Pound-Canadian Dollar Week Ahead: Stuck in a Range as Investors Seek Peak of Mount Coronavirus

- Written by: James Skinner

Image © Adobe Stock

- GBP/CAD spot at time of writing: 1.7328

- Bank transfer rates (indicative): 1.6758-1.6881

- FX specialist rates (indicative): 1.7106-1.7211 >> Get your quote now

The Pound-Canadian Dollar rate closed a second consecutive week Friday having changed little from the prior period and now appears to be setting itself up for a period of range-trading between well established support and resistance levels as investors search for the summit, or peak of the coronavirus mountain.

Pound Sterling rose against the Dollar, Euro, Japanese Yen and Swiss Franc in what was an eventful week but ceded ground to riskier rivals like the Canadian, Aussie and New Zealand Dollars as the mood among investors brightened in response to signs of a slowdown in momentum behind the coronavirus. Canada's Dollar rose against five of nine major rivals, aided through some of the week by what was once a sharp recovery of oil prices.

Increasing numbers of European countries have either seen or are expecting to shortly reach the peak of their coronavirus outbreaks, with the numbers of new infections now trending lower on a daily basis despite increased testing in some of the countries concerned. New case growth also slowed in the U.S. last week while members of the Organization of Petroleum Exporting Countries (OPEC) all but reached a deal to 'stabilise the market' for oil.

A slowing coronavirus stoked optimism about the potential lifting of 'lockdown' containment measures while weighing heavily on the U.S. Dollar and lifting stock markets, which have now recovered almost half their historic March declines. That kind of price action is normally good news for the risk-sensitive Loonie, and more so than it is for Sterling, although the Canadian Dollar's advance on the Pound was a tepid one at best.

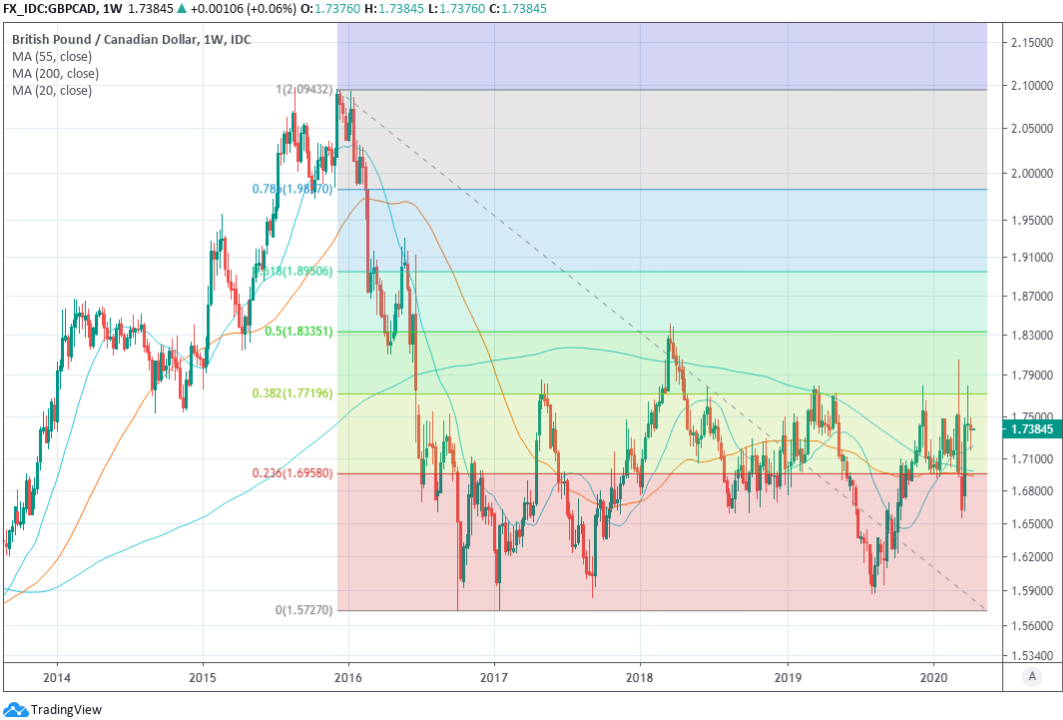

Sterling has now seen two consecutive weeks of little changed price action that have left it comfortable above the 20 and 55-day moving averages that arrested the Pound-Canadian Dollar rate decline seen last week, although those are backstopped by the 1.70 level that's offered good support since late 2019. Meanwhile, and on the upside, the exchange rate has been blocked by resistance at 1.78 on several occasions ahead of even tougher pushback that comes from the post-referendum high of 1.80.

Above: Pound-Canadian Dollar rate shown at daily intervals with selected moving-averages marked out.

"GBPCAD is stuck mid-range between support near 1.69 and resistance at 1.78," Juan Manuel Herrera, a strategist at Scotiabank, in a research note early last week. "The longer term chart signals are leaning more GBP-bullish we think and these point to firmed underlying support for the GBP near the range base. But the 1.78 zone remains a clear block on upside progress for now."

Herrera said early last week that the long-term charts favour a continued recovery from the 2016 post-referendum lows for Sterling but the short-term charts give little indication about the likely near-term trajectory of the exchange rate due to a 'doji candle' that formed on the weekly chart in the prior week. This absence of signals and lack of decisive price action could mean the Pound-Canadian Dollar rate is condemned to a narrow range-trade for the time being.

However, and within that range, the ebb and flow of investor risk appetite as well as the outlook for prices of oil will be key determinants of direction. That means the market response to last week's tentative agreement by OPEC and a number of other countries to reduce oil production in a co-ordinated manner will be an important and possibly supportive influence on the exchange rate.

The 10 million barrel per day production cut has the potential to lift oil prices and the Canadian Dollar but the deal is not yet fully done because Mexico has not agreed to carry its share of the production cuts and OPEC has so-far been reluctant to allow the U.S. to pick up Mexico's tab.

Any failure this week to firm up the new pact would likely weigh on the Loonie and could lift the Pound-Canadian Dollar rate.

"The OPEC+ alliance has agreed to cut oil output by 10MMbbls/d starting in May, however, this is conditional on Mexico accepting its allocated cut. So far, they don't appear willing," says Warren Patterson, head of commodities strategy at ING. "Until there is a concrete deal our price forecasts remain unchanged."

Above: Pound-Canadian Dollar rate shown at weekly intervals with Fibonacci retracements of 2016 downtrend marked out.

"There has been some widening in USDCAD bid/offer spreads as well as an explosion in intraday volatility in the spot rate, both of which reflect difficult trading conditions amid pockets of illiquidity. Month-end and quarter end may have contributed to volatile, flow-driven trade earlier this week, but we think difficult trading conditions may persist as North America braces for the brunt of the COVID-19 outbreak to manifest itself – which may boost risk aversion. We look for a 1.39/1.43 range in the coming week," says Shaun Osborne, chief FX strategist at Scotiabank, referrring to the USD/CAD rate.

Reaching the summit of Mount Coronavirus is key sustaining the recent improvement in investor risk appetite that's helped, alongside actions from the Federal Reserve, to weaken the greenback and pick smaller, riskier currencies like the Loonie and Sterling up off the floor. However, and as China has discovered in recent weeks, one country can go to the summit and back again but unless others also reach their own respective peaks then peaking might not mean much for the individual economy in question.

So although the currencies of countries whose outbreaks are peaking might be rewarded initially for success in containing national epidemics, isolated epidemic peaks might not be enough on their own to foster sustainable recoveries in exchange rates. For that to happen a global peak in the spread of the highly infectious disease might need to be reached first before investors can truly turn the page of the strong U.S. Dollar storybook, and put behind them the persistent weakness of risk currencies seen this year.

This is important for the Pound-Canadian Dollar rate because it is effectively the sum of GBP/USD over CAD/USD, and both those latter exchange rates might move materially in response to sustained signs of a peak in either the UK or Canada. But such moves may prove short-lived, along with any impact on the Pound-to-Canadian Dollar rate, unless and until signs of a global containment have also been seen and then sustained.

“While the past month has been marked by USD-directionality, as markets process the full economic fall-out of COVID-19, we expect that to evolve into more idiosyncratic moves,” says Elsa Lignos, global head of FX strategy at RBC Capital Markets. "We see negative growth in Q1 and Q2 2020, with the brunt of it in Q2 as the economy contracts around a whopping 30% and the unemployment rate spikes to above 20%. This should keep CAD on the defensive, with USD/CAD moving to 1.4300 in Q2 and the risk of an overshoot to 1.4500 possible as the shocks are absorbed."

Above: USD/CAD rate at weekly intervals with various moving averages displayed, alongside WTI crude oil futures price.