GBP/AUD Outlook Dimmed by Aussie's China Tailwind

- Written by: James Skinner

- GBP/AUD risking slippage to 1.75 or below

- With China reopening refloating AUD/USD

- Q1 GDP data could aid AUD/USD rebound

- Softer USD could also favouring AUD/USD

Image © Adobe Images

The Pound to Australian Dollar rate has struggled to sustain its May rebound and could be set to remain suppressed at the lower end of a multi-year range in the days and weeks ahead as the Chinese economy reopens in earnest, likely aiding an outperformance by the antipodean currencies.

Pound Sterling slipped lower against an outperforming Australian Dollar on Monday as Chinese authorities pushed ahead with a phased reopening of the port city of Shanghai amid reports of easing coronavirus-induced restrictions in the capital Beijing.

Local media reports suggest the government is seeking to enable manufacturing firms in Shanghai to resume work and production so as to “stabilise foreign trade and investment” as part of a broader effort to strike a balance between coronavirus control and the needs of the economy.

This is a positive development for the Chinese, regional and global economies that has implications for the AUD/USD and GBP/AUD exchange rates.

“What is good for the Chinese economy is ultimately good for AUD,” says Joseph Capurso, head of international economics at Commonwealth Bank of Australia. “AUD/GBP can outperform if the global economic outlook improves, particularly from China.”

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of mid-March decline indicating possible areas of technical resistance to any fresh or further recovery by Sterling. Click image for more detailed inspection.

Above: Pound to Australian Dollar rate shown at daily intervals with Fibonacci retracements of mid-March decline indicating possible areas of technical resistance to any fresh or further recovery by Sterling. Click image for more detailed inspection.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Pound to Australian Dollar exchange rate had fallen to some of its lowest levels since soon after the Brexit referendum following the Russian military’s initial encroachment into and invasion of Ukraine in late February, which lifted commodity-linked assets while pressuring European currencies.

But rebounded throughout April after Shanghai, China’s largest metropolis and globally important port city, was placed into the country’s most stringent and longest form of ‘lockdown’ seen to date, which upended commodity currencies and buttressed a 10-month rally by the U.. Dollar.

Now, with China’s restrictions beginning to be lifted and the U.S. Dollar also recently cooling its heels, the rebound in GBP/AUD has been curtailed.

“As for the Fed, despite solid April retail sales, steep falls in April new home sales and May regional business surveys are fuelling concerns that tighter financial conditions are sapping US momentum,” says Sean Callow, a senior currency strategist at Westpac.

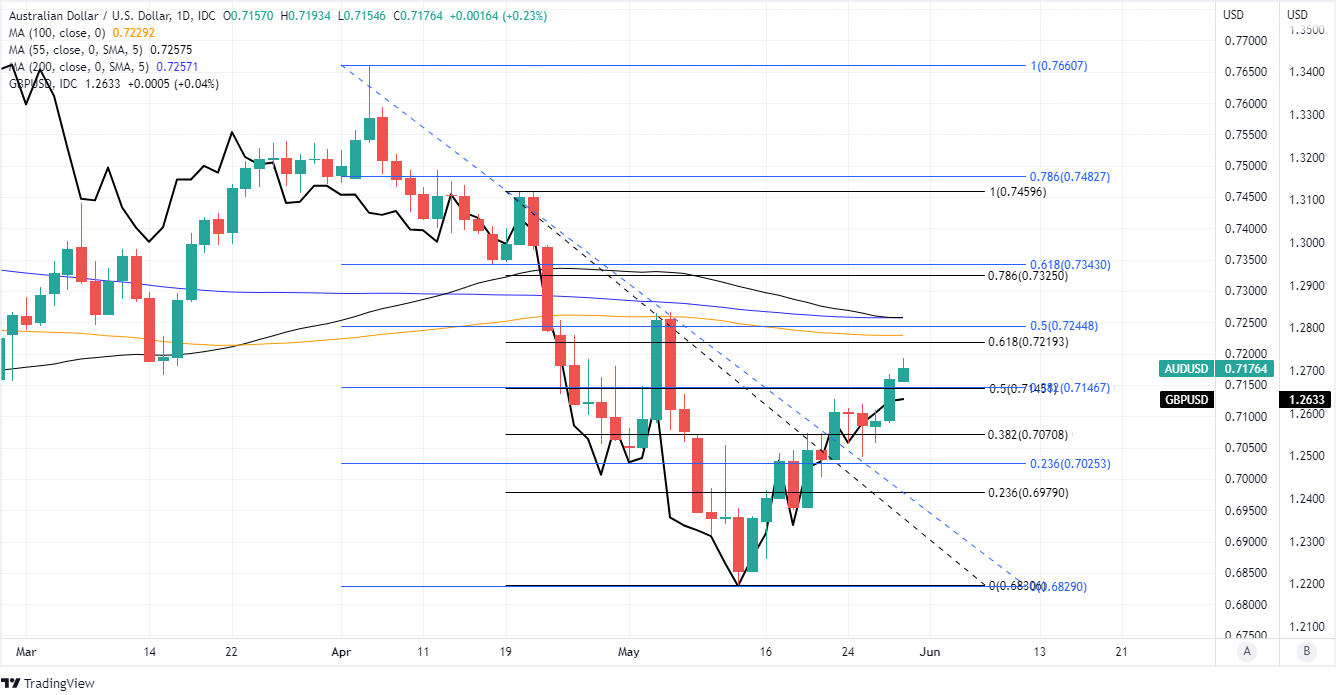

Above: AUD/USD shown at daily intervals with Fibonacci retracements of early and mid-April declines indicating possible areas of short-term technical resistance for Australian Dollar and support for U.S. Dollar. Includes selected daily moving-averages. Click image for more detailed inspection.

Above: AUD/USD shown at daily intervals with Fibonacci retracements of early and mid-April declines indicating possible areas of short-term technical resistance for Australian Dollar and support for U.S. Dollar. Includes selected daily moving-averages. Click image for more detailed inspection.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

“Moreover, there are indications that following the well-flagged 50 basis point rate hikes in mid-June and late July, the FOMC is considering a pause in rate hikes at the September meeting,” Callow wrote in a Monday review of AUD/USD’s recent performance.

The U.S. Dollar receded further from recent highs last week after economic figures including those covering the services sector, housing market and business investment pointed to a softening of the U.S. economy.

This data and last Wednesday’s minutes of the May Federal Reserve (Fed) policy meeting have encouraged speculation about a possible slowing in the pace at which the bank might be likely to lift its interest rate later this year, which has been at least as supportive of the Aussie as it has for Sterling.

“Positive risk sentiment is well-reflected in AUD gains, with AUD/USD climbing above recent range highs and also resistance from a former important low at 0.7165. Domestic focus this week is on 1Q GDP,” says Patrick Bennett, head of Asia FX strategy at CIBC Capital Markets.

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of February 2021 decline indicating possible medium-term technical resistance for Australian Dollar and support for U.S. Dollar. Includes 200-week moving-average. Click image for more detailed inspection.

Above: AUD/USD shown at weekly intervals with Fibonacci retracements of February 2021 decline indicating possible medium-term technical resistance for Australian Dollar and support for U.S. Dollar. Includes 200-week moving-average. Click image for more detailed inspection.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

“Terms-of-trade for May and the April trade report are also released. All come ahead of the RBA meeting next week. AUD/USD support 0.7125, resistance 0.7230,” Bennett said in a Monday market commentary.

Last week’s easing of the U.S. Dollar enabled the all-important AUD/USD rate, which has a significant influence on GBP/AUD, to climb back above its 200-week moving-average at 0.7138 while Monday’s Renminbi-aided climb placed AUD/USD on course for cluster of overhead daily moving-averages.

Those averages litter the charts between 0.7229 and 0.7257 and could be likely to temporarily obstruct the Australian Dollar’s recovery if seen, although even at these levels the implication for GBP/AUD would still be modestly bearish.

The Pound-Aussie rate always tends to closely reflect the relative performance of the Australian Dollar and Sterling when each is measured against the U.S. Dollar, and would likely trade back down near the round number of 1.75 or below this week if AUD/USD makes it back above 0.7219.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of August 2017 recovering indicating possible areas of medium-term technical support for Sterling. Click image for more detailed inspection.

Above: Pound to Australian Dollar rate shown at weekly intervals with Fibonacci retracements of August 2017 recovering indicating possible areas of medium-term technical support for Sterling. Click image for more detailed inspection.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes