Canadian Dollar a Buy with Barclays this Week

Image © Adobe Stock

- GBP/CAD at publication: 1.7600

- Bank transfer rates (indicative guide): 1.67-1.7110

- FX transfer specialist rates (indicative): 1.72-1.7450

- More information on securing specialist CAD rates, here

Foreign exchange strategists at Barclays are buyers of the Canadian Dollar this week, saying the currency should benefit from Canada's credible management of the covid healthcare crisis and the economy's attachment to a fiscal stimulus-fuelled U.S. economy.

In a currency research briefing analysts say they are looking for outperformance to be particularly notable against the U.S. Dollar, although it could extend to other G10 currencies.

"Canada scores better than most peers in terms of COVID preparedness, owing to its high procurement of vaccines per capita and decline in new cases," says Juan Prada, an economist with Barclays.

Barclays have recommended buying the Canadian Dollar against the U.S. Dollar, for the duration of this week only.

"Even though the rollout of vaccines in Canada has been slow and has lagged G10 peers, more robust vaccine rollout at a global scale and quicker-than-anticipated normalisation should provide a supportive backdrop for G10 commodity FX over the coming months," he adds.

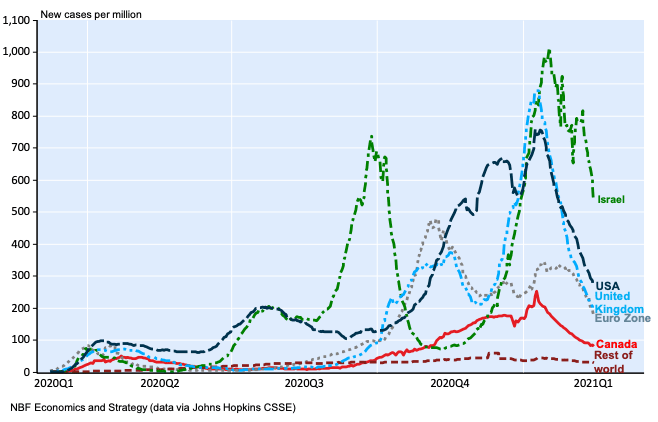

Above: Daily new cases per million population by region, 7-day moving average. Image courtesy of NBF.

On February 15 Canada reported a new case rate of 74 per million people, the UK 185 and the U.S. 257.

Although Canada's vaccination rate is lower than that of the two larger economies used in the above comparison, the data suggests the country's mitigation programme is proving effective.

However, a slow rollout of the vaccine could yet turn into a drag for the economy and Barclays strategists say it represents the main risk to a faster recovery.

"We expect the CAD to outperform as a strong bounce back, generous and extended fiscal support suggest a better management of the health crisis relative to its G10 peers," says Prada.

But there are other reasons to be bullish on the Canadian Dollar says Prada who says the Canada's economic ties with the U.S. could prove beneficial.

"Faster rollout of vaccines and greater fiscal stimulus in the United States would provide support to Canadian export growth and investment activity not just via the trade channel but also via broader economic stabilisation as a result of the vaccines," says Prada.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Barclays say the Canadian economy has the potential to bounce back quickly once vaccination rollout gathers pace allowing restrictions to be lifted.

"Even though the loonie remains susceptible to global risk sentiment, broad dollar moves and oil prices in the near term, we retain our constructive view on the loonie and remain long USDCAD put spreads," says Prada.

Meanwhile, foreign exchange strategists at UBS say they are looking for further appreciation in commodity currencies, the Canadian Dollar included, over the course of 2021.

"With more appreciation in store versus the USD during 2021, we advise investors to seek active long positions," says Thomas Flury, Strategist at UBS.

"Most commodity-linked currencies have strengthened this year versus the USD and rank among the best performers, led by the NOK, the RUB, the AUD, the CAD and the NZD. We believe there is more upside in store," he adds.

The U.S. Dollar-to-Canadian Dollar exchange rate is at 1.2636.

The Pound-to-Canadian Dollar exchange rate is at 1.7605.