Canadian Dollar Loses Touch with Oil Prices says RBC Capital

- CAD firms into oil price headwinds

- RBC Capital see limited link between oil and CAD

- But ING says impact of lower oil prices merely delayed

Above: A single oil pump jack in the farm field. Calgary, Alberta, Canada. Image © Adobe Stock

- GBP/CAD spot rate at time of writing: 1.7343

- Bank transfer rates (indicative guide): 1.6733-1.6854

- FX specialist rates on offer (indicative guide): 1.6960-1.7184 >> more information

The Canadian Dollar simply does not respond to movements in crude oil prices as it did ten years ago, shows a research note from Royal Bank of Canada, suggesting that a popular assumption that the Canadian Dollar is an 'oil currency' could need to be queried.

Research from RBC's Capital Markets division shows that oil has steadily lost importance as a driver for Canadian Dollar valuations over recent years, which will challenge an evergreen assumption by a significant portion in the foreign exchange profession that the Canadian Dollar can be viewed as a proxy for oil market dynamics.

The dramatic decline in oil prices in the March-April 2020 period - linked to the coronacrisis - has inevitably drawn focus on the value of the Canadian Dollar over this period. The foreign exchange textbook suggests that when oil prices fall, the value of one of Canada's leading exports declines in value.

This hit to the country's terms of trade should then inevitably be reflected by a weaker Canadian Dollar.

But according to RBC Capital Markets, while it is tempting to just think of the Canadian Dollar as an oil currency, "that relationship has weakened over the last decade and it is not linear".

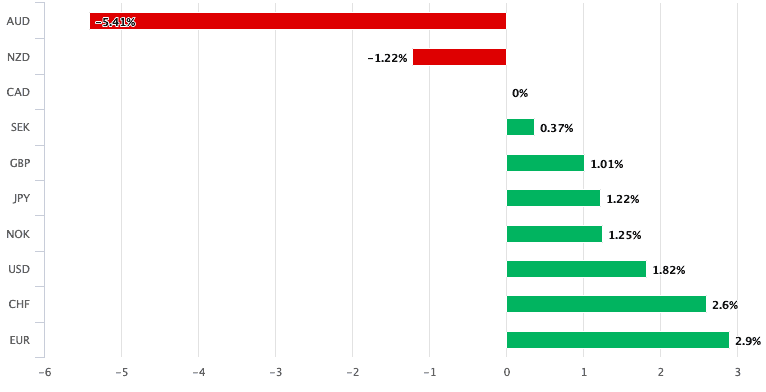

The findings could go some way in explaining the Canadian Dollar's decidedly robust tone over the course of the past month: the Pound-to-Canadian Dollar has actually fallen a percent, the U.S. Dollar-to-Canadian Dollar has fallen 1.82% and the Euro-to-Canadian Dollar has fallen 3.0%.

Indeed, only the commodity-linked currencies of Australia and New Zealand have outperformed the Canadian Dollar.

Strikingly, this period of relative outperformance also covers a time when the near-month contract for the U.S. WTI crude benchmark fall into negative territory as the inland oil market faced a severe shortage of storage capacity for crude deliveries, while at the same time the Canadian Select benchmarks also traded near zero.

Above: CAD performance over the course of the past month

"We have heard a number of people ask why CAD isn’t weaker," says Elsa Lignos, Global Head of FX Strategy at RBC Capital in London. "It partly reflects frustration – long USD/CAD has been a popular trade in spot and options, and given the price action in crude, this could have been the moment to look for an explosive move higher."

"The first obvious point to make is that looking the correlation of CAD to the first (May) WTI contract is misleading when contango reaches the extremes," adds Lignos, referencing the fall of the May WTI contract into negative territory.

RBC Capital's research shows that using the May WTI contract as a proxy for the entire crude market and applying historic elasticities, would suggest USD/CAD should have hit 1.46, with a peak as high as 1.70 when the May contract plunged.

Yet, the April high for USD/CAD was at 1.4265.

"The correlation between USD/CAD and crude has recently declined," says Lignos, "but more notable is the low elasticity or ‘beta’. It is not something specific to CAD, with similar patterns seen in NOK, MXN and RUB, though USD/CAD has the lowest beta overall."

Yet, other analysts suggest the Canadian Dollar's strength in the face of unprecedented oil market pressures is merely a case of a delayed reaction, and that oil prices still matter for the currency.

According to Chris Turner, Global Head of Markets and Regional Head of Research for UK & CEE at ING Bank N.V., the Canadian Dollar will ultimately start to feel the gravitational pull of softer oil market dynamics.

"The Canadian Dollar has navigated the recent turmoil in the oil market without facing any major sell-off. We suspect this won’t be the case for much longer: 1.45 may still be on the cards," says Turner in a recent briefing to clients.

"The storage constraints and extended lockdowns may still keep oil weak across the futures curve. WCS (the Canadian crude) has been trading around zero (also below zero) for the past weeks: the implications for the Canadian economy are set to be significant and can definitely hinder the ability to recover in 2H," adds Turner.

Results from the Bank of Canada's (BoC) Spring Business Outlook Survey suggest that business sentiment had softened in most regions even before concerns around COVID‑19 intensified in Canada.

"Confidence deteriorated the most among firms in energy-producing regions," said the BoC. "The sales outlook for businesses tied to the energy sector had weakened significantly because of falling oil prices."

Many of the businesses reporting back to the BoC said that low oil prices were leading to financing and liquidity issues and were forcing them to reduce costs and operations.

The majority of firms said the current oil price shock as worse than the episodes of significant oil price declines in 2008 or 2015.

"So, watch out for a delayed impact on CAD, which may depreciate faster if risk appetite takes another hit or trail other pro-cyclical currencies if good Covid-related news helps

sentiment," says Turner.