The Canadian Dollar is a Sell says Westpac

- Written by: James Skinner

Image © Pavel Ignatov, Adobe Stock

- CAD's likely to run out steam over coming weeks says Westpac.

- Technical factors, BoC rate policy, USMCA uncertainty to weigh.

- Westpac now buyer of USD/CAD, targeting move back to 1.33.

- Scotiabank says any upward move in USD/CAD just a correction.

- Scotiabank eyes more CAD gains Vs USD and GBP into year-end.

The Canadian Dollar bested its U.S. counterpart Wednesday but the Loonie's recent run of strong gains is likely to meet at least a temporary end over the coming weeks according to analysts at Westpac, who've told clients to sell the currency in anticipation of a correction lower.

Westpac, one of Australia's four largest lenders and notable force in the global league table, has listed a number of reasons why the Canadian Dollar is likely to soon run out of steam after a strong rally through the month of June. It says these reasons should translate into a bounce higher for the USD/CAD rate.

"CAD was the strongest G10 currency in June but prospects for further USD/CAD declines face tougher technical resistance into 1.3000, the area coinciding with a range of key supports. BoC rate cut pricing remains very guarded," says Richard Franulovich, head of FX strategy at Westpac.

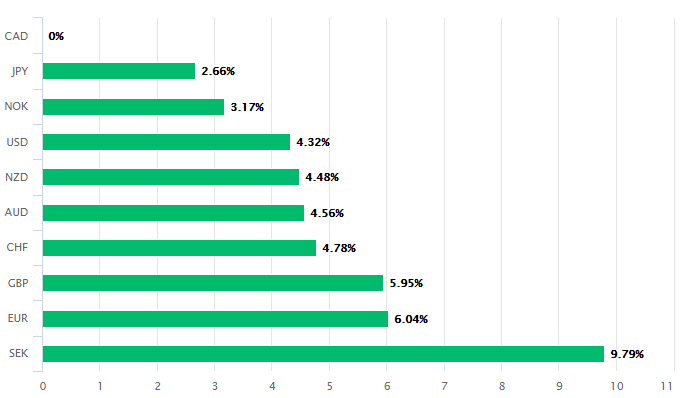

Franulovich has flagged that financial markets see only a mild risk of a Bank of Canada (BoC) interest rate cut coming inside of 2019 when most other developed world central banks are widely expected to begin cutting borrowing costs sooner or later. This is part of the reason why the Loonie is now the strongest G10 currency of 2019.

Above: Canadian Dollar performance Vs G10 rivals in 2019.

There are good reasons for why markets are sceptical of suggestions the BoC might cut rates later this year, not least of all because the consumer price index surged far above the bank's 2% inflation target in May.

However, central banks are pack animals and the Canadian one has always been averse to a stronger currency so could conceivably feel compelled to ruffle a few feathers after next week's policy meeting. The BoC will announce its latest rate decision and economic forecasts next Wednesday at 15:00.

"Firming inflation and a decent BoC business survey will encourage the BoC next week to reiterate an optimistic tone but global risks have grown and the Bank may well amplify these concerns," Franulovich warns.

BoC Governor Stephen Poloz said in May that future rate decisions would be dependent on "developments in household spending, oil markets and the global trade environment." The comments appeared to make future hikes contingent on a deescalation of the U.S.-China trade war and a range of other factors.

Presidents Donald Trump and Xi Jingping agreed at the weekend to avoid imposing further tariffs on each other for now and to resume their previously abandoned talks aimed at addressing U.S. concerns over "unfair" trading practices, but it's far from certain that the truce will last for long.

In addition, if the BoC was to hint that it might soon consider raising interest rates again, the Canadian Dollar would likely strengthen even further and that would risk slowing the economy by making exports less competitive and imports cheaper to buy. Exports are an addition in the calculation of GDP while imports are a subtraction.

Furthermore, a stronger currency and cheaper imports would reduce inflation. Rate decisions are normally made in relation to the inflation outlook and the consumer price index is now above the 2% target but whether the BoC wants to encourage the aforementioned effect would depend on if it sees May's inflation surge as temporary or not.

Above: USD/CAD rate shown at daily intervals.

"Passage faces a tougher slog on both sides of the border – writs for Canada’s elections likely issued mid-Sep and if not passed by then the next Parliament will need to take up USMCA. House Leader Pelosi is still fending Democrat concerns. "Side letters" may be added to the Bill to assuage Democrats but if not addressed in the next several months the USMCA’s fate in Congress increasingly approaches 2020 election considerations," Franulovich says.

Franulovich is worried about delays to the process of ratifying the new United-States-Mexico-Canada-Agreement, which is the update to 'NAFTA' negotiated by President Donald Trump. If there are delays to the ratification process the Canadian Dollar might suffer because the pact is critical for continued tariff-free trade between Canada and its largest export market, the United States.

Westpac has told clients to buy the USD/CAD rate and target a move back up toward the 1.33 handle over the coming weeks and months, with a walk-away 'stop-loss' price set at 1.3025, which is far below Wednesday's 1.3071 level. One of Canada's largest lenders also told clients this week that there's a danger the USD/CAD rate heads higher toward Westpac's target in the short-term, but it also says such a move would be likely to prove short-lived.

Scotiabank has long-held a bullish view on the Canadian Dollar's prospects and forecasts the USD/CAD rate will finish 2019 all the way down at 1.30. It's also looking for the Pound-to-Canadian-Dollar rate to close the year at 1.62, down from 1.64 Wednesday. Eric Theoret, a technical analyst at Scotiabank, updated his view on the short-term outlook on Tuesday.

"USDCAD found decent support around 1.3070 (the early 2019 low) over the long weekend, which is no great surprise," Theoret writes, in a note to Scotiabank clients. "We spot key short-term resistance at 1.3150 and can allow the USD to squeeze back to 1.3225/50 above here but we think USD corrections are liable to attract strong technical selling pressure."

Above: USD/CAD rate shown at weekly intervals.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement