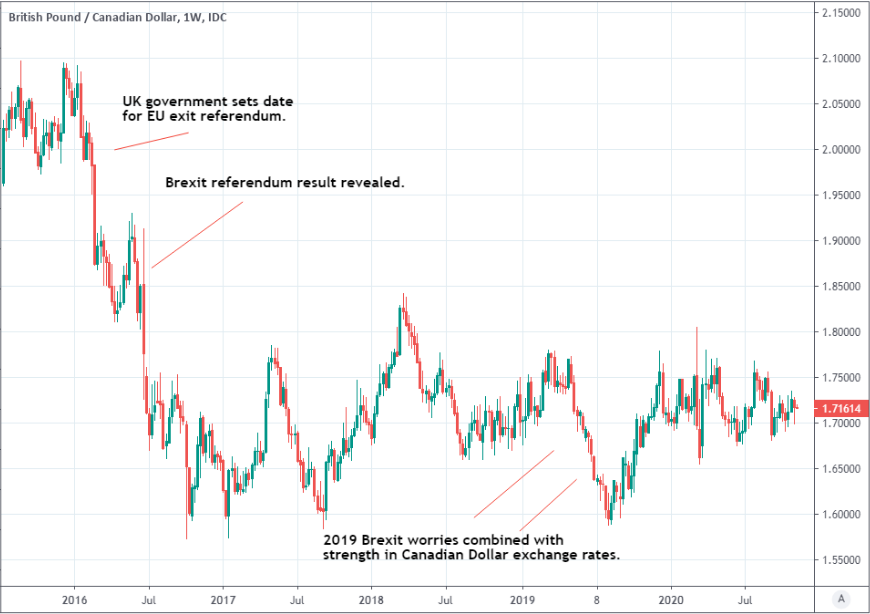

Pound-Canadian Dollar Forecast: Slipping as Biden Weighs On Brexit Trade Prospects

- Written by: James Skinner

- GBP/CAD risks being tipped back to bottom of multi-month range.

- 1.7052 and 1.6915 in pipeline as Biden bolsters EU in Brexit talks.

- Progress toward a deal needed to prevent further GBP/CAD falls.

- Stocks, Trump's contested election, Senate control also in focus.

Image © Pound Sterling Live

- GBP/CAD spot rate at time of writing: 1.7175

- Bank transfer rate (indicative guide): 1.6548-1.6668

- FX specialist providers (indicative guide): 1.6891-1.6994

- More information on FX specialist rates here

The Pound-to-Canadian Dollar exchange rate tumbled last week but with an incoming Democractic Party administration blighting Brexit Britain's trade prospects, as talks with European Union continue without progress, Sterling may be in line for further losses this week.

Sterling underperformed last week as slowly but surely the incoming election results pointed toward a decisive victory for Democratic Party presidential challenger Joe Biden, with the Pound-to-Canadian Dollar rate ending the period three quarters of a percent lower at 1.7175.

A Biden victory has implications for the Brexit talks given the EU might be less inclined to compromise in the still-deadlocked negotiations if it has White House backing. It also reduces scope for a UK-U.S. trade deal, which a campaign spokesperson said this weekend was not a priority, according to The Telegraph.

"It's not at all certain that the (now most likely) US election outcome will significantly reduce the odds of a 'WTO exit' from the transition period on Jan 1. If we go with the argument that both sides are roughly at the limit of how much they will be willing to move in order to reach a 'skinny' FTA, one could make the case that the US election outcome hasn't shifted the implied odds at all," says Stephen Gallo, European head of FX strategy at BMO Capital Markets.

With barely more than a week to go before the mid-November deadline for a Brexit deal to be done the above factors could weigh on the Pound over the coming days, leading GBP/CAD to reverse Thursday and Friday's recovery.

Talks continue between negotiators this week while Prime Minister Boris Johnson and European Commission President Ursula Von der Leyen are also in contact, but with progress roadblocked by differences over the so-called level playing field demands of the EU and fisheries access, there may be a risk of no progress being made at all.

GBP/CAD already traded as low as 1.6989 on the Thursday, although it could surpass that level if the rug is pulled from under Sterling this week.

Above: Pound-to-Canadian Dollar rate shown at daily intervals with USD/CAD rate (black line, left axis).

"We still don’t expect that the two sides will reach an agreement, and thus anticipate that the GBP will under-perform its key peers for the remainder of the year," says Shaun Osborne, chief FX strategist at Scotiabank.

Scotiabank says the main Sterling exchange rate GBP/USD is on course to test tough resistance at 1.3174 and 1.32 against the U.S. Dollar while analysts at RBC Capital Markets say the Canadian Dollar could overcome a similiar barrier and potentially push USD/CAD down to 1.2917 this week.

This kind of price action would likely require stock markets to hold last week's gains, although if it did materialise the Pound-to-Canadian Dollar rate would likely be found trading back down to 1.7052. GBP/CAD always closely reflects relative USD/CAD and GBP/USD price action.

"A daily close below 1.3029 would cause us to turn from neutral to bearish on USD/CAD technically, exposing 1.2952 and 1.2917 thereafter," says Elsa Lignos, global head of FX strategy at RBC Capital Markets. "Resistance is located at 1.3099 and 1.3148."

GBP/CAD would fall even lower and as far as 1.6915 if the two currencies weakened to nearby support levels against the greenback, perhaps due to profit-taking in the stock markets, with GBP/USD seen finding support at 1.2864 while USD/CAD meets resistance at 1.3148.

It could be the case that Sterling needs to see or hear of progress in the Brexit negotiations to get ahead of the Canadian Dollar this week, as was suggested by Scotiabank, and until it does the currency may be more vulnerable than others including the Canadian Dollar during bouts of risk aversion.

But if an eventual Brexit deal is succesful in lifting GBP/USD to the 1.3422 level flagged by Commerzbank as a faint prospect within current technical trends the Pound-to-Canadian Dollar rate would rise to 1.7338 if USD/CAD was trading near 1.2917 and even higher if the Loonie weakens before then.

"Barring a risk-correction after this week’s rally more USD weakness can now easily push USD/CAD below the 1.3000 mark. Still, CAD is once again underperforming its procyclical peers during big risk-on rallies (by contrast, it shows more resilience in troubled times) despite its high correlation to risk," says Francesco Pesole, a strategist at ING.

Above: CAD/USD shown at daily intervals alongside S&P 500 index futures (black line, left axis).

Profit-taking could deliver a setback to stock markets and the currencies that follow them this week, with adverse consequences for the Pound-to-Canadian Dollar rate if investors get cold feet with current levels near to post-coronavirus highs, which are prevailing as President Donald Trump contests the outcome of the election and as uncertainty remains over who will control the balance of power in Congress after January.

Biden was reported to have clinched as many as 290 electoral college votes by Sunday, more than the 270 needed to win the White House, but control over the senate is set to be determined by run-off votes in the state of Georgia on January 05. Meanwhile, President Trump has alleged that Biden's win was gained through illegal votes and is taking court action. It's not clear whether he'll succeed in casting doubt over the result, much less in changing it, but the incumbent has insisted "this election is far from over."

"It feels like risk markets are sprinting with blinders on, processing only the narrative's good bits," says Mark McCormick, global head of FX strategy at TD Securities. "Economic stimulus will be much slimmer than the hoped-for level of $2 trillion. Simultaneously, the rise of the global COVID curves (infections and mortality) has whacked short-term mobility trends, especially in Europe. The impact is likely to saddle growth in the next few months, while data surprises are likely to start bending lower. We doubt the USD can continue to sink at this pace if the global yield curve starts to flatten. That's a critical transmission to EMFX and may limit how much USD downside we see."

There's also a near certainty that markets will have to contend with either a divided Congress that gridlocks Washington, or a Democratic Party congressional majority that gives it freedom to implement an agenda that includes a reversal of Trump's 2018 tax cuts, large spending programmes as well as taxes and regulations for fossil fuels.

Such an agenda might not be taken so well in parts of the U.S. stock market, although gridlock that sees Washington delivering little stimulus or much other productive action isn't necessarily an argument for outperformance in risk markets either.

There are several pieces of key economic data due from the UK in the week ahead including jobs and third-quarter GDP data, although analysts say that currencies are likely to take little note of them. There are no major figures due from Canada over the period.

Above: Pound-to-Canadian Dollar rate shown at weekly intervals.