Pound-Australian Dollar Levels to Watch For On a Bad Brexit Outcome

- Written by: James Skinner

Image © Adobe Images

- GBP/AUD spot rate at time of publication: 1.7538

- Bank transfer rate (indicative guide): 1.6924-1.7047

- FX specialist providers (indicative guide): 1.7415-1.7275

- More information on FX specialist rates here

The Pound-to-Australian Dollar rate fell to two-year lows Friday but faces further steep declines if Britain and the EU fail to reach a trade agreement this month.

Sterling was the worst performing major currency again having sustained heavy losses against all major counterparts after Prime Minister Boris Johnson and European Commission chief Ursula Von Der Leyen warned overnight that a 'no deal' Brexit from the transition period is now likely after year-end.

But new highs for the antipodean currency also heaped further pressure onto a beleaguered Pound-to-Australian Dollar rate, with AUD/USD having touched 0.7540 and its highest since June 2018, a period that came not long after the beginning of the trade war between the U.S. and China. That wounded the global economy and weighed on commodity prices for years as well as the currencies which are sensitive to them.

"AUD at the moment might as well be a speculative play on Chinese iron ore futures, which have gone parabolic in recent days," says John Hardy, head of FX strategy at Saxo Bank. "The market will have plenty more sterling selling to do if it is clear that we are headed for no deal, even if that no-deal destination results in a further extension of a phased transition period over perhaps another six months or a year or more on some issues. On that note, GBPUSD is vastly preferred to EURGBP for expressing GBP downside, as any no-deal outcome will negatively impact EUR sentiment as well."

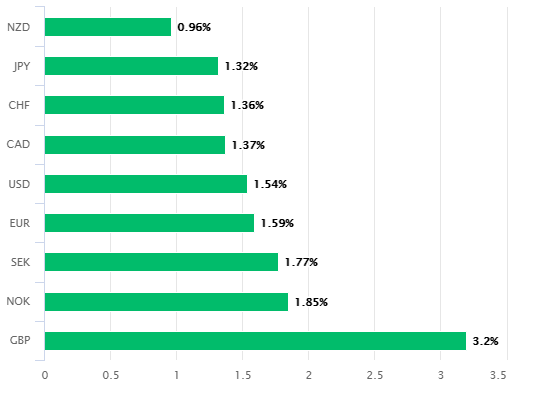

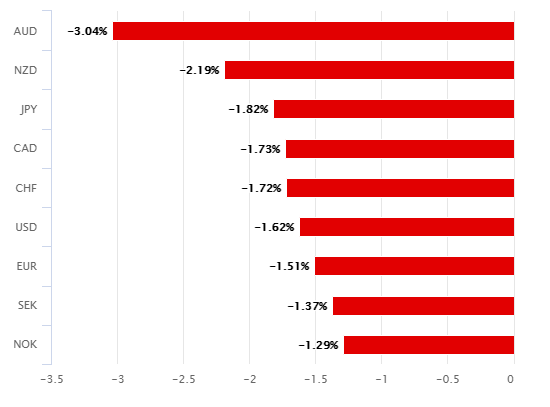

Australia's Dollar was the best performer for the week having risen more than one percent against all major counterparts with the exception the Kiwi. This was after iron ore prices touched new highs above $160 per tonne, which is boon for Australia's largest export industry, although AUD/NZD rose only 0.97%.

Above: Australian Dollar relative to major rivals this week (left) along with performance of Pound Sterling (right).

"China’s demand continues to remain impressive as construction activity and manufacturing drive end‑user steel demand. An unseasonal fall in Australian iron ore exports over the last month, most likely linked to infrastructure maintenance, is adding to the tightness in iron ore markets," says Vivek Dhar, a strategist at Commonwealth Bank of Australia.

Somewhat ironically, the Aussie topped the board among comparable currencies due not only to iron ore supply concerns but also surging demand from China, which continued its assault on the land down under when on Thursday it announced that tariffs will be applied to imported Australian wine carried in containers of two litres or less.

Chinese authorities have attempted to turn the screws on Australia's economy and Dollar ever since Prime Minister Scott Morrisson called for an investigation into Beijing's handling of the coronavirus which has cost the global economy so dearly in 2020, although Canberra's approval of the Foreign Relations State and Territory Arrangement bill may have been seen as an incitement. The bill, now an act, is widely expected to eventually nullify a 'Belt and Road' investment agreement between Victoria state and China.

But officials governing the world's second largest economy are unable to deal a decisive blow to the Aussie economy or Dollar without also spiting their own interests, given Australia's leadership in the global supply chain for iron ore, which China needs in order to continue developing its economy. It could tariff the output of Australia's largest export industry, but not without an economic cost that would also be borne heavily by itself.

Above: Pound-to-Australian Dollar rate shown at weekly intervals with AUD/USD (black line).

"AUD/USD remains extremely bid and has eroded the .7484 July 2018 peak and is poised to encounter the long term Fibonacci retracements at .7574 and .7639," says Karen Jones, head of technical anlaysis for currencies, commodities and bonds at Commerzbank. "These are he break points longer term for the 2018 peak at .8135."

Australian Dollar strength and resilience is magnifying the donwside for the Pound-to-Australian Dollar pair.

Sterling would fall to 1.7334 and a new two-year low against the Aussie if AUD/USD hits 0.7574 while GBP/USD retreats to the nearest support level of 1.3129 also eyed by Commerzbank's Jones.

Sterling's main exchange rate GBP/USD was pricing-in something like a 50/50 probability of a deal being struck when trading in the 1.31 region on Friday, but could fall to 1.25 or even below if the talks fail, analyst forecasts suggest.

This has significant potential implications for the Pound-to-Australian Dollar rate, which always closely reflects relative price actions in GBP/USD and AUD/USD. The Pound-to-Australian Dollar rate would fall to 1.6503 and its lowest since September 2017 in a 'no deal' Brexit scenario where GBP/USD fell to 1.25 if AUD/USD traded up to 0.7575.

Boris Johnson reiterated again on Friday that "From where I stand now it is looking very, very likely that we will have a no-deal."

This was after Dutch Prime Minister Mark Rutte was quoted saying the EU is willing to compromise in its demands for a so-called level playing field as well as in relations for ambitions around access to British fisheries following the UK's departure from the bloc, but that "there is a limit" to how far national leaders and EU officials in Brussels are prepared to go.

"Positioning analysis shows GBP is now in downtrends for five of the GBP/G10 pairs, with potential to enter into more," says Vadim Iaralov, a quantitative strategist at BofA Global Research. "GBPAUD's downtrend continuation signal is the most supported by positioning analysis, and it is our preferred pair for lower GBP in this coming week. The short-dated risk reversal in GBPAUD has collapsed, favoring puts, suggesting bearish risk-reward for spot. The risk to this trade is a breakthrough in the EU-UK trade deal negotiation, as any positive news could lead to a short-term appreciation for GBP."

Above: Pound-to-Australian Dollar rate shown at weekly intervals with GBP/USD (black line).