The Canadian Dollar Is Not Out of the BoC's Woods Yet, Despite Strong November Retail Sales Number

- Written by: James Skinner

- CAD shines alongside safe-havens amid yield hunt.

- But retail sales rebound fails to close October's gap.

- So CAD not yet out of the BoC's interest rate woods.

- But continues to dominate low-yielding rivals inc GBP.

- GBP seen remaining heavy ahead of BoE decision.

Image © Trending Topics 2019, Flickr. Reproduced under CC Licensing

- GBP/CAD Spot rate: 1.7232, down 0.21% today

- Indicative bank rates for transfers: 1.6585-1.6706

- Transfer specialist indicative rates: 1.6929-1.7032 >> Get your quote now

The Canadian Dollar outperformed all other than safe-haven rivals Friday as an upside surprise in November retail sales and a hunt for yield among investors lifted the Loonie, which scored one of its best gains over a weeping Pound, although it's not out of the Bank of Canada's (BoC) woods yet.

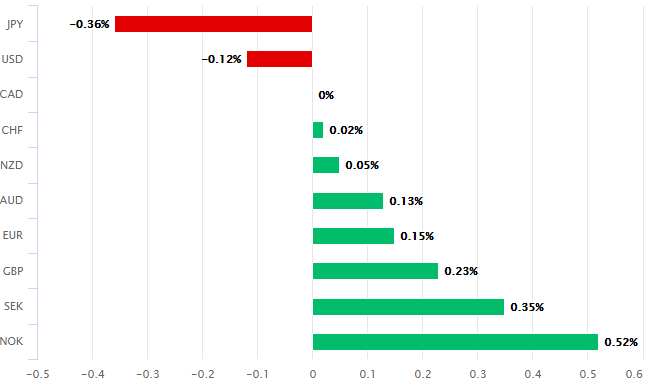

Canada's Dollar rose against all other than the safe-haven Japanese Yen and U.S. Dollar in the noon session Friday, with gains over low-yielding European rivals being the most notable. The Pound and Euro were among the biggest losers Friday with Sterling weeping ahead of an anticipated Bank of England (BoE) rate cut next week, although losses were outpaced by those of a Norwegian Krone that's blighted by domestic political uncertainty.

Friday's performance from the Loonie has half its roots in November retail sales figures that surprised on the upside and the other half in bond yields that are still proving an allure for investors, even though they have recently dipped back beneath those of the U.S. However, some local economists have said not to get too excited about the retail figures.

"Retail sales figures did nothing to lift the fog of uncertainty surrounding the health of the Canadian consumer. Yes, headline sales rebounded smartly following a soft October. However, growth was driven largely by the sometimes volatile autos category, and the rebound didn’t quite make up for the decline seen in the prior month," says Andrew Grantham at CIBC Capital Markets.

Above: Canadian Dollar performance against major rivals Friday. Source: Pound Sterling Live.

Retail sales rose by a sharp 0.9% in November, Statistics Canada said Friday, when markets were looking for a 0.4% rise to only partially close the gap created by the -1.1% reading from October. The outcome was clearly far better than the markets had anticipated although the more important core retail sales measure actually surprised on the downside.

Core retail sales rose by just 0.2% when consensus was for a 0.4% increase to completely close the gap opened up by October's 0.4% decline. And economists assign a greater importance to the core number because it ignores sales of expensive one-off items like cars, which distort underlying trends in spending.

Above: Pound-to-Canadian Dollar rate shown at hourly intervals alongside 2-year Canadian government bond yield.

"In determining the future path for the Bank’s policy interest rate, Governing Council will be watching closely to see if the recent slowdown in growth is more persistent than forecast. In assessing incoming data, the Bank will be paying particular attention to developments in consumer spending, the housing market, and business investment," the Bank of Canada said on Wednesday.

The BoC said Wednesday that consumers are one of Canada's main sources of economic resilience and hinted that if spending doesn't pick up sufficiently in the months ahead, then it could then feel compelled to cut interest rates.

Above: USD/CAD rate shown at hourly intervals alongside 2-year Canadian government bond yield.

Canada's 1.75% cash rate is matched only by that of the Federal Reserve (Fed) among major developed economies and the fact it was left unchanged throughout 2019, as other central banks cut their interest rates and in some cases on multiple occasions, played a key role in making the Canadian Dollar the best performing major currency of last year. However, the coveted and almost-high-yield status will be placed at increasing risk by any further disappointments in economic data up ahead.

"The central bank will rightly be more focused on economic data releases until it becomes clear whether recent faltering is a sign of underlying fundamental deterioration, or yet another statistical blip in what is often volatile Canadian economic data," says Nathan Janzen, an economist at RBC Capital Markets.

Above: Pound-to-Canadian Dollar rate shown at daily intervals.

Focus on the Canadian economy has intensified at the same time as markets have increasingly move to price-in a January 30 rate cut from 0.75% to 0.50% at the BoE, which partly explains why the Canadian Dollar's Wednesday losses to Pound Sterling were partially reversed ahead of the weekend.

"We think GBP will stay heavy ahead of next week's BoE meeting. Elsewhere, our focus turns back to the CAD," says Mark McCormick, head of FX strategy at TD Securities. "We note that the pair has closely tracked CA-US curve changes as BOC expectations have recently been repriced. 1.3125 should act as interim support for USDCAD, while 1.3180 will be notable resistance."

Above: USD/CAD rate shown at daily intervals

Friday's IHS Markit PMI surveys of the UK manufacturing and services sectors rose further than markets expected although the market's final call on the BoE and therefore, the Pound, is unlikely to be made until after next Wednesday's autumn forecast statement from HM Treasury.

There's a meaningful expectation in the market that Chancellor Sajid Javid will unveil a large fiscal stimulus that lifts expectations for growth and lessens the pressure on the BoE to provide stimulus to the economy. And if the market ends up disappointed next week, it would almost certainly seal the deal on a rate cut and could even lead to fresh losses for Pound Sterling.