Canadian Dollar Sold after July Jobs Data Shocks Markets

- Written by: James Skinner

Image © Pavel Ignatov, Adobe Stock

- CAD hits ropes after second consecutive jobs disappointment.

- Jobless rate spikes on woes among oil, retail and wholesalers.

- Data could portend new economic slowdown and BoC rate cuts.

- Comes amid trade war escalation, after CAD loses G10 crown.

The Canadian Dollar hit the ropes Friday after official data revealed a second consecutive contraction in employment during July and a surprise spike in the unemployment rate, which has further undermined the Loonie just days after losing its position as the best performing G10 currency of 2019.

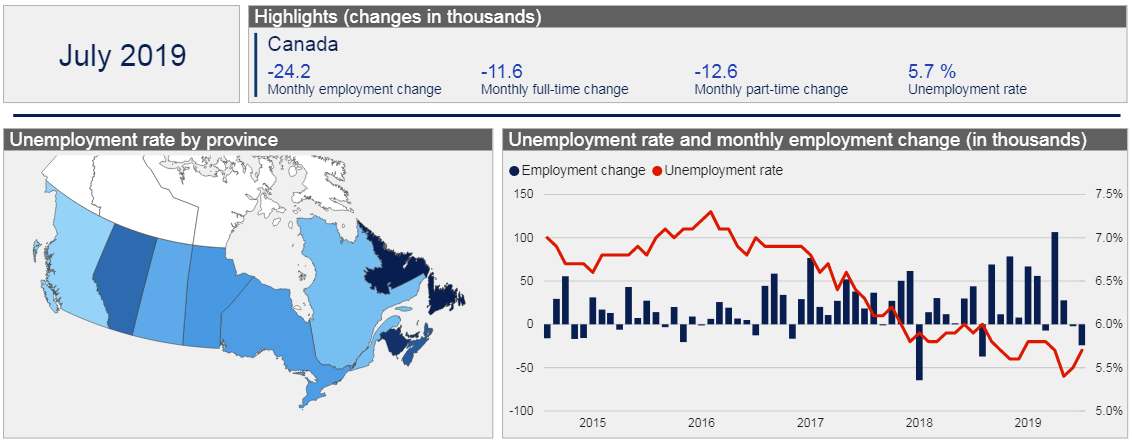

Canada's economy lost 24.2k jobs during the July month, according to Statistics Canada data, when markets had looked for a 15.2k increase to draw a line beneath the modest fall seen back in June.

The surprise fall prompted the unemployment rate to spike from 5.5% to 5.7% when consensus was for it to remain steady.

"The only upside surprise in the report showed up in wages. Hourly wages for permanent workers are now 4.5% higher than they were a year ago, accelerating from 3.6% in the prior month. We'd caution in taking that at face value though," says Royce Mendes at CIBC Capital Markets. "The report as a whole will be taken as a negative for Canadian markets, with the Canadian dollar selling off and yields falling."

Employment fell mainly in Alberta, Nova Scotia and New Brunswick, with more than half of the decline coming in the oil producing province of Alberta and some 8.7k jobs being lost in the energy industry alone. Oil prices fell 10% during the last month and on Wednesday, were quoted at their lowest levels for 2019. The Wall Street Journal reported Friday that global demand for oil is falling because of the U.S. trade war with China.

The wholesale and retail trades, both areas that have struggled in recent months, saw the bulk of job losses in July. This could be a worrying sign for the Bank of Canada (BoC) as it might portend weakness retail sales, broader consumer spending and ultimately, economic growth.

Above: Snapshot of Statistics Canada employment dashboard.

"Worries about the potential impact on Canada from escalating US-China trade tensions will persist. And we still fully expect employment growth to be softer over the second-half of this year than it was over the first. But details of the July report are still not really soft enough to change the narrative that Canadian labour markets still look pretty solid on balance," cautions Nathan Janzen, an economist at RBC Capital Markets.

Markets care about the labour market data because falling unemployment and improving job creation are thought to put upward pressure on wages. Pay growth leads to increased demand in an economy and upward pressure on inflation, with implications for interest rates and financial markets.

Changes in rates are normally made in relation to the outlook for inflation, which is sensitive to economic growth, but impact currencies because of the influence they have over capital flows and decisions of short-term speculators. Capital flows tend to move in the direction of the most advantageous or improving returns, with a threat of lower rates normally seeing investors driven out of and deterred away from a currency. Rising rates have the opposite effect.

"Weakening private sector employment at a time of heightened trade tensions and falling commodity prices is not a great story for Canada. The likelihood of rate cuts is increasing," says James Knightley, chief international economist at ING Group. "The market is looking for a 25bp rate cut in around 6M and if trade tensions persist we could well see Canada pull the trigger in December."

Above: USD/CAD rate shown at hourly intervals, alongside GBP/CAD (orange line, left axis).

"We’ve been long a USD/CAD call that expires next January with a strike at 1.3420.," says Bipan Rai, head of FX strategy at CIBC. "If you’d like to go the spot route – buying USD/CAD dips to the 1.3200 area is a defensible strategy in this environment. The target should be at the 1.3500 mark or above."

The USD/CAD rate spiked higher in response to the report, rising from 1.3220 to 1.3254, which leaves it 0.2% higher for the session. The Pound-to-Canadian-Dollar rate rate pared a steep earlier loss, rising from 1.5950 to 1.5994, although that still leaves it down 0.42% for Friday's session.

"Relative central bank policy appears to be offering renewed support and oil prices are extending their recovery from Wednesday’s low. The CAD continues to trade well below our estimated equilibrium (USDCAD FV 1.2672) based on interest rate differentials and oil prices, and we remain medium-term CAD bulls," says Shaun Osborne, chief FX strategist at Scotiabank.

Above: USD/CAD rate shown at daily intervals, alongside GBP/CAD (orange line, left axis).

Canada's Dollar had been the best performing currency in the G10 universe until this week after strong economic figures stood the country in contrast to its developed world rivals, leading the BoC to eschew the kind of rhetoric used by other central banks ahead of interest rate cuts that have either already materialised or are about to.

"The Canadian dollar has been somewhat insulated from the global risk sell-off, but it won't be for long, in our view. The sizeable divergence between Fed and BoC expectations is unlikely to sustain, while exposure to the global cycle via oil should also make CAD vulnerable. Although this is largely a risk-off 'catch up' view, long USD/CAD would likely perform well even under a more positive growth scenario," says Vassili Serebriakov, a strategist at UBS.

Canada's economy is right in the firing line of both the U.S. and China in the trade war, which is why the BoC has said will particular attention to "developments in the energy sector and the impact of trade conflicts on the prospects for Canadian growth and inflation" when making future interest rate decisions.

The Canadian Dollar ceded its crown as the best performer in G10 to the Yen earlier this week, after falling more than 2% against the Japanese currency amid market concerns the U.S.-China trade tariff fight could escalate again and soon turn into a 'currency war'.

This was after the People's Bank of China (PBOC) encouraged the Renminbi to further depreciate this week by fixing the midpoint of permissable trading ranges for the USD/CNY rate highe and higher throughout the week, and breaching the psychologically important 7.0 level. Those fixings for the state-managed currency will offset some of President Donald Trump's tariffs by reducing the cost of Chinese goods for those paying in foreign currency.

The PBOC fixes, which followed a White House decision to target China's remaining $300 bn of annual exports to the U.S. with a 10% tariff from September 01, saw Trump declare China a 'currency manipulator". Analysts say the tariff will rise to 25% sooner or later and markets are adjusting to the idea that hostilities between the world's two largest economies go on for a while.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement