Pound-Canadian Dollar Rate in BoE-induced Surge as Loonie Holds Own Elsewhere

- Written by: James Skinner

- GBP/CAD surges in sigh of relief over BoE rate decision.

- Steers clear of negative rates, prompts shift in expectations.

- As CAD swept up by bid for USD & oil on reappraisal of U.S.

- FX buys American & sells Europe, China amid disparities.

Image © Adobe Images

- GBP/CAD spot rate at time of writing: 1.7524

- Bank transfer rate (indicative guide): 1.6922-1.7045

- FX specialist providers (indicative guide): 1.7273-1.7413

- More information on FX specialist rates here

The Pound-to-Canadian Dollar rate surged in relief on Thursday following a favourable Bank of England (BoE) policy decision, while the Loonie was holding its own against a resurgent U.S. Dollar amid a possible market reappraisal of the Transatlantic growth outlook.

Sterling came rallying back from earlier losses enabling the Pound-to-Canadian Dollar rate to rise more than 100 points back above 1.75 after the BoE left Bank Rate at 0.10%, and remained non-commital on negative interest rates as a policy tool following an in depth feasibility study.

Pound-to-Canadian Dollar gains built as traders otherwise bought American including most U.S. Dollar exchange rates.

"USD has resumed its slow march higher against most major currencies as our attention shifts to the BoE," says Ned Rumpeltin, European head of FX strategy at TD Securities. "Cable may see a short-term lift. We doubt, however, this will be enough for GBP to sustain fresh highs above 1.3750. Like other G10 pairs, we think sterling will struggle to escape the steady pull of a stronger USD."

Consensus among economists was always for an unchanged Bank Rate and no sign of an imminent decision to cut the benchmark below zero, although pricing in the overnight index swap market indicated that investors were anticipating a cut to 0% before summer, which may explain Sterling's recovery.

The Pound-to-Canadian Dollar rate would rise above 1.76 the main Sterling exchange rate GBP/USD returned to 1.3750 and at the same time USD/CAD remained in relative stasis around 1.28.

Above: Pound-to-Canadian Dollar rate shown at hourly intervals with GBP/USD (orange).

GBP/CAD always closely reflects a combination of the main British exchange rate GBP/USD and its Canadian equivalent USD/CAD.

"The broader downtrend in USDCAD has clearly stabilized in the past few weeks and near-term trends perhaps risk tilting a little higher for the USD overall but firm commodities and the pro-risk mood in markets generally at present suggest limited downside risk for the CAD, we believe," says Shaun Osborne, chief FX strategist at Scotiabank.

USD/CAD was up 0.19% with the smallest increase among major U.S. exchange rate as the Loonie and other oil-linked currencies proved exceptions to a U.S.-dominated pecking order that left the greenback vying with Sterling for first place in an ever-tentative schedule of comparative winners and losers.

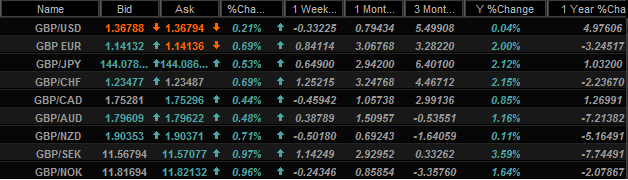

Above: GBP Vs G10 quotes & performances. Source: Netdania Markets. Click image for closer inspection.

With GBP/USD aside, GBP/CAD was Pound Sterling's lesser riser on Thursday and also a laggard for 2021.

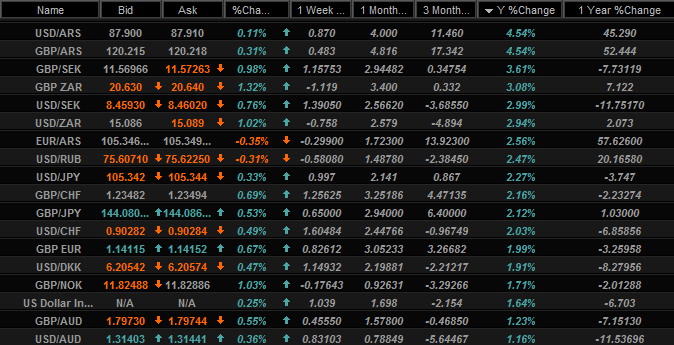

Above: Top performing FX rates of 2021. Source: Netdania Markets. Click image for closer inspection.

U.S. Dollar strength marks a departure from a heavily subscribed consensus view that looks for U.S. exchange rates to extend last year's falls in 2021, although gaining traction among the potential culprits for the rebound is a divergence in the Transatlantic growth outlook.

"The slow initial roll out of vaccines in Europe is also creating some concern that it risks undermining the outlook for global recovery in 2021 and boosting the relative appeal of the US dollar. Those fears have been reinforced as well," says Lee Hardman, a currency analyst at MUFG. "Surveys suggest the euro-zone economy is likely to contract again in Q1 while the US economy continues to recover from the COVID shock and is less impacted by restrictions."

Both Institute for Supply Management and IHS Markit surveys of the U.S. services sector rose in defiance of market expectations for January when published this week while over in Europe their equivalents managed to eke out a tepid increase but did so from lower levels that remained far beneath those of North American survey indices.

Above: USD/CAD rate shown at 4-hour intervals with GBP/USD (orange).

Europe's economy and currencies are under the spotlight amid a sluggish vaccine rollout that has seen them overtaken by the U.S. and UK, while potentially threatening to delay by months their economic recoveries. Meanwhile, the European Central Bank (ECB) has signalled its objection to a higher EUR/USD rate multiple times.

Recent data has asked questions about the short-term outlook for the global economy, while heavy declines in Asian stock markets and currencies have been felt elsewhere following steps by China's central bank to reign in perceived bubbles in stock and other asset markets

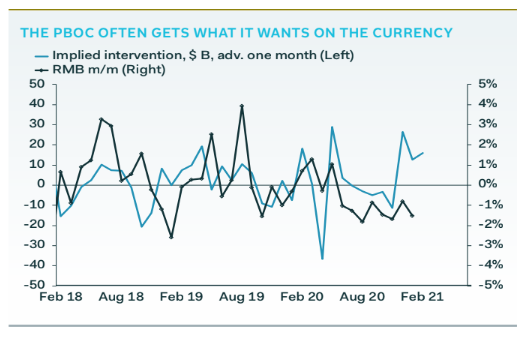

"China's FX reserves likely rose in January, thanks to intervention to curb RMB strength. The PBoC has re-anchored interbank market rates, but China will be early in the global hiking cycle. High frequency data corroborate the message from the services PMIs; activity is pulling back," says Freya Beamish, chief Asia economist at Pantheon Macroeconomics.

China's PMI indices also dipped lower for January on Sunday, placing a further question mark over short-term momentum in the world's second largest economy, although the Yuan was already being sold in exchange for Dollars before then and as the Asian FX week got underway.

Source: Pantheon Macroeconomics.

"The chart suggests that the PBoC often gets what it wants on the currency, with intervention in either direction frequently followed by RMB moves the next month. But, so far, the Bank has been thwarted, with the rate against the dollar staying high even after concerted intervention," Beamish writes.

Yuan and Euros have been sold in exchange for Dollars even as the U.S. currency was jettisonned in favour of the Pound, which normally follows the former but has recently outperformed all, helping to disrupt market correlations. Sterling has outperformed since the UK stepped up its vaccine rollout, which has seen 15% of the population provided with a first dose of a two-shot treatment and offers the economy scope to be first among the majors in achieving herd immunity.

The UK is followed closely by the U.S. on the vaccination front, however, while Sterling is being pursued by the Dollar in the currency market.

"Encouragingly, the current wave of outbreaks in these countries now seem to have passed their peaks. A sustained decline in virus infections would favour easing of lockdown restrictions and bolster economic recovery in the UK and the US. By contrast, daily new infections in the Eurozone show no signs of abating.Outflows from Asian stocks," says Elias Haddad, a senior FX strategist at Commonwealth Bank of Australia. "Still, real 10‑year Treasury yields remain deeply negative because the Fed plans to keep the Fed Funds rate at the effective lower bound of 0.25% until 2023 even if US inflation overshoots 2%. Negative US real yields will ultimately drag USD lower."