Pound-to-Canadian Dollar Rate Week Ahead Forecast: Downtrend Tipped to Continue Despite Hints of a Bottom

Image © Adobe Images

- GBP/CAD is in a strong downtrend

- Increasing signs of a possible long-term bottom

- Canadian Dollar to be driven by geopolitics, jobs and housing data

The GBP/CAD exchange rate is trading at 1.6299 at the time of writing on Monday, having fallen 1.69% in the previous before.

Studies of the charts are showing that the overall downtrend remains intact and likely to extend over the next few days.

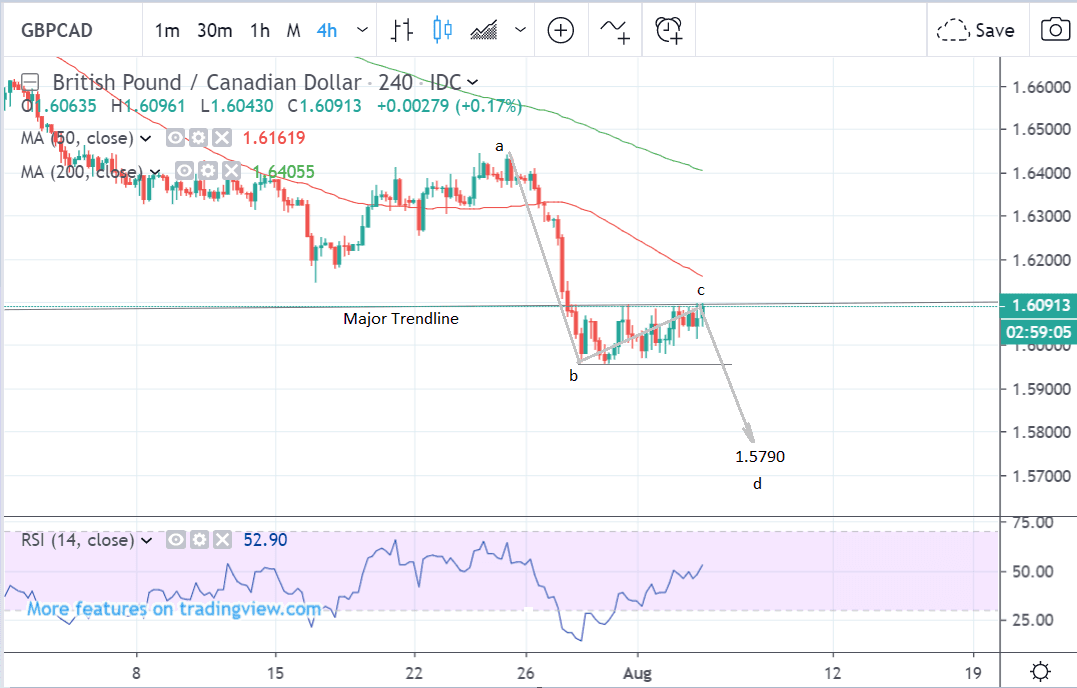

The 4-hour chart - used to determine the short-term outlook, which includes the coming week or next 5 days - shows the pair consolidating after a steep decline.

The sideways consolidation is shallow and unlikely to result in a reversal higher. It is capped by a major trendline and our suspicion is the downtrend will probably resume.

A break below the 1.5957 July 30 lows, would provide confirmation of a continuation down to a target at 1.5790.

The target is based on the possibility that the move down from the July 25 highs may be a measured move in which wave’s a-b and c-d are either of a similar length or related by a Fibonacci ratio of 0.618.

The Fibonacci ratio is a mathematical discovery from the 14th century which appears to explain many proportions in the natural world, aesthetics and also financial markets.

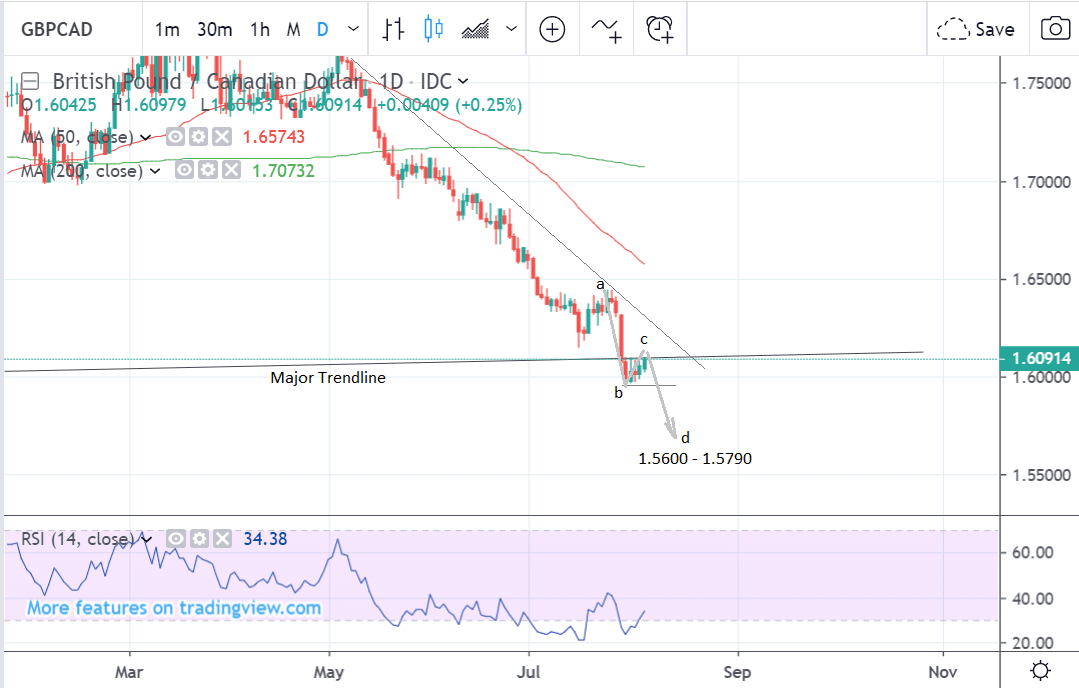

The daily chart - used to give us an indication of the outlook for the medium-term, defined as the next week to a month ahead - shows the dominant downtrend more clearly.

The scenario is similar to that shown on the 4hr chart with the pair expected to break lower subject to a successful breach of the July 30 low.

The downside target is deeper in the medium-term, however, with a range between 1.5600 and 1.5790 posited based on the final leg of the measured move extending either by a ration of 1.00 or 0.618 of the initial leg.

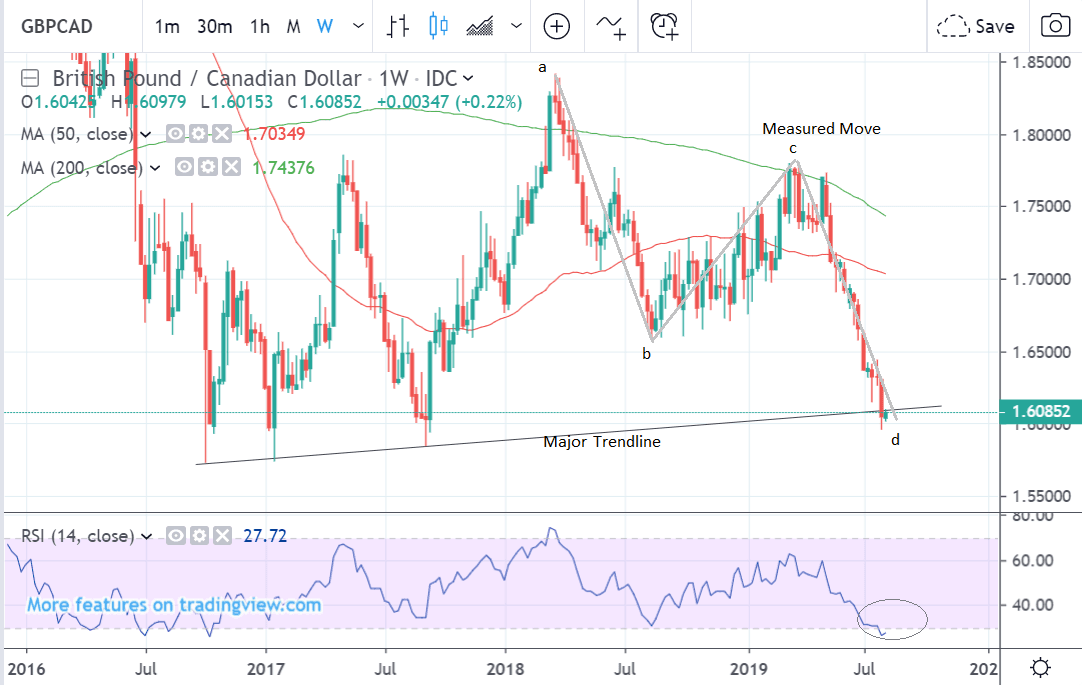

The weekly chart - used to give us an idea of the longer-term outlook, which includes the next few months - shows the pair forming a much larger ‘measured move’ which began at the 2018 highs.

Although we remain bearish because the downtrend is intact the evidence on the weekly chart is much less bearish and suggests a risk of a reversal higher.

The measured move has probably finished since the final C-D leg is of a similar length to the first A-B leg. This now suggests the downside target has been met, selling pressure will reduce, and the pair will probably start rising.

The fact the RSI momentum indicator is inside the oversold zone, which suggests positioning may be stretched to the downside, further increasing the risk of a rebound higher.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement

The Canadian Dollar: What to Watch

The main drivers of the Canadian Dollar are likely to be global risk trends and domestic data including jobs and housing data.

The escalating trade war between the U.S. and China is a negative risk factor for the Canadian Dollar because of its potential to negatively impact manufacturing and global growth.

The most recent spat was triggered by President Trump who last week threatened to impose a 10% tariff on the $300bn of remaining Chinese imports which are not currently tariffed. The Chinese retaliated by canceling orders via state-run companies for U.S. agricultural products.

Geopolitical developments took the shine off a positive run for Canadian data.

“External developments left a dour mark on what was otherwise a fairly constructive week for the Canadian economy. Wednesday saw May GDP came in above market expectations, with a 0.2% month-on-month gain reported. Combined with solid, upwardly revised activity in the prior months, the May data contributed to the best three-month string of GDP reports since mid-2017,” says TD Securities, a Canadian investment bank based in Toronto, in a client briefing.

The main data highlights in the week ahead according to TD Securities are jobs and housing data - both out on Friday.

They are unlikely to impact on the Canadian Dollar unless they show worrying signs of slowdown and miss estimates. This might suggest Canada is now immune to the global slowdown and the Bank of Canada could start cutting interest rates like most of the rest of the G10 central banks.

Lower interest rates are negative for currencies as they make the country less attractive to investors and reduce net foreign capital inflows.

Housing starts are forecast to slow to a consensus estimate of 204k in July from 246k in June when released at 13.15 BST. Despite forecasting a decline, the June figure was extremely high, so the decline will be from a high level.

TD Securities expect a stronger 220k result.

“Housing starts are expected to slow to a 220k pace in July, down from 246k, on a pullback in multi-family housing starts from record levels observed in June when developers broke ground on 185k units,” says TD Securities. “On a regional basis, we look for a broad-based slowdown given a heatwave across Eastern Canada and mean reversion in the West; housing starts for BC were 10% higher in June than any other month on record, while a 40% m/m increase saw Alberta housing starts hit their highest level since mid-2018.”

Employment data is out at 13.30 on Friday. The consensus estimate is for a 12.5k rise in July and 5.5% unemployment rate, but TD expect a 10k rise in payrolls and 5.5% unemployment.

TD Securities looks for the Canadian economy to add 10k jobs in July in a further moderation from the robust performance observed in fourth quarter of 2018 and the first quarter of 2019.

"The goods-producing sector should provide the main engine for job growth following the loss of 30k positions in June; while manufacturing firms may be hesitant to add back workers given ongoing trade tensions, the recent strength of residential construction suggests last month’s 7.5k decline should be short-lived,” says TD Securities.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement