Canadian Dollar Tipped to Rise another Four Percent this Summer

- Written by: James Skinner

Image © Adobe Images

- USD/CAD to decline further 4% this summer says Societe Generale.

- CAD shines ss Fed cuts and BoC stands apart from the G10 crowd.

- Credit Suisse sounds sceptical of further CA growth outperformance.

- BMO sees CAD heaping its own funeral pyre amid scrutiny from BoC.

The Canadian Dollar built further on recent strong gains Friday and could yet rise another four percent throughout the summer months, according to strategists at Societe Generale, but analysts at some other firms are mindful the Loonie could be heaping fuel upon its own funeral pyre.

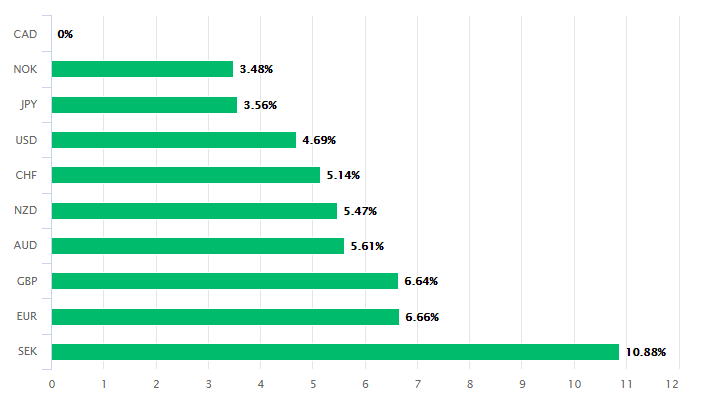

Canada's Loonie was still the best performing G10 currency for 2019 by a country mile on Friday because it has continued to be supported by perceived economic divergence from many developed world counterparts, which has enabled the Bank of Canada (BoC) to stand apart from the crowd as far as interest rates go.

The BoC emphasised risks to the economic outlook this week but stuck to its guns as far as its guidance goes, signalling that no change in its interest rate is likely in the short-term. It says the 1.75% cash rate is "accomodative" for the economy and that it will pay particular attention to "developments in the energy sector and the impact of trade conflicts on the prospects for Canadian growth and inflation" when making future interest rate decisions.

Meanwhile, the U.S. Federal Reserve (Fed) and many other G10 central banks are rapidly retreating from earlier guidance that suggested interest rate hikes were on the way and are increasingly hinting that they could soon begin to slash borrowing costs for companies and consumers in order to support their own economies in the face of a global slowdown. The Fed is expected to begin cutting rates on Wednesday, July 31.

Above Canadian Dollar performance Vs G10 rivals in 2019.

"While recession risks are threatening a slowing US economy, the BoC’s Wilkins highlighted that “Canada is moving back up to its trend growth”," says Oliver Korber, a strategist at Societe Generale. "This divergence reflects the fact that “the two countries are at different points in the economic cycle”. According to the BoC analytical framework, the impact of negative tariffs on growth and prices will eventually be larger on the US and China than on Canada."

Surveys have suggested the U.S. manufacturing sector is creaking beneath the weight of tariffs being levied on imports from China, which is slowing domestic activity as well as hurting global demand because of the damage done to economies in China and elsewhere. Economists are now widely tipping a U.S. economic slowdown with some even fretting about the prospect of a recession, although U.S. growth picked up in the first quarter of 2019 and figures for the recent period aren't out until August.

The Fed is now widely expected to begin cutting rates in an effort to sustain the expansion and shield itself from White House criticism that's come thick and fast this year after four 2018 rate hikes lifted borrowing costs for companies and consumers and drove the greenback higher. The strong Dollar is making U.S. exports less competitive and incentivising imports from other countries, among other things.

"USD/CAD continues to lag the move in relative rates, and the BoC is definitely out of synch with the Fed, which is securing expectations of the coming easing cycle. With equites shining, a summer move towards 1.25 is possible," Korber says.

Above: USD/CAD at daily intervals alongside U.S.-CA 2-year bond yield gap (green line, left axis).

The diverging stances of the two North American central banks have seen U.S. bond yields lag Canadian yields in the turn higher that followed the end-June agreement between Presidents Donald Trump and Xi Jingping. The detente averted an escalation of the trade war and led the gap, or 'spread', between yields on U.S. and Canadian bonds to narrow in favour of the Loonie.

In other words, U.S. yields are no longer quite so attractive to international investors, relative to their Canadian counterparts, as they were a few weeks ago. Although the yield gap or 'rate spread' has been turning in favour of the Loonie ever since the middle of May when Trump lifted the tariffs levied on some Chinese exports to the U.S.from 10% to 25% and threatened further action.

Societe Generale's Korber says those developments in the bond market are due to the fact the U.S.-China trade war will hurt the world's two largest economies more than it will Canada's over the long term, although a strong Canadian economic performance has also been at play too. Growth rebounded from earlier falls in the second quarter, although the BoC says the strength is temporary, while inflation surged to 2.4% in May. The latter makes it difficult for the BoC to follow its G10 colleagues in cutting rates.

"Oil prices have failed to return to April highs, and the trade outlook is only nominally improved following the friendly but still effectively fruitless Trump-Xi meeting at the G20 in Osaka. Furthermore, the BoC singled out non-energy trade and business investment as the two key indicators for the policy outlook in the April Monetary Report, and neither has made strides in the past few months," says Shahab Jalioos, head of FX strategy at Credit Suisse.

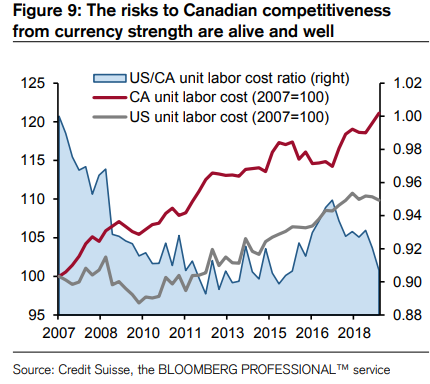

Above: Credit Suisse graph showing changes in Canadian labour competitiveness.

Credit Suisse is sceptical that Canada's economic outperformance can continue for much longer and mindful that the more the Loonie strengthens, the greater the threat to Canadian labour and export competitiveness becomes. The Swiss banking giant is not alone either because domestic firms have also expressed concerns about currency strength and are increasingly attuned to the risk that the Bank of Canada might seek to drive the exchange rate lower as a result.

Currency strength makes imports cheaper for Canadians to buy, which could eventually reduce inflation below the BoC's 2% target, and also risk slowing the economy by making exports more expensive for other countries to buy. Inflation would be particularly vulnerable to a downward correction below the target if the economy slows after a period of exchange rate strength, which might then necessitate a change in the BoC's interest rate stance.

"We're keeping an eye on USDCAD too and remain conscious of a potential test below the 1.3000 mark. We think that such a move would contradict the broader fundamental picture - especially in light of this week's BoC rate decision," says Stephen Gallo at BMO Capital Markets.

Gallo has said earlier this week that a move below 1.30 for the USD/CAD rate would be likely to draw a verbal response from the BoC. Presumably, if the exchange rate falls as far as Societe Generale envisages there might be a danger of a bit more than a verbal reaction for the central bank.

BMO forecasts the USD/CAD rate will rise to 1.34 by the end of September and then fall back to 1.32 in time for year-end. The exchange rate is forecast to fall to 1.31 by March 2020 and 1.30 by June 2020. The Pound-to-Canadian-Dollar rate on the other hand, is seen rising from 1.6350 Friday to 1.65 by the end of September although BMO sees the Brexit-stricken British currency slipping back to 1.64 by year-end.

Above: Pound-to-Canadian-Dollar rate shown at weekly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement