Pound-to-Canadian Dollar Rate Week Ahead Forecast: Upside Potential

Image © Pavel Ignatov, Adobe Stock

- GBP/CAD expected to continue rising short-term

- Longer-term charts also turning bullish

- Sterling to be moved by Brexit developments as parliament returns

- Canadian Dollar eyes employment data release

The GBP/CAD exchange rate is trading at around 1.6184 at the time of writing after falling almost 0.84% in the previous week.

Despite this weakness, studies of the charts are constructive and suggest the pair will probably move higher in the week ahead.

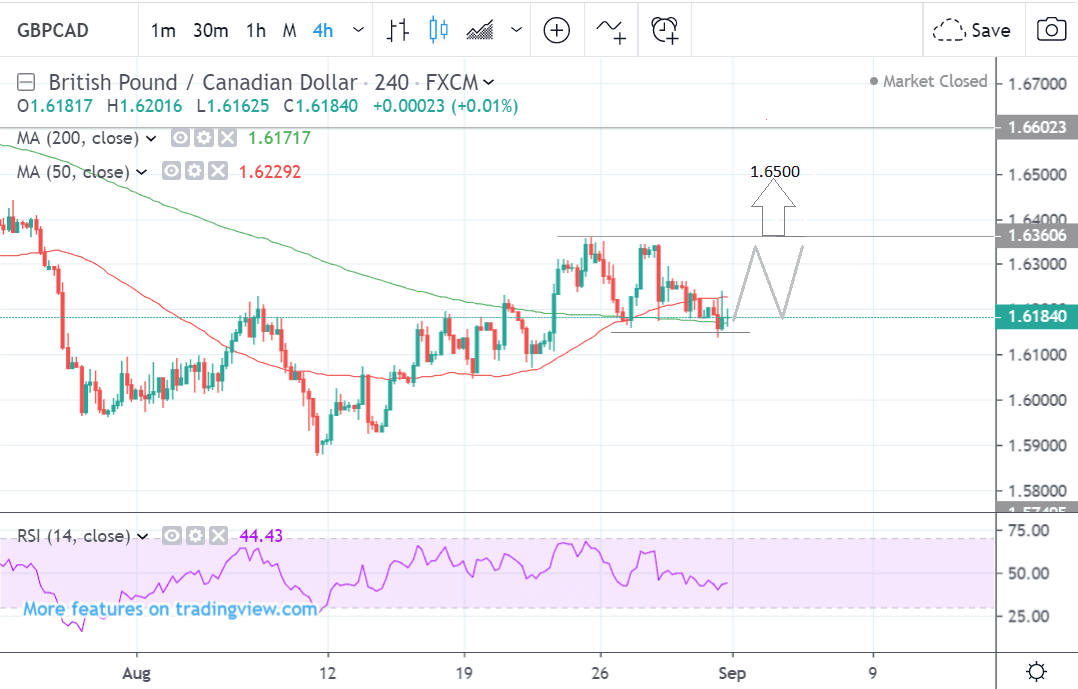

The 4 hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows how the pair has started going sideways after initially rising strongly following the August 9 lows.

This sideways trend could continue unfolding between the 1.6180 lows and 1.6380 highs or it could breakout above the range highs and rise up to 1.6500, which is roughly the target based on the height of the range extrapolated higher.

A break above 1.6375 would provide confirmation to a target at 1.6500.

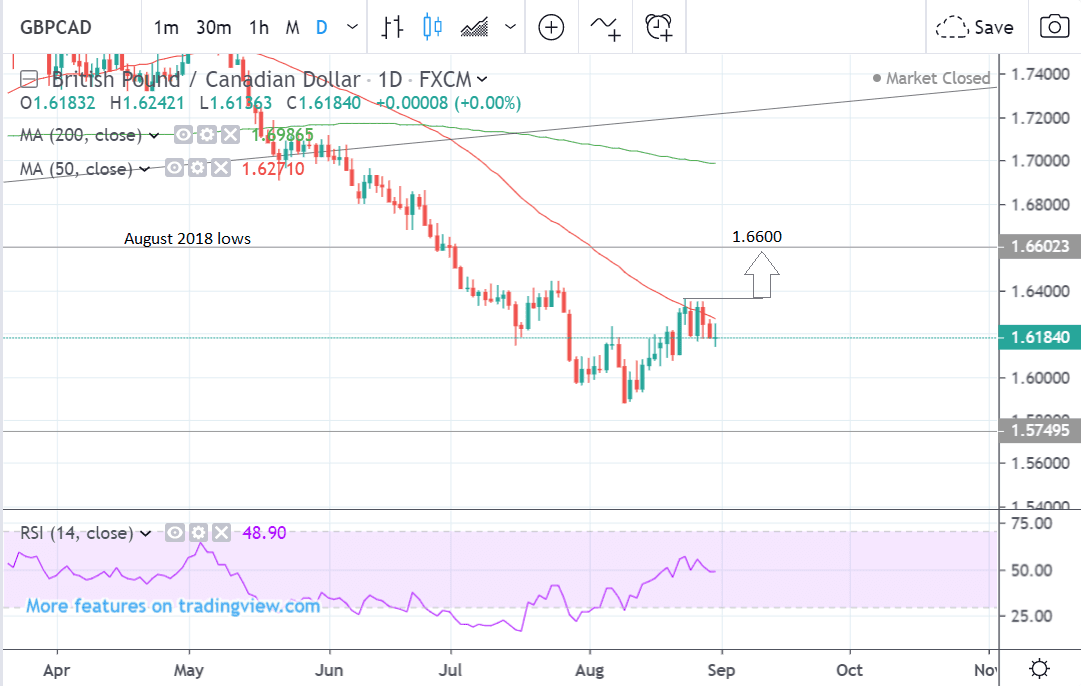

The daily chart shows how the pair has corrected higher to the level of the 50-day moving average (MA) at 1.6270. We see a good chance it will continue higher eventually.

A break above the 1.6357 highs would probably lead to a continuation up to a target at 1.6600, the August 2018 lows.

The RSI momentum indicator is rising strongly and is at the same level as it was when the exchange rate was in the 1.70s, which is a bullish sign for the exchange rate.

The daily chart is used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead.

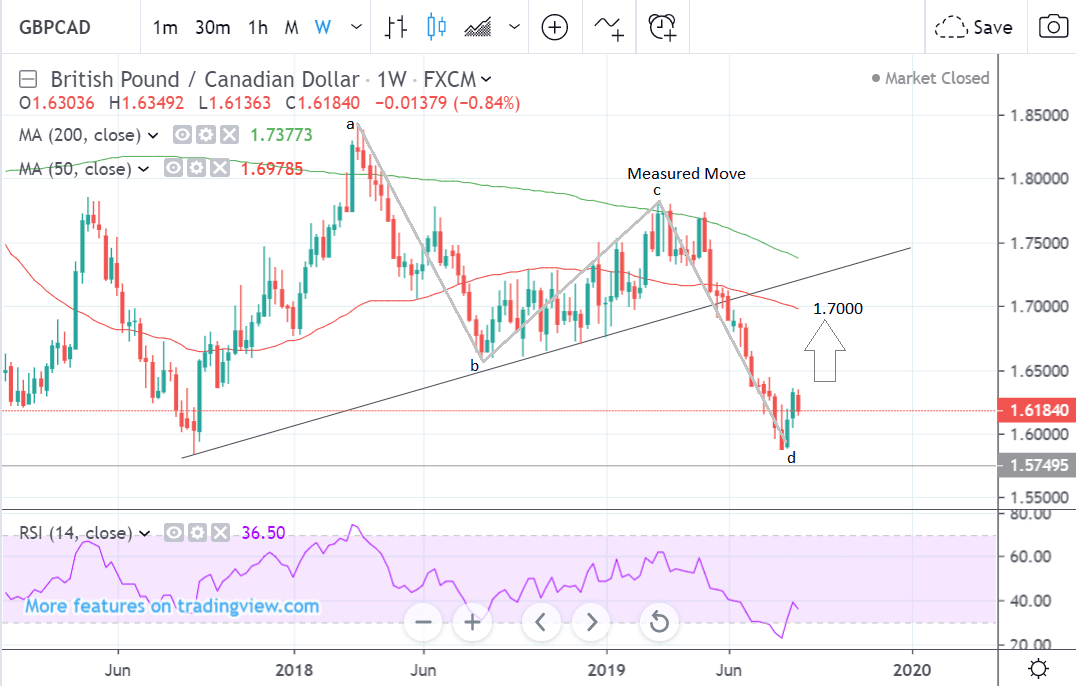

The weekly chart - used to give us an idea of the longer-term outlook, which includes the next few months - shows the pair having completed a ‘measured move’ which began at the 2018 highs.

The pattern is now probably complete as the final c-d leg has reached the same length as the a-b leg.

The fact the RSI momentum indicator has exited the oversold zone and is rising quite strongly provides further bullish evidence and suggests a rise up to a target at 1.7000 is not out of the question.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Canadian Dollar this Week: Bank of Canada, GDP in Focus

The main event for the Canadian Dollar is the Bank of Canada (BOC) rate meeting at 15.00 BST on Wednesday and Canadian employment data on Friday.

The BOC meeting is not expected to result in a major shift in monetary policy, although there is a risk of a subtle dovish shift in the language of the monetary policy statement which could impact negatively on the currency, as some commentators have noted evidence of an underlying slowdown in the economy.

Interest rates in Canada are still relatively high at 1.75% and the BOC has so far managed to avoid the ‘race to the bottom’ which other central banks have been taking part in, which has in turn proved supportive of the Canadian Dollar.

The Canadian economy continues to grow relatively steadily and recent GDP data for Q2 was strong, although not as strong as it would appear from the headline figure.

“Q2 GDP growth was materially stronger than the BoC’s forecast from July, but declining domestic demand hints at cracks forming beneath the surface. We therefore expect the Bank to downplay recent economic strength in the face of worsening global trade tensions," says TD Securities, a Canadian investment bank based in Toronto. "Concerns over US-China relations should also be reflected in the forward-looking language, where we expect subtle dovish tweaks linking further stimulus to continued deterioration in the global outlook.”

On the data front, Canadian employment data is expected to show an extra 15k jobs created in August from -24k in the previous month and for the unemployment rate to remain at 5.7% when it is released at 13.30 on Friday.

Such a result or better would probably support the Canadian Dollar as it would be a positive sign for the economy.

The Pound: Political Fireworks

September 03 sees the UK parliament sit once more, and the return of MPs should herald what is potentially going to be the most explosive week of parliamentary politics of our generation.

We fully expect Sterling to react to developments in parliament, and therefore warn readers that volatility is likely to be elevated.

MPs return to a shortened parliamentary session owing to the decision by Prime Minister Boris Johnson to suspend parliament from September 12 to October 14. The move has galvanised those MPs in the House opposed to Brexit into accelerating the passing of legislation designed to frustrate the Prime Minister and remove the option of a 'no deal' Brexit taking place on October 31.

Reports out late last week suggest MPs have agreed the form of legislation they would want to present.

If markets deem the legislation as having the potential to pass, and block a 'no deal' then there is a decent chance Sterling can extend higher.

However, we are of the firm belief that the best possible outcome for those wanting a stronger Pound would be for a Brexit deal to be struck. We believe that removing 'no deal' from the equation lessens the incentive for European negotiators to offer the substantive changes on the Northern Irish border backstop that Johnson is seeking.

It also materially lessens the incentive for MPs in the House to vote for a deal.

Johnson is looking to strike a fresh agreement with the EU and see it passing through the House on the back of the votes of MPs who have no option but to vote for a deal if they want to avoid a 'no deal' outcome.

Keep in mind that it is also possible opposition leader Jeremy Corbyn calls a vote of no-confidence when parliament.

A vote of no confidence has a fairly good chance of being successful given the large number of rebel Conservative MPs who are against a hard Brexit.

Press reports out on the weekend suggests Johnson will look for those MPs who vote against the government to be expelled from the party. This could shrink the scale of the Conservative rebellion against him.

It could however free up a number of MPs to vote against their ex-leader.

We view a no-confidence vote as offering up fresh uncertainty, and therefore potential downside for Sterling.

However, highlighting just how difficult it is to judge the landscape, some analyst believe a no-confidence vote could in fact be good for the Pound.

“If we have that vote of no confidence, whilst it is uncertain what the outcome would be, the Pound would go up on that headline alone. So that is why I think there is a shimmer of hope for a tactical long trade,” says Jordan Rochester, an analyst at Nomura.

There is a risk the Pound could also gain a boost from a legal challenge mounted by the anti-Brexit campaigner Gina Miller, who is attempting to prevent the proroguing of Parliament in the high courts.

Miller's argument is that a proroguing of this length of time is unprecedented. That the Queen was ill-advised and that it is unlawful as it was undertaken precisely to prevent parliament from doing its job of scrutinising the executive.

Opponents claim parliament typically does not sit at this time of year anyway, to allow for party conferences and that it is not within the remit of the courts, as it is a solely political matter.

“The Johnson hijackers are saying that the prorogation of parliament ahead of a Queen’s speech is what always happens – and that it is no more than a normal convention and precedent in our unwritten constitution. But there is no convention or precedent for a five-week prorogation. In the last 40 years, parliament has never been prorogued for longer than three weeks. In most cases it has been prorogued for only a week or less, for example for 3 days in 2015, 5 days in 2016 and 6 days in 2017,” says Miller.

The court hearing for Miller’s case has been set for Thursday, September 5. If she is successful Sterling will almost certainly rally.

On the economic data front, the main releases are manufacturing, construction and services PMI data on Monday, Tuesday and Wednesday respectively.

These could impact the Pound since PMI’s are seen as fairly reliable leading indicators of economic growth, and a better-than-expected result is likely to lead to a rise in Sterling, whilst vice versa for a lower-than-forecast result.

Manufacturing PMI for August is forecast to show a rise to 48.4 from 48.0 when it is released on Monday at 9.30 BST.

Construction PMI is expected to show a rise to 45.5 from 45.3 when it is released on Tuesday at 9.30.

Services PMI is estimated to have fallen to 51.4 in August from 51.0 previously when it is released at the same time on Wednesday.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement