The BoC has a Canadian Dollar Problem and Following the Fed Just Might Solve It

- Written by: James Skinner

- CAD underperforms after BoC voices concern about FX moves.

- As resilient inflation risks emphasising the CAD's attractiveness.

- U.S. Dollar woe is key to rising CAD exchange rate pressures.

- May see BoC adopting the Fed's "symmetric" inflation target.

Image © Bank of Canada, Reproduced Under CC Licensing

- GBP/CAD spot rate at time of writing: 1.7215

- Bank transfer rate (indicative guide): 1.6615-1.6736

- FX specialist providers (indicative guide): 1.6960-1.7097

- More information on FX specialist rates here

The Canadian Dollar underperformed Wednesday but nonetheless, there is a trend emerging that is a problem for the Bank of Canada (BoC) and its economy, a problem which may be solved if policymakers simply do as they sometimes have done by following along in the footsteps of the Federal Reserve (Fed).

Canada's Dollar was down against all major currencies for the session on Wednesday, although it's risen against those of all of Canada's top four export markets for the month and if left unchecked, could soon reassert a long-running trend of appreciation in the places where it's least welcome.

The Canadian Dollar ebbed through much of the session on Wednesday although it pared losses for a period after Statistics Canada said that inflation rose from 0.7% to 1% last month, leaving it at the midpoint mark between zero and the 2% target of the Bank of Canada.

With investors, that could be taken in more ordinary times as a signal that a potential shift in BoC rhetoric or even interest rate policy may not be too far off and as a result, could be enough to lead to some flirtation with the Canadian Dollar. Central banks like the BoC are obliged by statutory mandate to use interest rate and other policies to ensure inflation meets predefined objectives over a multiyear horizon, and a pickup in the direction of the target is exactly the kind of thing that might normally get them thinking about a change of policy which would typically incite demand for the Loonie.

"The CAD has failed to participate in the broader FX rally against the USD overnight and has lost further ground in early European trade, edging back to the mid 1.27s at writing. The CAD’s performance runs counter to the general market mood—rising equity markets and stronger crude oil—and some more Canada-specific data factors (record house prices, surging lumber) that might otherwise add some incremental support at least," says Shaun Osborne, chief FX strategist at Scotiabank. "Absent any clearly CAD-negative news, it is hard not to connect the drop in the CAD with BoC Governor Macklem’s comments."

Above: Pound-to-Canadian Dollar rate shown at hourly intervals alongside USD/CAD (black line, left axis).

Currency appreciation, especially against export market currencies, is one of the last things that any policymaker would want in the middle of a pandemic and especially at a point when parts of the economy are contending with a second wave of coronavirus infections and the resulting curbs on activity. The BoC's challenge is made harder by reluctance to cut its cash rate and a bloated balance sheet that may limit its ability to do more quantitative easing.

"Canada’s recovery from the pandemic will be long and choppy, and we need to expand our exports to help the economy recover fully," says BoC Governor Tiff Macklem in a Tuesday speech to the Greater Vancouver Board of Trade. "The rebound in goods exports could fizzle out as companies finish rebuilding inventories, while prolonged hardship could force many services exporters to close their doors. And the underlying competitiveness challenges that have restrained export growth over the past decade have not gone away. More recently, the Canadian dollar has been appreciating...This is hurting the competitiveness of Canadian exporters in our largest market."

With the Loonie down against all majors Wednesday, while having fallen against half the G10 bucket for the month, a cause for concern is not necessarily obvious. However, the few that the Canadian Dollar has risen against this month include the U.S. Dollar, Chinese Yuan, Pound Sterling and Japanese Yen.

These are the currencies of countries which are by far Canada's largest markets for a range of exports, prices of which will rise for overseas buyers whenever the Canadian Dollar strengthens. But it's not just the month to Wednesday over which the Loonie appreciated against these currencies.

Above: Canadian Dollar performance against major developed and emerging market currencies over the last 5 years.

"Governor Macklem’s speech didn’t ruffle any feathers but a Q&A soundbite in his post speech press conference sounded like a half-hearted attempt to talk down the Canadian dollar," says Eric Bregar, head of FX strategy at Exchange Bank of Canada. "While these comments have stalled the USDCAD selling for now, we’re still not seeing meaningful signs of “seller failure” on the daily charts to warrant attempting to call a short-term bottom for this market. Weekly support is lacking until the 1.25 handle and the leveraged funds are still long USDCAD. USDCNH’s NY close looks particularly depressing."

Pound Sterling Live data shows the Canadian Dollar has risen steeply against all of these currencies over the last five years, a period in which the country's annual GDP growth rate has ebbed and its exports have been outgrown by GDP-eating imports, leading to a deteriorated balance of trade.

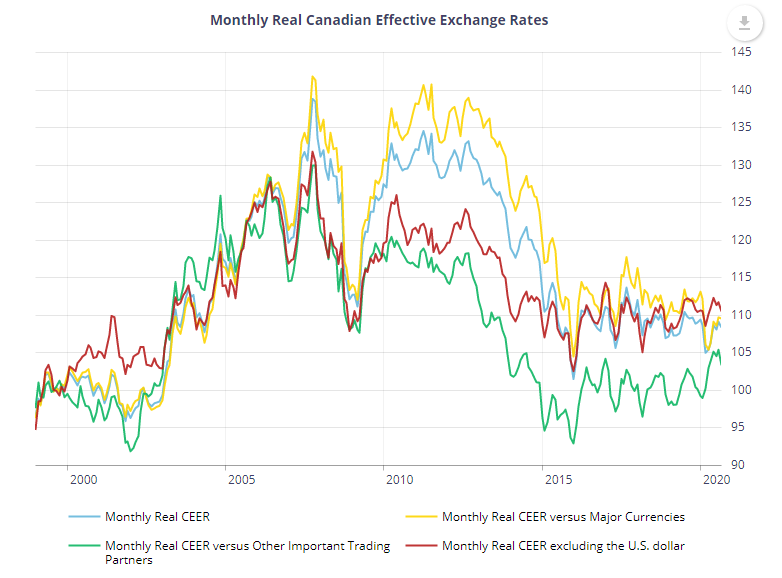

Many factors have contributed to these developments but among them is a steady appreciation of the real-effective-exchange-rate (REER) for the Canadian Dollar, the better measures of trade-weighted strength or weakness.

"Unfortunately, ‘jawboning’ the currency lower will only have temporary effects. That’s also true for a non-standard cut in the overnight rate," says Bipan Rai, North American head of FX strategy at CIBC Capital Markets, who sees the U.S. Dollar's fall from grace with investors at the heart of the BoC's conundrum.

The U.S. Dollar has fallen against all major currencies this year and is expected to go on declining in 2021, posing a challenge to the BoC given that it accounts for 78% of the bank's own measure of Canada's REER.

Above: Bank of Canada graph depicting various Canadian REER exchange rates.

The impact of this decline on Canada's export competitiveness might be partially self-offsetting if it makes British imports of U.S. Dollar-denominated precious metals cheaper. Precious metals and other commidity exports are what makes the UK the third largest market for Canadian goods, while their USD-denomination may explain Sterling's less-than 2% weighting in the BoC's REER.

But a GBP/USD appreciation like that underway in December wouldn't offset by much at all the overall upward pressure on Canada's trade-weighted currency arising from U.S. Dollar declines, and it'd do nothing at all about Canadian Dollar appreciation relative to other currencies.

For all the other currency moves, it could be the case that only a change of policy at the BoC will suffice, and one which again leaves the country's lender of last resort following in the footsteps of the Fed across the southern border.

Above: Bank of Canada graph depicting weightings for currencies of Canada's export destinations.

"If the Fed is going to continue to be at the vanguard of monetary policy, then other central banks need to adjust," CIBC's Rai says. "The paths towards a sustained ‘cheapening’ in the domestic currency include: a.) Sending a message to the market that the ELB is below current levels. For the BoC that would mean implying its below zero. b.) Sending a message to the market that you’re willing to tolerate higher inflation over the medium-term. c.) Hope that market forces somehow find a way to stabilize the USD."

The Fed, faced with the imminent collapse of both U.S. and global economies as well as a viscious and financially-destabilising surge in its Dollar back in March, went to DEFCON 1 and hit its big red button repeatedly until much of its arsenal was deployed to the markets. It cut U.S. rates near to zero and launched an unprecedented array of new initiatives as well as an "unlimited" reopening and extension of its crisis-era quantitative easing programme.

But not even that was enough to assure that the Dollar's prospective suitors would be kept reliably at bay and the U.S. economy sufficiently supported on its long and likely-winding road to recovery. So in August this year Chairman Jerome Powell announced at the Jackson Hole Symposium that the bank would adopt a new monetary policy strategy. That strategy is a simple commitment to investors and the market at large that U.S. interest rates will not rise until inflation has spent as much time above its target as it does below it in the current downturn. The commitment is effectively a promise to wipe out the little that is left of inflation-adjusted American bond yields.

Above: Pound-to-Canadian Dollar rate shown at daily intervals alongside USD/CAD (black line, left axis).

That, along with a host of other problems, has helped sink the U.S. Dollar through much of the time since the Fed took action. Canada doesn't suffer from many of the "other" problems facing the U.S. so the BoC might not necessarily get the same bang for its own buck should it follow in the Fed's footsteps, but adopting a so-called symmetrical view of the inflation target would almost certainly mean that investors are more than just a bit less inclined to bid the Canadian Dollar higher in most circumstances.

Rather, it would convert rising inflation from the potential positive that investors view it as, into a net-negative which promises to eat away at any returns that might otherwise be earned from buying the Loonie and pushing up the trade-weighted Canadian exchange rate in the process.

"November’s CPI report came in stronger than expected," says Matthieu Arseneau, deputy chief economist at Montreal-headquartered National Bank Financial. "We continue to expect sticky inflation despite the economy running below capacity. Generous government aid programs are creating artificial labour shortages and they are expected to last until vaccines allow a progressive return to normal. Commodity prices, including food, have also risen strongly which could also affect the purchasing power of Canadian consumers in the months ahead. Finally, supply chain disruptions could last for some time, also helping core inflation to persist close to the BoC’s mid-point target."

Above: Pound-to-Canadian Dollar rate shown at monthly intervals alongside USD/CAD (black line, left axis).