Canadian Dollar Can Extend its 2019 Dominance say Analysts Following BoC Signal

- Written by: James Skinner

Image © Bank of Canada

- 'Wait and see' approach comes as others cut, supports the CAD.

- EUR/CAD a sell at TD as USD/CAD eyes trip lower to 'fair value'.

- But others warn BoC cannot remain immune to the global trend.

The Canadian Dollar followed oil prices, stock markets and bond yields higher Thursday after the Bank of Canada (BoC) suggested it will 'wait and see' how the U.S.-China trade war impacts the economy before deciding whether to lower its benchmark cash rate, setting it apart from others in the G10 crowd.

The Canadian Dollar retains its crown as the best-performing major currency for 2019 following the BoC's decision, and analysts say the appreciation can continue.

Because it looks as though the BoC will sit on its hands for a while longer, Canadian bond yields will remain among the most attractive in the developed world for a while yet, which should ensure foreign investors continue to send money into Canada, thereby providing support for the country's currency as a result.

Canadian and U.S. yields have reached post-crisis highs in recent months and remain best-in-class within the developed world.

"Most traders had expected that central bank to be more explicit in setting up a potential interest rate cut in its October meeting; in other words, the BoC’s statement was less dovish than generally expected," says Matt Weller, an analyst with Forex.com. "As a result, the loonie saw a quick 40-pip rally against most of its major rivals."

"Our fair value estimate has consistently suggested that USD/CAD should be trading sub-1.32," says Mazen Issa, a strategist at TD Securities, who says fair-value is currently situated at 1.3120. "We think spot will correct towards fair value as the market still has room to price-in a more patient BOC. Indeed, the OIS curve is now pricing in ~50% chance of a cut in October (from 65% prior to the meeting). Yesterday's 'wait and see' BOC statement makes us comfortable in maintaining our call for a January 2020 cut."

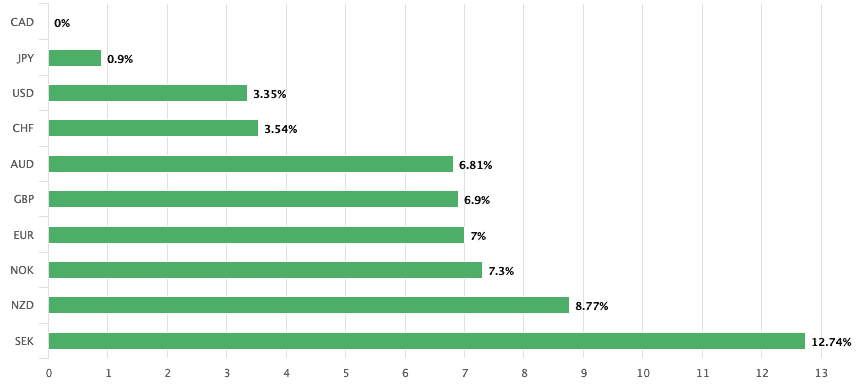

Above: CAD is the best-performing major currency of 2019

Governor Stephen Poloz noted again Wednesday the recent outperformance of the economy and acknowledged that inflation is contained at the target level when announcing the Bank of Canada's decision to leave the overnight rate unchanged at 1.75% in September. But he also warned again that economic growth will likely slow in the second half of the year and clearly tied forthcoming interest rate decisions to developments in the U.S.-China trade war, which is in the frame for the slowdown.

The decision might have simply been an attempt to avoid pre committing to rate cuts in case of a de-escalation in tensions ahead of the next decision which is scheduled for October 30, seeing as it came alongside a hint that BoC forecasts for Canadian growth could be downgraded at that meeting, which will follow what is expected to be the second interest rate cut from the U.S. Federal Reserve later this month.

Nonetheless, the decision has more than arrested the recent decline in the Canadian Dollar, which is now being tipped by some analysts to win back further ground from its U.S. rival and to continue getting the better of the Euro.

"Our tactically bullish CAD view was vindicated. We think there is more room to price out BoC easing this year and we continue to like tactical CAD upside. We hold onto our short EUR/CAD position and see USD/CAD fair-value around 1.3120," says Issa, in a note to clients. "The Bank has essentially telegraphed that while a worsening international outlook is receiving particular attention from policymakers, it would need to be patient to observe how it will impact the domestic economy."

TD Securities are meanwhile forecasting Canadian Dollar strength to contribute in pushing the Pound-to-Canadian Dollar exchange rate lower to 1.60 by year-end.

Above: TD Securities estimates of G10 currency mispricings relative to USD and in percentage terms.

Central banks the world over have either cut rates in recent months or signalled that they could do so before long, as momentum has ebbed from the global economy and is threatening to undermine inflation pressures that were in some cases already insufficient, but not the BoC.

Above: USD/CAD rate at 4-hour intervals with GBP/CAD (orange, left) and EUR/CAD (purple, left).

Canada's separation from the crowd has boosted the attractiveness of Canadian bonds and seen investors flock toward the Loonie as a result, but even the BoC has said Canada won't remain immune to the global trend.

The implication of this is the BoC may soon have to cut rates and in the process, risk undermining the Loonie's grip on the top spot in the G10 league table for 2019, which it briefly ceded to the safe-haven Japanese Yen in August when the U.S.-China tariff fight flared again.

Canada's economy has outperformed most rivals in recent months but last week's blowout GDP figures for the second quarter resulted mostly from a strong increase in exports of manufactured goods and oil from the energy sector, both of which are at risk from the trade war between the U.S. and China.

Negotiators are to go ahead with previously-telegraphed trade talks this month with a view to lining up more substantive discussions for October, Chinese media were said to have reported Thursday, but this comes only after fresh tariffs went into effect on Sunday.

"Quite a few market participants had expected the Bank of Canada (BoC) to follow in the Fed’s footsteps now and change from a neutral to a dovish approach, as CAD made considerable ground against the dollar following the rate decision. However, things are simply going too well domestically," says Antje Praefcke, an analyst at Commerzbank. "If it has to revise its outlook to the downside the BoC is likely to shift to a more expansionary monetary policy stance. However, until then that means for CAD: if the data deteriorates and / or the trade conflict intensifies it is likely to ease."

Above: USD/CAD rate at daily intervals with GBP/CAD (orange line, left axis).

Governor Poloz will unveil new forecasts in October, which could see expectations downgraded given he has already said the BoC expects the economy to slow in the second half. The BoC lifted its forecast for growth in 2019 to 1.3% in July, from 1.2% previously, owing to a stronger-than-anticipated performance by the economy in the recent quarter that the bank has already described as temporary, but it downgraded projections for growth in 2020 and 2021, and by more than it lifted the 2019 forecast. Furthermore, those downgrades came before the Sunday increase in U.S. tariffs on imports from China, which are now expected to weigh further on the global economy.

"USD/CAD pierced short-term uptrend support at 1.3271 after the BoC kept rates steady and was slightly less dovish than expected ," says Dario Parkhomenko, a strategist at RBC Capital Markets. "Our rates strategists believe that it is reasonable to assume that the Bank is leaning towards easing, but without a detailed timetable. Yesterday’s bearish trend reversal highlights support at 1.3225 and 1.3185, with resistance now at 1.3279."

Parkhomenko is waiting for the release of the BoC's economic progress report Thursday afternoon, which she says will provide more detail on the BoC's view of the economic outlook, particularly in relation to the anticipated impact of the trade war. The BoC has already blamed that for a fall in domestic and global business sentiment as well as investment. Markets will be looking for hints about a possible cut to the cash rate in October.

Changes in rates are normally made in relation to the outlook for inflation, which is sensitive to economic growth, but impact currencies because of the influence they have over capital flows and decisions of short-term speculators. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

"CAD held on to its earlier gains against USD and AUD after the Bank of Canada (BoC) maintained its neutral bias. However, the BoC did warn that escalating trade conflicts are weighing more heavily," says Kim Mundy, a strategist at Commonwealth Bank of Australia. "We expect the slowing global economic backdrop will be a key headwind to Canadian economic growth in coming months....we expect the BoC to cut interest rates by 25bp to 1.5% in October, to help cushion Canada’s economy."

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement