The Pound-to-Canadian-Dollar Rate in the Week Ahead: Mixed Signals Coming from the Charts

Image © Adobe Stock

- GBP/CAD rate continues to probe upside of rising trend channel.

- But chart signals conflicted with market at technical inflection point.

- Brexit vote to be main mover of GBP; oil prices main factor for CAD.

The Pound-to-Canadian-Dollar rate was trading around 1.7692 Monday after a week that saw it little changed by the Friday close, although the market is now at a technical inflection point and the path ahead uncertain given mixed signals coming from the charts.

The GBP/CAD pair was volatile last week due to a series of domestic and international factors on both sides of the equation. Sterling whipsawed after the government requested from Brussels only a very short delay to the Brexit process.

It recovered later, however, after the EU left the door open to a much longer extension of the Article 50 negotiating window, and potentially an indefinite one if Prime Minister Theresa May fails again to get the EU Withdrawal Agreement through parliament.

Pundits are still suggesting she will struggle to win enough votes for her deal to be approved next week so there is at least one fundamental reason for why the Pound could rise during the week ahead, because a third rejection of the Withdrawal Bill might see the market fixate on the odds of Brexit being abandoned by the government or prevented through a second referendum.

Above: GBP/CAD rate shown at daily intervals.

From a technical standpoint, the outlook for GBP/CAD is mixed. The pair has been rising steadily within a channel since the middle of last year. More recently it accelerated and broke out above the top of the channel but this came at a pivotal moment as it could either be a bullish signal for the pair or a sign of exhaustion.

If the market continues climbing this week then an eventual break above 1.7794 would confirm a likely move all the way up to 1.8000. But a sustained move lower would suggest the recent challenge of the channel top was an exhaustion move. That would be bearish.

The 50-day moving average (MA) is situated at 1.7349 and could be an impediment to any loses seen over the coming days but a break below 1.7300 would open the door for a more protracted downward slide all the way to 1.7125.

The one chart timeframe where there is clarity is the weekly one. This shows a series of upward movements over recent weeks that have left the market appearing poised for further gain. The only impediment is the 200-week moving-average located near to the recent highs. It would take a break above 1.7794 to clear the path above here.

Above: GBP/CAD rate shown at weekly intervals.

AA

The Canadian Dollar: What to Watch

The main economic release for the Canadian Dollar in the week ahead is trade balance data for the month of January, which is due out on Wednesday at 12:30 London time. Consensus is for the goods trade deficit to come in at -$2.3bn in January, down from -$4.59bn.

Trade balance data measures the difference in value between a nation's imports and its exports. Currency markets care about it because the data provides insight into supply and demand of a currency in the "real economy", while also giving a steer on the likely pace of GDP growth in a given period.

A narrowing deficit suggests either that exports and their associated demand for a currency are rising, or that imports and their associated supply of a currency are falling. Both are typically good for a currency while a steadily narrowing trade surplus, or a widening deficit, is a negative influence.

The size and trajectory of a trade surplus or deficit is important for economic growth because imports are a subtraction in the calculation of GDP, while exports represent a credit to the value of economic output. As a result, rising exports and, or, falling imports can help boost the economy.

Another key driver of the Loonie in the week ahead will be the price of crude oil, especially Canadian crude oil, both of which have been volatile in the last six months or so.

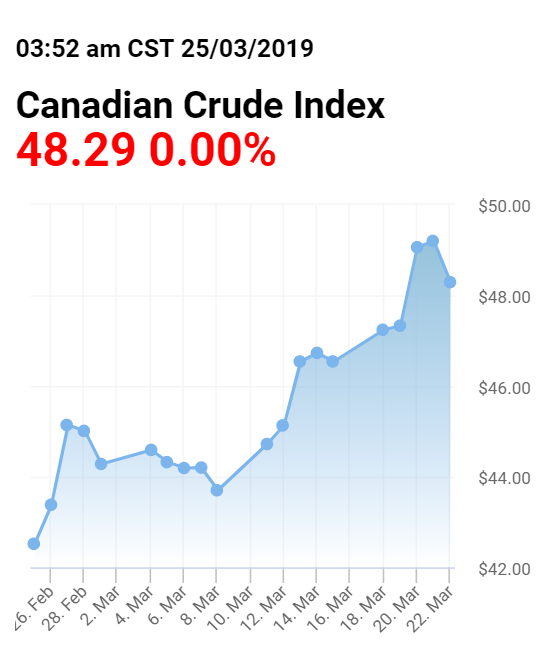

Above: Canadian Crude Index. Source: oilprice.com.

The Canadian oil index rose quite strongly in the last week. It is currently trading in the $48s per barrel, up around $2 from a week ago.

Gains in other oil benchmarks were attributable to increased demand from emerging market economies such as China. This combined with supply outages due to sanctions in Iran and Venezuela have supported the price of oil.

Demand is forecast to continue growing at over 1.03 million barrels per day over the coming months while consensus is for supply growth of just 0.3 million barrels per day, according to Nick Cunningham, an analyst at oilprice.com. The squeeze should be positive for prices over the medium-term and also the Canadian Dollar.

AA

The Pound: What to Watch

The main event for the Pound in the week ahead will be the third parliamentary vote on the government’s EU Withdrawal Agreement, although an exact date is yet to be set.

If Parliamentarians support the bill the UK will leave the EU on May 22 under the Withdrawal Agreement. But if MPs reject it then there the government has said it will offer a series of "indicative votes" to MPs, giving Parliament an opportunity to express its desired course.

At that point there will still be a risk that the UK leaves the EU without a deal and the key date in focus will be April 12, although this could change the moment the EU agrees to a further extension, if and when it does.

If Parliament was succesful in foisting another referendum or a general on the electorate, another much longer extension is sure to be required, alongside participation in the EU parliamentary elections.

However, and alternatively, if Parliament was to back the idea of a customs union with the EU or some other model of post-Brexit relationship it's possible that no further extension would be required as the details of such a relationship would be thrashed out in the second stage of the negotiations.

But the government must notify the EU of the path it intends to take before April 12.

“Leaving on April 12 without a deal is now the default path, and while that will most probably be avoided at the end, the mere fact this massive risk still lurks in the background is likely enough to keep sterling under pressure for now,” says XM's Hadjikyriacos.

On the data front, the next key release for the Pound is the final estimate for final quarter GDP growth, due out at 09:30 on Friday. Consensus is for growth to be confirmed at 0.2% for the final quarter and 1.4% for 2018 as a whole.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement