Pound / Australian Dollar Technical Outlook: Support at 1.60 Defends the Downside but How Far can the Rebound Go?

Once again we have seen the Pound successfully defend the 1.60 level against the AUstralian Dollar.

The bounce above 1.60 on Tuesday, March 22 confirms to us that this exchange rate will require a gargantuan piece of news to crack the line.

We therefore start our mid-week technical forecast on GBP/AUD with the observation that we are confident that the exchange rate will hold on to ground above 1.60.

Of more interest to us though concerns how far the rebound can extend.

GBP/AUD has broken above a major trendline and has moved forcibly higher.

Although it is early days, the strength of the up-move alone is cause to see it as the start of something bigger than would otherwise be the case.

The most recent price activity has shown a stalling of the rally at the 50-day moving average, and we would want to see a break back above the current day’s highs at 1.6319 for confirmation of more upside.

Such a move would have theoretically substantial upside potential, however, initially we would take a conservative view of it moving higher to 1.6400.

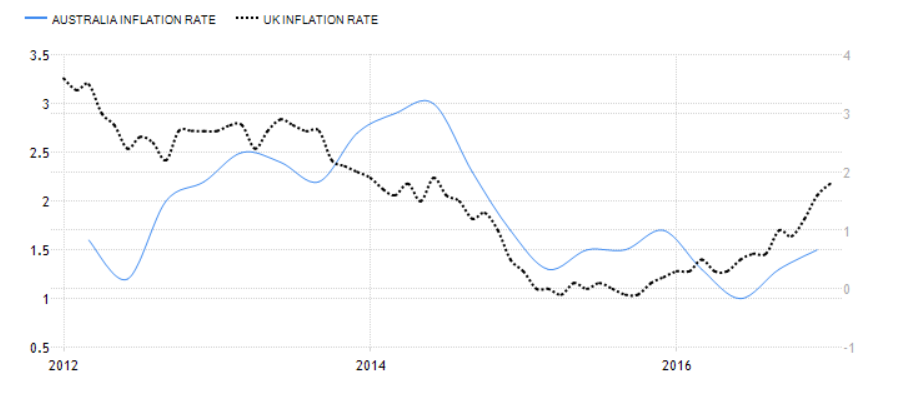

The bullish move off the lows commenced after the release of UK inflation data which shot higher in February by 2.3% in February.

This contrasts with Australian inflation which remains below 1.00%.

Inflation influences the interest rates set by central banks and the jump in UK inflation is expected to put pressure on the Bank of England (BOE) to raise rates.

Higher rates lead to currency strength as they tend to attract more inbound capital from foreign investors seeking yield.

Data Ahead for the Aussie

All the most significant releases for the Aussie have already been published including the minutes of the Reserve Bank of Australia (RBA) March rate meeting, and the

House Price Index, which showed a higher-than-expected 4.1% rise in February.

UK data will, therefore, take precedence in the second half of the trading week.

Thursday is still a big day for the Pound from a data perspective, with Retail Sales released at 9.30 GMT expected to rise 2.6% year-on-year and 0.4% month-on-month and Core Retail Sales by 3.1% year-on-year and 0.4% month-on-month.

Retail Sales has been a poor performer of late due to rising shop prices from weak-pound induced inflation on imported products.

If there is yet another decline it will start ringing alarm bells for the economy and spell weakness for the Pound.

BOE’s Broadbent will also speak on Thursday, at 9.15, so we might get the first response from the BOE since the overwhelming inflation data.