Australian Dollar Bullish on Iron Ore Developments says Analyst

- Written by: Fawad Razaqzada, analyst at City Index

By Fawad Razaqzada, Market Analyst for City Index and FOREX.com. Image © Adobe Images

The recent upsurge in metals prices should keep the Australian dollar supported, more so now with Iron Ore prices hitting their highest levels since February.

What’s more, the ongoing risk rally across asset classes argues against a significant drop in risk-sensitive commodity dollars anyway. So, my AUD/USD outlook remains bullish despite its struggles so far this week.

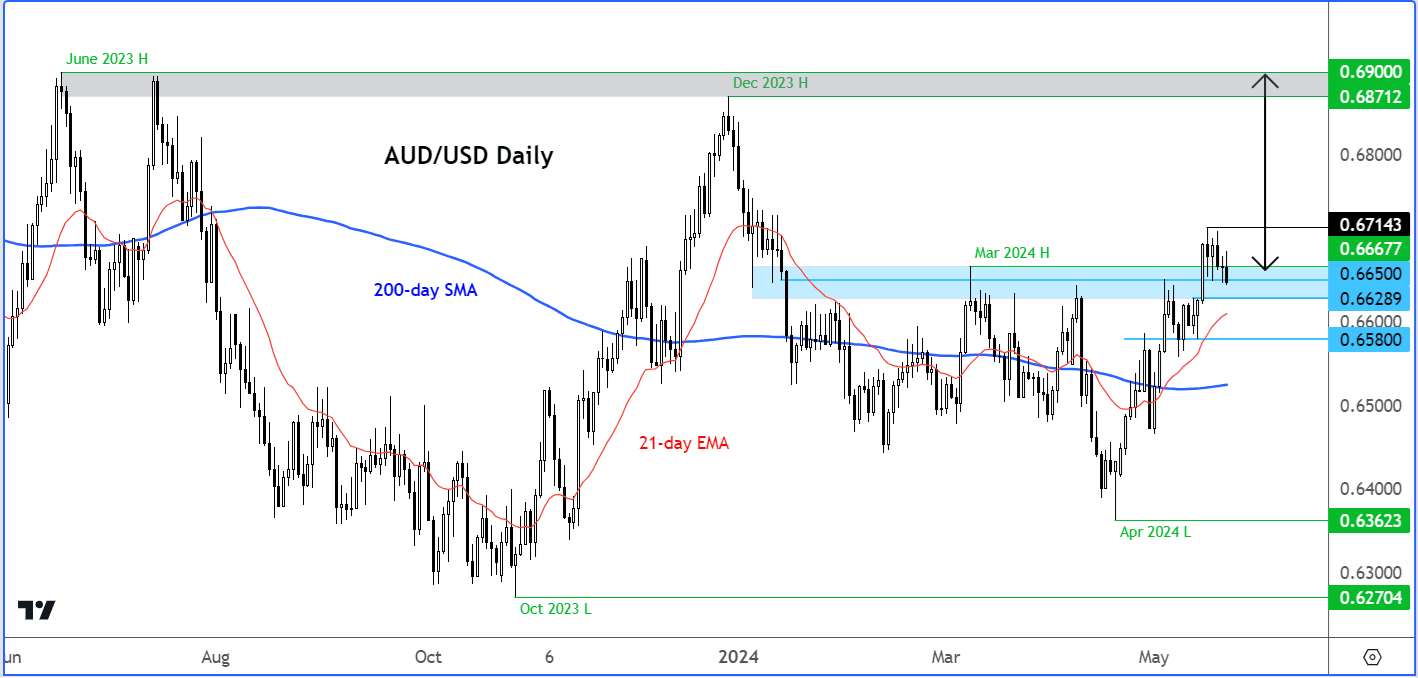

The AUD/USD was testing the breakout area of 0.6650 at the time of writing. Given that only a few days ago it tested its highest levels for the year, the trend is clearly positive on the Aussie.

Image courtesy of City Index. Track AUD with your own custom rate alerts. Set Up Here

Given everything I mentioned above from a macro point of view, I would be on the lookout for a bullish candle to form around current levels, which, if seen, would be an indication that rates are ready to resume higher again.

The Aussie dollar has given back about half of the gains made the week before. But key commodity prices like copper and iron ore remain supported.

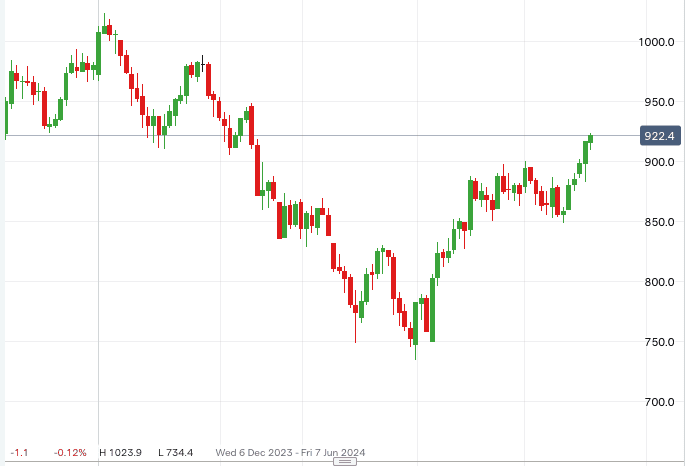

Iron Ore prices have rallied another 2% today to reach their best levels since February, thanks in part to strong demand from China.

Above: Iron ore prices, image source: IG.

Australia is by far the world’s largest exporter of iron ore and is the fourth largest exporter of copper. Meanwhile, sentiment towards Chinese stocks remains positive with the China A50 index rebounding after a two-day drop to remain near its yearly highs. Given that China is Australia’s largest trading partner, these factors should keep the Aussie supported on the dips.

What’s more, the AUD and NZD tend to move in tandem, and with the NZD/USD finding support from a hawkish Reserve Bank of New Zealand (RBNZ) meeting overnight, this argues against a sharp drop in the AUD/USD exchange rate. In a surprising move at its latest monetary policy meeting, the RBNZ indicated that interest rates might need to rise again, with cuts being postponed.

The RBNZ is determined to curb inflation, even at the cost of economic growth. This unexpected hawkish stance caused the New Zealand dollar to surge. While the Reserve Bank of Australia is a little less hawkish, it too remains far from cutting interest rates.

Despite recent caution from Fed officials due to persistent inflation, the US dollar has not been able to rise to its lofty levels of April and remains in the negative for the month of May, after its recent sell-off that was triggered by weaker-than-expected economic data. So, there is a chance it could resume the downtrend as we get into the second half and business end of the week.

This month's economic reports have largely been disappointing, including the monthly job figures, forward-looking manufacturing and services PMIs, as well as data on retail sales, building permits, and housing starts. Even the inflation data came in slightly cooler.

With the US economy clearly weakening, it is becoming increasingly difficult to maintain a bullish stance on the dollar, especially after its gains in the first four months of the year against a basket of foreign currencies. If the trend of disappointing data persists, it could suggest a more rapid easing of inflation, reducing the need for prolonged tight monetary policy. So, there is a risk that the Fed might be behind the curve.