The Canadian Dollar Holds 18-month Low after GDP and Retail Data Underwhelm

- Written by: James Skinner

Image © Pavel Ignatov, Adobe Stock

- CAD holds 18-month low after GDP and retail sales data underwhelm.

- GDP surprises but risks remain, as retail sales disappoint the market.

- Some say CAD a "sell on rallies" as others eye scope for a rebound.

The Canadian Dollar held at an 18-month low against the Dollar and also ceded ground to Sterling Friday, after the latest GDP and retail sales data appeared to put a further dent in the economic outlook.

Canada's economy grew by 0.3% in October, more than reversing a -0.1% contraction seen in September, although it still leaves annualised growth running well below the 2.7% Bank of Canada (BoC) forecast for the final quarter.

A strong manufacturing sector and an increase in oil production were responsible for the result, although output from the energy sector had been expected to rebound because of the extent that it fell in September.

However, production could decline over coming months once the Alberta province's government-mandated production cuts come into effect at the beginning of 2019.

"Canada's economy was in bad need of a Christmas present, and October's return to growth was at least something to put under the tree this week," says Avery Shenfeld, chief economist at Toronot-headquartered CIBC Capital Markets. "The data are in line with our 1.7% estimate for Q4 GDP, but we'll need decent news outside the energy sector to hit that mark."

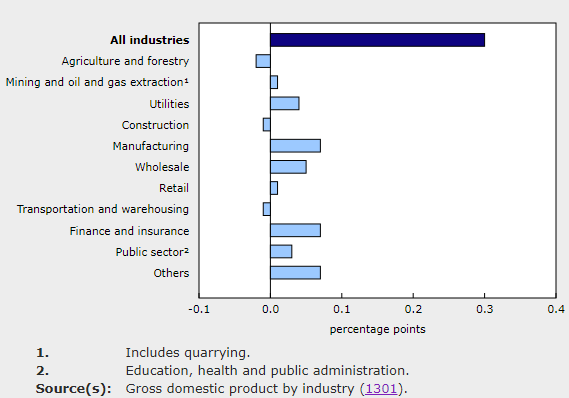

Above: Statistics Canada graph showing contributions to GDP.

Separately, other data showed retail sales growing by only a meagre 0.3% during the month of the November when markets had looked for growth of 0.4%. What's more, once car sales are removed from the data, spending was unchanged for the recent month.

"We expect to see a bit better news in the holiday period, as low gasoline prices and softer housing resales could leave more money for discretionary holiday shopping," Shenfeld remarks, in a note to clients.

Currency markets care about the retail and GDP data because economic growth has a direct bearing on inflation and it is changes in consumer price pressures that central banks are attempting to manipulate when they tinker with interest rates, which are themselves the raison d'être for most swings in exchange rates.

Changes in interest rates, or hints of them being in the cards, are only normally made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

"With the backdrop for risk on shaky footing and limited scope for the BoC to further normalize rates anytime soon, the CAD is a sell-on-rallies," says Mark McCormick, head of FX strategy at Toronto-headquartered TD Securities. "We think CAD pessimism is well entrenched in the USDCAD rate, with fair value situated near 1.3525 at the moment. For this reason, we see scope for CAD downside to prevail in a more substantial fashion on the crosses."

Above: USD/CAD rate at daily intervals, alongside US-Canada 2-year yield differential.

The USD/CAD rate was quoted 0.33% higher at 1.3549, close to an 18-month high, following the release Friday and is now up 7.7% for 2018.

The USD/CAD rate has spent this year following the gap or spread between yields on two-year U.S. and Canadian government bonds, which has moved significantly in favour of the U.S. Dollar in 2018.

"With CAD exposed both to weaker oil prices & softer equities, we’re fearful that $/CADextends to 1.37," says Petr Krpata, a currency strategist at ING Group.

The Pound-to-Canadian-Dollar rate was 0.28% higher at 1.7145 and has now risen by 1.17% for 2018 despite heavy losses for Sterling against all other major currencies this year.

Above: Pound-to-Canadian-Dollar rate shown at daily intervals.

"Canadian interest rate futures have already significantly pared back the probability of a March 2019 BoC interest rate increase following the Q3 slowdown in Canadian GDP growth and the more cautious tone struck by the BoC at the December meeting," says Joseph Capurso, a currency strategist at Commonwealth Bank of Australia.

Canada's economy slowed to a standstill at the end of the third-quarter as business investment slowed and energy production fell.

And with the oil market going from boom-to-bust during October and November, risks to the outlook have been mounting ever since.

The Bank of Canada raised its interest rate by 25 basis points to 1.75% in October and said it will go on lifting it over coming quarters, potentially taking the benchmark up to 3.5%.

But it backed away from that guidance in December following a series of disappointing economic figures and a rout in oil prices. Inflation data has also given the BoC another reason to be patient before raising rates again.

Investors had anticipated until December that January's BoC meeting would yield what would then be a fourth rate hike inside of 12 months, but markets have become outright pessimistic in their outlook for rates in recent weeks.

Pricing in interest rate derivative markets had implied close a 100% probability of that happening as recently as October, but those markets now suggest there is almost zero chance of another hike until well into 2019.

"We don’t see anything that would change the story in the first couple of quarters of the year. Although the BoC has backed off on its hawkishness, we are still looking for a couple of rate hikes," says Greg Anderson, head of currency strategy at Toronto-headquartered BMO Capital Markets. "So our outlook is for relative CAD strength in H1 of the year."

Advertisement

Bank-beating exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here