GBP/AUD Forecast: Climb Above 1.77, Approach of 1.78 Possible

- Written by: James Skinner

- GBP/AUD supported at 1.75 with upside risks

- Risk of break above 1.77 & climb toward 1.78

- China, U.S inflation & AU job data all in focus

Image © Adobe Images

The Pound to Australian Dollar exchange rate entered the new week on its front foot and may be at risk of climbing toward the 1.78 handle in the days ahead.

Australia’s Dollar came under pressure alongside Pound Sterling and many other currencies early in the week as the U.S. Dollar strengthened almost across the board including against China’s Renminbi while risk aversion reigned across stock and commodity markets.

Further coronavirus outbreaks in China including in the port city of Shanghai are threatening a return of onerous restrictions on economic activity and social contact in the world’s second largest economy at a point when global markets were already under strain.

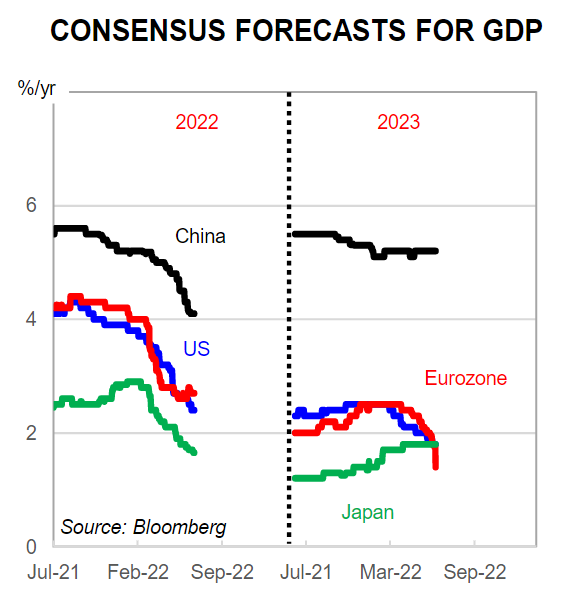

“Markets are increasingly worried central banks will tighten monetary policy too much, too quickly and cause a material slowing in the global economy. Adding to recession fears is China’s zero covid policy and Europe’s energy shortage. As the facing chart shows, economists have materially downgraded their growth expectations for the major economies,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia.

Source: Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

“The downgrades to the Chinese GDP growth for 2022 and the European GDP growth for 2023 are particularly noticeable. We expect concerns about a global recession will persist into next year, underpinning the USD. Commodity currencies such as AUD and NZD will likely underperform in the face of a strong USD in our view,” Capurso and the CBA team warned on Tuesday.

Australia’s Dollar broke below a major level of technical support against the U.S. Dollar on the charts early this week and was not helped on Tuesday by the message of Westpac and National Australia Bank measures of consumer confidence for July and June respectively.

Market concerns about the economic outlook, ongoing strength in the U.S. Dollar and fresh declines by China’s Renminbi all pose risk to the Australian Dollar and could yet see the all important AUD/USD exchange rate slipping further throughout the week.

“We remain of the view that commodities are clearly signalling that the global growth outlook is deteriorating markedly as central banks raise rates super aggressively, the Fed enacts record QT, and China maintains its zero-Covid policy. Our near term target of 0.6760/65 for the A$ has now given way as we warned it would,” says Sean Callow, a senior FX strategist at Westpac.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonnaci retracements of March decline indicating possible areas of technical resistance for Sterling and support for the Aussie. Click image for closer inspection.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonnaci retracements of March decline indicating possible areas of technical resistance for Sterling and support for the Aussie. Click image for closer inspection.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

“Our next target level is at 0.6670 and for us to start thinking about buying into this weakness, we would need to see signs China is relaxing its zero-Covid policy and/ or that the Fed is set to pause on its aggressive tightening policy. Neither of those look likely at the moment,” Callow also said on Tuesday.

GBP/AUD was softer on Tuesday but tends to closely reflect the relative performance of the Aussie and Sterling when each is measured against the U.S. Dollar and so likely benefited from the Monday decline in AUD/USD.

Much now also likely depends on whether AUD/USD can hold above the 0.67 handle in the week ahead because any break below would likely place GBP/AUD on course for the 1.77 level.

The Pound to Australian Dollar rate may even be seen trading above that level in any market where AUD/USD is trading down toward or below 0.6650.

Above: AUD/USD shown at daily intervals with Fibonacci extensions of April’s Renminbi-induced fall and other downtrend extensions indicating prospective pivot points for the Aussie. Click image for closer inspection.

Above: AUD/USD shown at daily intervals with Fibonacci extensions of April’s Renminbi-induced fall and other downtrend extensions indicating prospective pivot points for the Aussie. Click image for closer inspection.

There is a huge volume of Australian, U.S. and Chinese economic figures that could impact both the Australian Dollar and Pound Sterling during the week ahead and beginning with the release of U.S. inflation figures on Wednesday, which could impact the Federal Reserve interest rate outlook.

Many economists expect U.S. inflation to rise from 8.6% to 8.8% for the month of July and for the core inflation rate to slip from 6% to 5.7% after energy and food prices are excluded from the goods basket under the microscope.

“Since the start of this year, there has been a clear bias towards a stronger USD on days when CPI numbers are released. Keep this in mind on Wednesday,” says Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

U.S. inflation figures are the first major hurdle for all currencies this week but will be followed closely by Thursday’s release of June employment figures in Australia and Melbourne Institute Inflation Expectations survey, both of which can impact the Reserve Bank of Australia (RBA) interest rate outlook.

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of March and April 2020 recovery rallies indicating areas of possible medium-term technical support. Click image for closer inspection.

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of March and April 2020 recovery rallies indicating areas of possible medium-term technical support. Click image for closer inspection.

The RBA lifted its cash rate by 0.5% for a second time last week, taking it up to 1.35%, but said nothing to encourage financial markets to ramp up expectations for the cash rate in subsequent months, expectations which many analysts and economists view as excessive.

"It is important that we chart our way back to an inflation rate in the 2 to 3 per cent target range. We do not need to, nor can we, get there immediately," RBA Governor Philip Lowe told the American Chamber of Commerce in Australia (AMCHAM) in a late June speech.

"Australia has long had a flexible medium-term inflation target, which, by design, can accommodate deviations of inflation from target. For a number of years inflation was below target and now it is above. What is important here is that we chart a credible path back to an inflation rate of 2 to 3 per cent,” he added

Australia’s employment data comes ahead of second quarter GDP data due to be released in China during the early hours of Europe’s Friday morning, which is released alongside a raft of other important economic figures and could impact overall market risk appetite as well as the Aussie.