Pound-to-Canadian Dollar Exchange Rate 5-Day Forecast: Awaiting Breakout Moment

Image © Stockyme, Adobe Stock

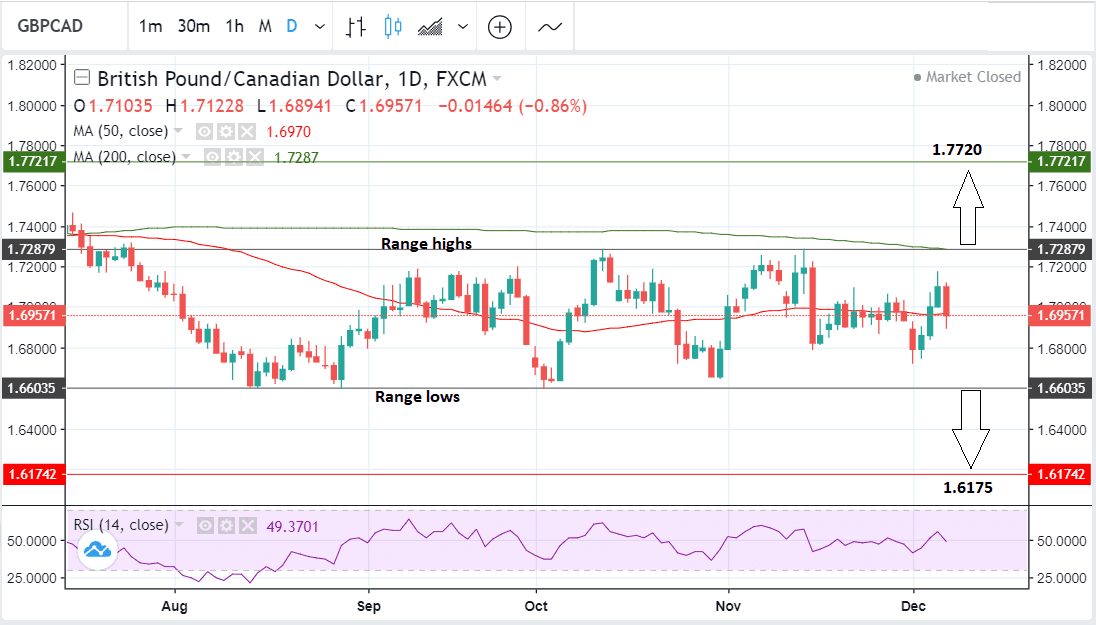

- GBPCAD is trading within a narrow range

- No clear bias one way or another until a breakout

- Brexit vote will drive the Pound; geopolitics and housing data the Canadian Dollar

The Pound-to-Canadian Dollar rate starts the new week trading at 1.6957 after only a gain of two tenths of a cent over the previous week’s 1.6936 close.

That’s not to say the pair had an uneventful run - a much broader range encompassed the real body, in which the pair undertook a rollercoaster - first down then up - before settling near to where it started again.

In the week ahead we see no overall bias favouring one direction over another: GBP/CAD remains stuck in the relatively narrow sideways range it has been in since the summer.

Trying to forecast moves within a range is a fool’s errand and a task fraught with difficulty. It is better to wait for a breakout from the range before trying to forecast directional moves.

Although the trend prior to the formation of the range was bearish the pair could break in either direction. The RSI momentum indicator is not sloping one way or another and provides few clues as to a bias either.

Ideally, we would look for a break above the range highs before forecasting a continuation higher. A move above the range highs at 1.7300 could provide the necessary confirmation for such an expansion, although a more conservative level might be 1.7350.

The 1.7720 level provides an eventual upside target based on the width of the range extrapolated higher.

Alternatively, a break below the range floor at 1.6600 would probably lead to a continuation down to a target at 1.6175. Again, a more conservative confirmation level would lie at 1.6550.

Advertisement

Bank-beating GBP/CAD exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

The Canadian Dollar: What to Watch

One major event which could impact on the Canadian Dollar is the growing diplomatic crisis between Beijing and Ottawa caused by the arrest of Meng Wangzhou, the CFO of Chinese mobile company Huawei, (and daughter of its owner) over alleged fraudulent activities to avoid US-imposed sanctions on Iran.

Meng is held in Canada pending extradition to the US to be tried. China has demanded she be released, saying her detention is, “unreasonable, unconscionable and vile in nature.”

The issue is fast becoming a major diplomatic incident which could easily boil over and impact on financial markets if China were to take retaliatory trade sanctions against Canada.

China has already warned Canada of “grave consequences” if it does not release Meng Wangzhou.

On the domestic data front, the week ahead sees the release of much property data, with housing starts (13.15 Monday), building permits (13.30 Monday), and the new house price index (13.30 Thursday).

Housing starts are forecast to read at 198K in November, building permits are forecast to read at -0.2K while the New Housing Price Index is forecast to show a reading of 0%.

The Canadian housing market is showing early signs of rolling over thanks to four months of weakening house price momentum.

The backdrop to the Canadian housing data releases is a more cautious assessment from the previously bullish Bank of Canada (BoC), which delivered a dovish message to markets at its meeting last week and the Canadian Dollar fall rapidly as a result.

"Poloz and BoC followed in the footsteps of Powell and Fed last week, by hinting a much more gradual approach to rate hikes," says Martin Elund with Nordea Markets who says he sees value in selling the Canadian Dollar "if we add renewed housing market risks to the mix for Poloz and BoC."

Strong employment data on Friday, however, did go some way to assuaging the pain from the BoC meeting.

Another key influence on the Canadian Dollar is the price of oil. The Canadian government recently took the unusual step of unilaterally cutting its oil supply to support the price of Canada Select, the variety of crude which comes from the country. OPEC also agreed to cuts at its meeting last week, which led to a rally in global oil prices.

The Pound: What to Watch

Despite rumours the vote may be postponed, the coming week promises to be busy for Sterling if the crucial Brexit vote in Parliament goes ahead.

It is an event which has the potential to start a new era for the Brexit story and Theresa May’s future in her role as Prime Minister and leader of the Conservative party.

Parliament’s meaningful vote on the government’s Brexit deal is scheduled for Tuesday 11, at 19.00 GMT. The government is currently expected to lose the vote and this could cause some short-term weakness for the Pound.

Rumours have surfaced over the weekend that the vote could be delayed whilst Theresa May attempts to draw more concessions from Brussels, but further clarification from Downing Street confirm the vote will indeed progress as planned.

For Sterling, the extent of the loss is key. If the loss is smaller than expected, May will take heart that some further concessions on the political declaration from European leaders can help the deal go through.

"We would not expect Sterling to slump if she loses by a narrow margin," says Thomas Pugh with Capital Economics.

If the government loses by 200 or more votes Theresa May could resign. She could also simply head back to Brussels and insist talks are reopened telling the European Union if they do not a 'hard Brexit' becomes inevitable.

The Labour party may also force a vote of no-confidence which could lead to a general election if the government loses, however this would require some Conservative party MPs to vote with the opposition, which is unlikely.

"A decisive defeat could have a more significant market impact though. Theresa May might have to face down a vote of no confidence in the government and a leadership challenge, which would rattle markets," says Pugh.

A second referendum is also said to be a further possible outcome, however we doubt there is a majority in the House of Commons for this.

The bottom line? No one quite knows what will happen next.

"Political uncertainty is likely to continue to hang over the economy for at least the next few months," says Pugh.

Beyond Brexit, a major release for the Pound is GDP data, which is forecast to show a slowdown in October when it is released at 9.30 on Monday. The average over the previous 3 month period was 0.6% but this is expected to slow to 0.4% in the most recent period.

Industrial and Manufacturing production are also released at the same time and forecast to show a slowdown.

Industrial production is expected to show a -0.1% decline in October, and Manufacturing a 0.0% change.

Labour market data is forecast to show little change in November with the unemployment rate stuck at 4.1% and pay excluding bonuses at 3.2% whilst pay including bonuses continues to show a 3.0% rise. Overall employment change is expected to show a 20k rise.

"We expect to see another robust, if unspectacular, rise in employment in the three months to October. Meanwhile, wage growth probably edged up further," say Capital Economics.

Finally, balance of trade data is out on Monday at 9.30. The deficit in the previous month of September was a very marginal -£0.03bn.

"We think the trade balance slipped back in to deficit in October, as imports rebounded and the recent strength of exports came to a halt," says Capital Economics in a note covering the coming week. "Surveys also suggest that exports, which performed well in recent months, fell back in October."

Advertisement

Bank-beating GBP/EUR exchange rates. Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here