Canadian Dollar Tipped for Highest Since April 2018 as GBP/CAD Strolls Sidelines

- Written by: James Skinner

- CAD remains a laggard but continues to best USD, GBP.

- USD/CAD in breakdown mode and eyeing a move to 1.25.

- On OPEC cuts, as GBP/CAD sidelined amid UK lockdown.

Image © Bank of Canada

- GBP/CAD spot rate at time of writing: 1.7270

- Bank transfer rate (indicative guide): 1.6666-1.6786

- FX specialist providers (indicative guide): 1.7011-1.7149

- More information on FX specialist rates here

The Canadian Dollar remained a laggard among major currencies on Wednesday but has been tipped by analysts for an imminent return to levels last seen in April 2018 and a resilient enough showing to ensure GBP/CAD is prevented from rising to new highs in the short-term.

Canada's Dollar is a long way from being an investor favourite when it comes to the outlook for 2021 but nascent gains for oil prices and weakness in the U.S. Dollar mean USD/CAD is still expected to fall to new multi-year lows over the coming weeks, with implications for GBP/CAD.

This is after Saudi Arabia said Tuesday it'll reduce oil production by -1 million barrels during each of February and March which, after accounting for a +75k production increase afforded to Russia and Kazakhstan, means a net 925k barrels will be drained from the market in each of the next two months.

"We think it now very much justifies crude oil’s +5% surge today and the broad uptick for risk sentiment," says Eric Bregar, head of FX strategy at Exchange Bank of Canada in a Tuesday note. "We’d like to see the market show “new” signs of USD seller exhaustion first, and preferably quickly, before getting more constructive on the idea of a short term bottom. Otherwise, this USD downtrend looks set to continue."

Above: USD/CAD shown at daily intervals.

Organization for Petroleum Exporting Countries (OPEC) cartel activities have prevented a total of 1.9 billion barrels reaching the market in the last year, the group said this week, which played an integral role in limiting 2020's oil price decline to around -20% for West Texas Intermediate and Brent crude.

While Canada is not an OPEC member its Dollar benefits at least at the margins from anything that lifts prices of the country's largest export so the announcement goes some way toward explaining the more-than 100 point fall seen in USD/CAD Tuesday, even if U.S. Dollar weakness was also at play.

USD/CAD fell from 1.2777 to trade below 1.2670 on Wednesday but could now have scope to advance toward 1.25, its highest since April 2018.

"Yesterday’s sharp reversal lower has effectively neutralized Monday’s bullish key reversal day, with the daily close below 76.4% retracement of the 2017-2020 advance at 1.2677 now shifting the focus down to the April 2018 low at 1.2528," says George Davis, CMT and chief technical strategist at RBC Capital Markets, who forecasts USD/CAD at 1.25 in three months.

Above: USD/CAD shown at weekly intervals with Pound-to-Canadian Dollar rate (blue).

Incremental Canadian Dollar strength and resilience has, when combined with weakness in the U.S. greenback, seen USD/CAD fall further than the main Sterling exchange rate GBP/USD has been able to rise thus far in the New Year which has translated into a net loss for the Pound-to-Canadian Dollar rate.

Pound Sterling has gotten not help during the first week of trading for 2021 from the UK-EU trade agreement that was announced on Christmas Eve, potentially because the positive development that was the aversion of a trade cliffedge with the EU has been offset for investors by the latest coronavirus developments.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

All of England returned to an all-out state of 'lockdown' this week for which the government cites a new and more infectious strain of coronavirus that had already seen Scotland, Wales and the province of Northern Ireland subjected to enhanced restrictions previously.

"The GBP was capped near 1.75, the late November high, over the holiday period and weekly price action is tilting more negative after a weekly “doji” candle formed last week. We note also that the daily and weekly DMI oscillators are flat, which supports the choppy and range-bound environment. Daily support stands at 1.7220 (200-day MA and former pivot). We look for more short-term drift. Weakness below 1.72 should see losses extend to 1.7050/00," says Juan Manuel Herrera, a strategist at Scotiabank. "We have no strong view directionally at the moment."

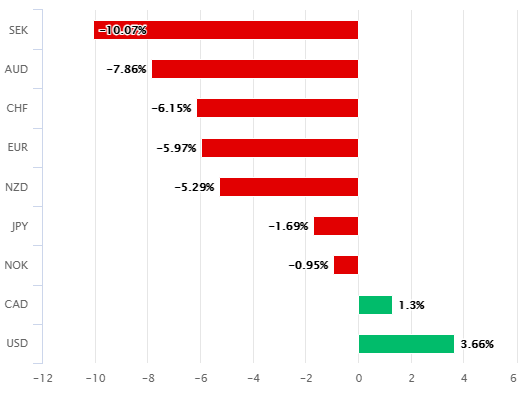

Above: Pound Sterling performance against major counterparts in year to January 07. Source: Pound Sterling Live.

Resulting losses for Sterling exchange rates have pulled the Pound to the bottom of the major currency league table for 2021 already, while adding -0.56% to GBP/CAD's decline. The Pound-to-Canadian Dollar rate was -0.59% and trading at 1.7278 for the year-to-date on Wednesday.

The UK's economy is widely expected to have contracted by a double-digit percentage in 2020, leaving it the most badly damaged among major industrialised economies due to a heavy reliance on services trades that involve more person-to-person contact than is the case for more manufacturing and goods oriented economies.

Britain has one of the largest books of preorders for coronavirus vaccines, second only to Canada, but after having been first to detect a more infectious variant of the disease it now faces a lengthier period of more draconian restrictions on activity before any recovery is able to be sustained.

'Lockdown' was intended to last until mid-February when it was announced this week although Prime Minister Boris Johnson has already implied in more recent statements they could be extended until the end of March.

"Sterling continues to underperform comparable G10 pairs given its new lockdown restrictions. December Services PMI came in at 49.4, only slightly missing consensus, though will likely be overlooked given new social distancing measures in place at least until mid-February," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets. "USD/CAD falls to lows not seen since 2018, with the next support level at the April 2018 low at 1.2528. Indeed, a move towards the 1.2500 mark feels likely now."

Above: Pound-to-Canadian Dollar rate shown at weekly intervals with 50-week (orange) and 200-week (red) moving-averages.