Canadian Dollar Can Hold Recent Gains, Some Say, as Jobs Data Looms

- Written by: James Skinner

Image © Bank of Canada

- CAD can hold gains given shift in BoC rhetoric says CIBC.

- BoC policymakers comfortable with divergence from Fed.

- BoC to leave rates on hold for while yet, supporting CAD.

- But jobs data looms Friday as others eye CAD positioning.

- TD Securities says positioning leaves the CAD vulnerable.

The Canadian Dollar was treading water early in the Friday session and has been tipped some local analysts to cling onto its recent gains in the weeks ahead, although others are concerned that already-weighty wagers from investors have made the Loonie vulnerable to a downward correction.

Canada's Dollar was drawing support from a range of factors Friday decent gains for international oil prices, uncertainty about the local and U.S. jobs reports due out in the noon hours and also an apparent shift in rhetoric from the Bank of Canada (BoC).

Deputy Governor Timothy Lane told the Ottawa Board of Trade on Thursday that the BoC's apparent 2019 divergence from the U.S. Federal Reserve (Fed) has been overegged in the market. He noted that in spite of the Fed's three rate cuts this year, U.S. and Canadian interest rates are at parity this December before also noting past periods of actual divergence in monetary policies that was even greater than that perceived by the market this year.

"A top official from the Bank of Canada stated today that monetary policymakers in this country can chart their own course when it comes to interest rates," says Royce Mendes, an economist at CIBC Capital Markets. "The rest of the speech was in line with the communique from yesterday, again not mentioning the strength of the exchange rate versus non-US currencies which had been in the October statement, but removed in the latest write-up. Therefore, the moves in markets from [Wednesday] are likely to hold."

Above: USD/CAD rate shown at daily intervals.

The BoC often says things abotu rates and the economy that then stoke volatility in the currency although the market doesn't always interpret the hints and clues given by policymakers in the intended way.

For that reason it's not uncommon for deputies of the governor to get out on the speaking circuit in the wake of policy announcements, because doing so provides the bank with an opportunity to correct any misconceptions that might have emerged in the market.

Thursday is a case in point, with Lane addressing the Board of Trade and the Ottawa Business Journal barely a day after the BoC sounded an almost-hawkish tone in the statement accompanying its December interest rate decision. That saw the cash rate left unchanged at 1.75% and the bank itself cheer a better-than-expected set of business investment numbers that were revealed in the third-quarter GDP report last week.

Many had anticipated a reiteration of earlier downbeat rhetoric that was seen as having the potential to portend a rate cut to 1.5% as soon as the January meeting. However, the BoC said Wednesday it sees "nascent evidence" of a stabilisation in the global economy, weakness of which has been a key driver of the bank's caution this year, before noting an unexpected rise in business investment as well as strong increases in housing construction last quarter.

"There is "nascent evidence" that global growth is stabilizing. Perhaps more importantly, Canada's economy has continued to display resilience in other sectors, particularly services," says Josh Nye, a senior economist at RBC Capital Markets. "It is that resilience, as well as concerns about household debt, that has the BoC sounding more reluctant to lower interest rates."

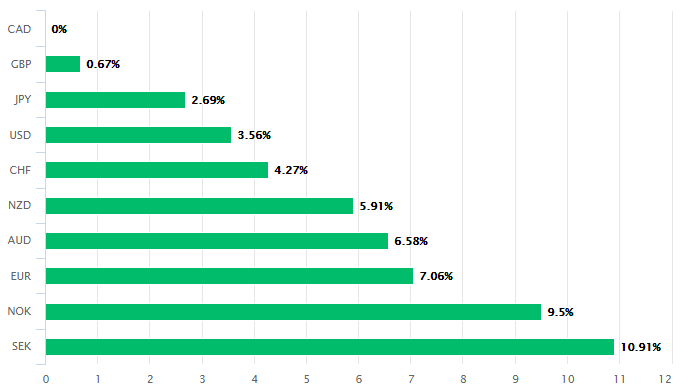

Above: Canadian Dollar performance against major rivals in 2019. Source: Pound Sterling Live.

Canadian economic resilience has seen the cash rate left unchanged all year, even as the Federal Reserve and others have cut rates repeatedly. That's elevated the Loonie to the top of the major currency league table although recent BoC communications had planted the seeds of doubt about the sustainability of that situation in the collective mind of the market.

CIBC says the BoC's latest statements suggest that rates will remain on hold for a while yet and that this can help support the Loonie in the short-term. Meanwhile, RBC also tips steady interest rates based upon the resilience of the domestic economy. However, another Canada-based global firm is concerned about the impact that already-weighty wagers in favour of the Loonie could have on price action - especially in the short-term.

"CAD positioning is one of the most one-sided in the G10; that means that while markets have scaled back long exposure over the past month, there’s little reason to reengage on the long side. There’s a partial offset on the HFFV, which still holds around 1.3150ish but offers little indication that the 1.30/1.33 won’t prevail. We still prefer the CAD cross story," says Mark McCormick, head of FX strategy at TD Securities.

Investors have backed the Canadian Dollar enthusiastically this year and are yet to meaningfully reduce their bets on the currency despite the fact that the pace of gains has trailed off in more recent months. That could mean the Canadian Dollar is vulnerable to even only minor disappointments in economic data up ahead because such things might prompt investors to lighten up their bets, which would require them to sell at least some Canadian Dollars.

Above: Pound-to-Canadian-Dollar rate shown at daily intervals.

"We expect a set of stronger USD/weaker CAD prints - at least relative to consensus estimates. If confirmed, this could compel investors to unwind some of the recent declines in USDCAD. We think the 1.3160 level should be a key pivot today with additional support arising in the 1.3100/15 zone. A retracement higher could see a test of 1.3240 ahead of 1.3255/60," McCormick says.

Friday's price action and commentary comes ahead of the November employment reports for both Canada and the U.S. which are almost always scrutinised intensely by the market as well as the respective central banks.

Consensus is looking for Canada's "random number generator" of a labour market to have produced 10k new jobs last month, which would more than reverse the -1.8k fall seen in the prior period and is expected to keep the unemployment rate at long-term low of 5.5%. Meanwhile, investors are looking for the larger U.S. jobs market to have produced 181k new jobs that month which are seen keeping the jobless rate steady at 3.6% - just 10 basis points above a multi-decade low of 3.5%.

Any disappointment over either of those two sets of figures could be enough to prompt weakness in the respective currencies this Friday.

"With both the Fed and BoC having hinted strongly they will remain on the sidelines for the next few months, the impact of economic data is a bit dampened, but these are still extremely important releases for each country," says Greg Anderson CFA, global head of FX strategy at BMO Capital Markets. "With USDCAD having dropped 110 pips on the last two days, we think there is particular vulnerability on the upside for USDCAD. A weak Canadian report and a strong US report could have us knocking on the door of 1.3300."

Time to move your money? The Global Reach Best Exchange Rate Guarantee offers you competitive rates and maximises your currency transfer. Global Reach can offer great rates, tailored transfers, and market insight to help you choose the best times for you to trade. Speaking to a currency specialist helps you to capitalise on positive market shifts and make the most of your money. Find out more here.

* Advertisement