interest rate outlook they currently hold.

"If it moves much further, that could become more of a headwind on our export projections," Macklem said. "That could have a material impact on our outlook and it’s something we’d have to take into account in our setting of monetary policy."

Although the BoC won't like the CAD appreciation, it is hard to argue that the advances are not warranted.

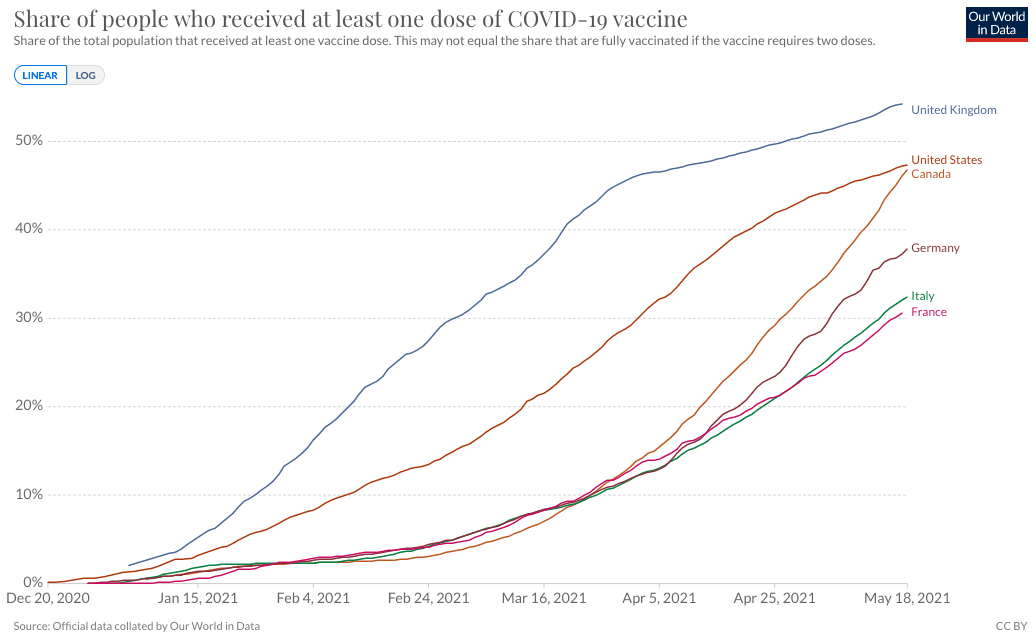

Valentin Marinov Head of G10 FX Strategy at Crédit Agricole says a relatively successful vaccination campaign by the Canadian government is one reason they are optimistic about the Canadian economy's prospects and they have upgraded their Canadian Dollar outlook as a result.

With foreign exchange markets in 2021 often rewarding those countries that are ahead of the curve on vaccinations - this was a noted driver of Sterling gains in the first quarter - the Canadian Dollar could now be in a position to benefit.

Having suffered a slow start to the programme the country has rapidly accelerated rollout and now looks set to catch its southern neighbour:

"We upgrade our CAD outlook and expect more gains over the medium to long term," says Marinov. "This will be consistent with the CAD ranking at the top of our long-term FX score card."

A new wave of Covid-19 infections gripped Canada in April, leading to fresh lockdown measures being put in place which raised questions as to whether the economy would suffer a notable setback heading into mid-year.

However a surge in vaccine supply appears to have eased concerns over rising cases, flipping the pandemic narrative into a positive driver for the currency.

The U.S. was able to start shipping vaccines to Canada as demand there declined, and Canadian authorities expect to break a record for vaccine deliveries in the coming days as it is set to receive 4.5 million doses of vaccines in a single week.

"The combination of the speedy vaccination rollout and better ability of the services economy in particular to adapt to the lockdown conditions, means that the outlook for the domestic economy should continue to improve from here," says Marinov.

"It is true that the vaccination campaign in Canada has accelerated recently and thus it should be possible to ease the corona restrictions in the foreseeable future. This further brightens the economic outlook," says Park-Heger.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

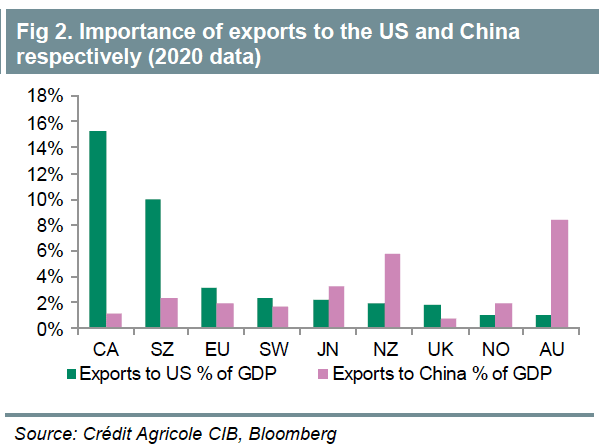

Canada's exposure to the U.S. economic rebound is meanwhile also cited by Crédit Agricole as a reason to back the Canadian Dollar.

"Canada is clearly a special case given the huge relative importance of trade with the U.S.," says Marinov.

Data from the Office of the United States Trade Representative showed that in 2019 the main Canadian exports to the U.S. were mineral fuels (27% of total), vehicles (17%), services (12%), agricultural products (8%), machinery (7%), plastics (3%), others (6%).

"Given the dominance of manufacturing exports, we think the CAD could be a net beneficiary from the recovery in the U.S. that favours manufacturing imports on the back of the support from President Joe Biden’s fiscal stimulus," says Marinov.

The BoC is meanwhile assessed to be "more hawkish" than the U.S. Federal Reserve (Fed), opting to reduce its quantitative easing programme in April at a time the Fed looks stubbornly opposed to similar moves.

The BoC on April 21 announced a reduction to its quantitative easing programme and indicated that an interest rate rise could come as soon as the middle of next year.

The BoC had traditionally been a follower of Fed policy, opting to tighten monetary conditions only when the Fed had done so.

But with the Fed resolute in its desire to keep policy unchanged - it is not yet even contemplating reducing quantitative easing until the labour market gets back on its feet - the BoC now stands out as being more 'hawkish' in comparison.

Foreign currencies react to differences in policy stances between two central banks and right now the relative stances of the BoC and Fed favour the Canadian Dollar.

"The BoC surprised with a more hawkish stance at its April meeting and adjusted its forward guidance. The CAD has appreciated significantly as a result," says Park-Heger.

Crédit Agricole economists expect that the BoC’s gradual tapering of its asset purchases could continue with the potential conclusion of the Quantitative Easing programme at the end of 2021.

"The rates markets have responded emphatically to the hawkish BoC message and have boosted the rate and yield appeal of the CAD," says Marinov.

However Crédit Agricole join Commerzbank in saying the Canadian Dollar could be in for a period of short-term consolidation as much of 'the good news' surrounding central bank divergence is already absorbed into the currency's value.

One notable risk to the Canadian Dollar near-term is that the Fed brings forward the timing of its quantitative easing 'taper' into 2021, which would in turn invite markets price an earlier interest rate hikes.

Such a move could aid the U.S. Dollar at the expense of the Canadian unit.

"There are clear upside risks to our CAD outlook. We think that these are more pronounced over the long term rather than the short term," says Marinov.

Commerzbank are also of the view that while the short-term positive story in CAD might have played out, the longer-term prospects remain constructive and near-term weakness is likely to be limited.

"The positive economic outlook and the more hawkish BoC should limit the risk for a weaker CAD," says Park-Heger.