Pound-to-Canadian-Dollar Rate Crushed after Steel Tariffs Lifted, PM May Woes Worsen

- Written by: James Skinner

© kasto, Adobe Stock

- GBP/CAD hits new lows, USD/CAD slides, after metal tariffs ended.

- Strong CA economy, end of tariffs, risks driving second BoC u-turn.

- As PM Mays woes deepen and no deal Brexit risk weighs on GBP.

The Pound-to-Canadian-Dollar rate plumbed fresh lows Friday and the Loonie bucked a global trend by besting the U.S. greenback after the White House lifted tariffs on imports of Canadian steel and aluminium, amid a return of 'no deal' Brexit risk.

The White House said Friday that it tariffs on imports of alumiium and steel from Canada and Mexico will be lifted from midnight Friday, bringing an end to more than a year of 25% levies that were originally imposed in the name of national security.

The announcement is a win for the Canadian Dollar and Bank of Canada (BoC) given how trade tensions and tariffs have played such a significant role in its December-to-April u-turn on earlier interest rate guidance.

"The main impact from todays news will be the improvement in sentiment towards trade with the US, something that has been holding back business investment for the past year," says Katherine Judge, an economist at CIBC Capital Markets. "The deal improves the odds of ratification of the USMCA although that is far from being final. Overall, positive for CAD, mainly on improved sentiment."

The decisions comes with Canada's Dollar trading at a steep discount relative to the greenback and amid an oil price outlook that analysts say should be supportive of the Loonie, although all G10 currencies other than the Japanese Yen have lost ground to the big Dollar in recent days.

Already-steep losses for the Pound-to-Canadian-Dollar rate were magnified yet further still following the report, which comes at the end of a punishing week for Pound Sterling, while the USD/CAD rate was also sent tumbling lower.

"The CAD remains undervalued relative to its fundamentals however sentiment continues to dominate in the context of global trade policy uncertainty and material weakness in China’s currency. The market tone appears fragile as we head into the weekend and domestic risk is limited ahead of next Wednesday’s retail sales release," says Shaun Osborne, chief FX strategist at Scotiabank.

President Donald Trump imposed tariffs on imports of steel and aluminium from a range of countries in 2018, citing 'dumping' and anticompetitive behaviour from some countries and declaring imports from even many allies a threats to national security given the then-dire health of the U.S. steel industry.

The decision to lift the tariffs on Mexico and Canada is a boon for sentiment in both smaller economies and might be taken as a sign the Unites-States-Mexico-Canada trade agreement is more likely to be ratified over the summer.

However, it still leaves tariffs in place on imports from a range of other countries so cannot necessarily be taken as a softening of Trump's 'protectionist' trade policy stance, which is still roiling global markets as the tariff conflict between the U.S. and China threatens to evolve into a serious and protracted economic conflict.

"Growing trade tensions between the world’s two largest economies drew plenty of attention this week, and for good reason with the US and China tagging each other with higher tariffs. The Bank of Canada highlighted potential escalation of trade conflicts as a key economic risk, and in turn a risk to the stability of the financial system," says Nathan Janzen, an economist at RBC Capital Markets.

Above: USD/CAD rate shown at hourly intervals.

The BoC about-turned in December on earlier guidance that had suggested it could lift its interest rate as many as three or four times in 2019. Its guidance now is that rates could go up or down in the next change.

The turn took several months to carry off but is now complete, although the USD/CAD rate is up from the 1.32 level it was at before the pivot and the Pound-to-Canadian-Dollar rate has risen from 1.67.

"We expect short-term, corrective GBP gains to be limited to 1.73 from here now and see some support for the GBP in the mid 1.71 area. Failure to see support emerge around 1.7150/55 could see the GBP decline accelerate," warns Eric Theoret, a technical analyst and Scotiabank colleague of Osborne's.

For the Loonie, if lifting tariffs and any read-across for the USMCA deal comes as balm for the economic outlook there's a chance that markets begin to ponder if the Bank of Canada could soon be forced into yet another u-turn.

Any suggestions by the BoC, and certainly suspicions on the part of the market, that rates may in fact still need to rise in 2019 could be met with much weaker USD/CAD and GBP/CAD exchange rates.

Above: USD/CAD rate shown at daily intervals.

"Let’s not lose sight of the fact that Canada enjoyed a run of solid economic data though the first half of May. This week it was stronger home sales and manufacturing activity; last week it was record job growth and a surge in housing starts. We expect the trend will continue next week with March’s retail sales," says Janzen.

Pricing in the overnight-index-swap market suggests strongly that investors have until now been betting that an interest rate cut is more likely in 2019 than an interest rate hike. The December 04 implied cash rate was 1.64% Friday, far below the current 1.75% rate.

Interest rate decisions impact currencies through the influence they have over capital flows, as well as their allure for short-term speculators, which tend to move in the direction of the most advantageous or improving returns.

"Domestic rate expectations have held in remarkably well throughout this most recent period of risk aversion and yield spreads have narrowed considerably. Oil prices remain supportive and our fair value estimate for USDCAD (using the 2Y spread and 5Y spread as well as WTI) is 1.3106. We remain bullish CAD on the basis of fundamentals and continue to feel that CAD shorts are vulnerable to a turn in sentiment," warns Scotiabank's Osborne.

Above: Pound-to-Canadian-Dollar rate shown at daily intervals.

Meanwhile, in London, Pound Sterling is on course to finish a punishing week at the bottom of the G10 league table, after declining against all of its major rivals over recent days in response to a return of so-called 'no deal Brexit' risk.

Losses escalated on Friday after opposition leader Jeremy Corbyn withdrew from cross-party talks with Prime Minister Theresa May, citing irreconcilable policy differences. PM May is now under relentless pressure to clear out her desk and make way for a Brexit-supporting replacement.

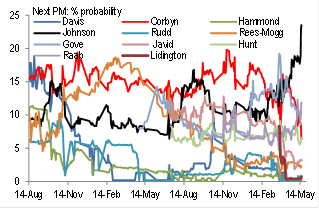

"Markets are converging on a scenario of May’s early exit and her replacement with a pro-Brexit PM and, implicitly, a growing risk of no deal exit and GBP weakness as a result. On Betfair’s prices, the Q3 peak probability of May’s departure date is now almost 80% and Johnson is increasing his lead as likely next PM. Today, this stands at 22% - more than double that of the next most likely candidate," says Adam Cole, chief currency strategist at RBC.

Corbyn's decision is now expected to pave way for one last 'meaningful vote' on PM May's EU withdrawal agreement and another series of 'indicative votes' that seek to establish a majority among MPs in favour of one particular path out of the European Union.

However, parliament remains divided over the best course of action with little sign or hope of a majority being seen any time soon while the market is not even willing to entertain the notion that PM May might be succesful in securing a majority for her withdrawal treaty on the fourth asking.

This sets Sterling up for a potential summer of discontent as international investors go on strike, eschewing the currency through fear of what might happen to it in the months ahead, and as short-sellers return to bet against British exchange rates.

Above: Conservative Party leadership polls. Source: RBC Capital Markets.

"GBP is exceptionally weak, reflecting Brexit uncertainty, the latest breakdown in cross party talks, and PM May’s looming departure," says Scotiabank's Osborne.

The EU withdrawal agreement, if approved by parliament, would prevent the UK from departing the bloc and defaulting to doing business with it on World Trade Organization terms through a series of mechanisms. But Brexit-supporters have been up in arms about ever since it first saw the light of day.

"The Withdrawal Agreement, which contains the Irish backstop, would commit the UK to a customs union style arrangement as the bare minimum for the future relationship. Any further agreement would need to be practically equivalent to this or more comprehensive," says Holger Schmeding, chief economist at Berenberg Bank.

Riding high in first place in all of those polls is The Brexit Party which sprung from the political ether less than two months ago and, headed by arch eurosceptic Nigel Farage, is expecte to emerge from the May 23 EU parliament election as the UK's largest.

Such a performance in the EU poll does not necessarily mean The Brexit Party, which has built a coalition of candidates drawn from across the political spectrum, is would win a general election for Westminster but it does position it as a credible challenger to the two main parties.

Fears are that the Conservative Party could be forced to pivot toward a "Brexit at any cost" strategy, in order to save itself from electoral oblivion, that sees the UK leave the EU and default to doing business with it on World Trade Organization terms.

Many parliamentarians are opposed to a 'no deal' exit and some have threatened to bring down the government if it attempts to pursue one but opposition to PM May's deal - one of only two things that can prevent it at this stage - remains high in the House of Commons.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement