Australian Dollar Cedes Major Currency Performance Leadership as RBA Balance Sheet Grows

- Written by: James Skinner

Image © Newtown Grafitti, Reproduced under CC Licensing.

- GBP/AUD spot rate at time of writing: 1.8197

- Bank transfer rate (indicative guide): 1.7560-1.7687

- FX specialist providers (indicative guide): 1.7924-1.8033

- More information on FX specialist rates here

The Australian Dollar advanced against most major currencies on Wednesday but increasingly risks becoming a laggard in the months ahead, according to new research from Westpac, as the Reserve Bank of Australia (RBA) expands its balance sheet through an enhanced quantitative easing programme.

Australian Dollars were in demand as commodities and stocks built on earlier gains made when Pfizer and its partners said on Monday that their coronavirus vaccine candidate had demonstrated high effectiveness in clinical trials.

Vaccine progress provides investors grounds for hoping that politicians will eventually see themselves as having alternatives to the so-called lockdown of people, companies and economies in the name of containing the coronavirus.

Optimism about a vaccine has bolstered the rally in risk assets that was ignited when last week's U.S. election appeared to show Democratic Party challenger Joe Biden beating President Donald Trump in the race for the White House but falling short of the support needed for a Congressional majority. The result is being contested, leaving an air of uncertainty over the outlook although few if-any analysts see the outcome changing.

"With US election uncertainty now mostly cleared, notwithstanding the Georgia Senate double run off early January, Brexit tacking in a more risk friendly direction and a game-changing vaccine on the way the environment is very fertile for healthier risk appetite. The main fly in the ointment is the expanding US and European outbreaks," says Richard Franulovich, head of FX strategy at Westpac. "There’s a clear inverse relationship between the growth in new cases across the globe and mobility. The large outbreaks in the US and Europe are consistent with steep falls in mobility."

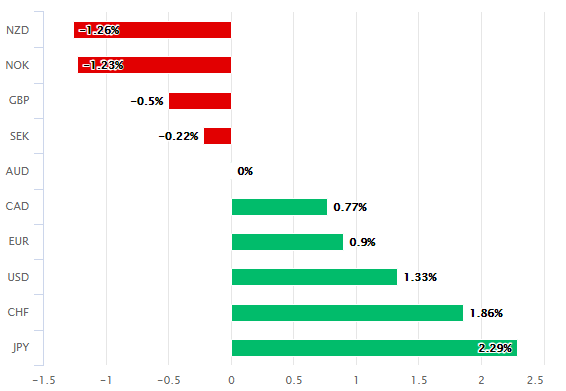

Above: Australian Dollar performance against major currencies in week to Wednesday. Source: Pound Sterling Live.

Australia's commodity-backed Dollar is highly exposed to a Chinese economy that will benefit from having a friendlier face in the White House, but it hasn't performed as strongly in the week following the election as it had done in the months between March and September.

This could be symptomatic of recent changes in RBA monetary policy and may be an early taste of what's to come in the months ahead.

"While AUD has jumped sharply after the election and on the positive vaccine news, it has ceded its leadership position," Franulovich says. "While the AUD led the pack as global risk appetite recovered from mid-March that might not be the case going forward."

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Aussie advanced against all major currencies on Wednesday other than an outperforming New Zealand Dollar and a U.S. greenback that corrected higher from recent lows against many counterparts, but its performance over the last week has been even more mixed. For the week to Wednesday the Aussie was outpaced and overcome not only by the Kiwi, but also Pound Sterling, the Norwegian Krone and Swedish Krona in the major currency sphere.

This chequered and middling performance may continue in the months ahead as the Reserve Bank of Australia implements its enhanced quantitative easing programme and in the process, grows its balance sheet as a portion of GDP through increased purchases of government debt.

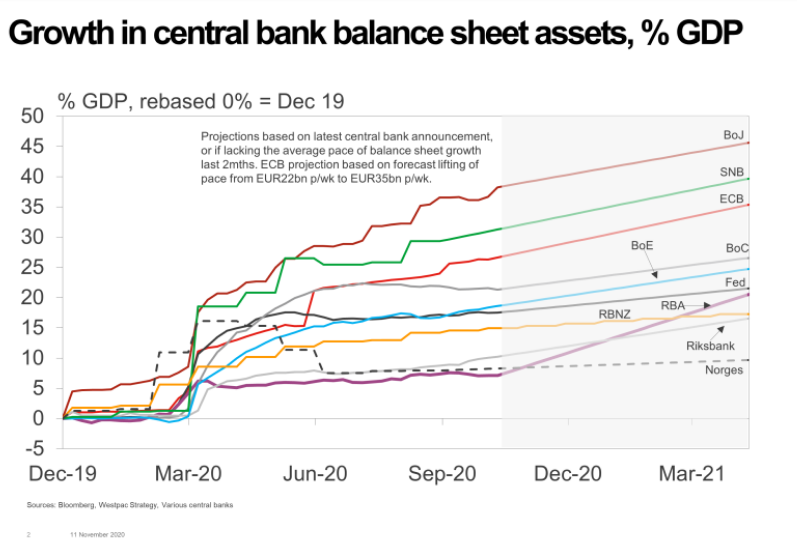

Above: Westpac graph showing central bank balance sheets as a percentage of GDP, with anticipated changes.

The RBA said on November 03 that its cash rate and three-year yield target would be cut from 0.25% to 0.10% and that it'll buy "$100 billion of government bonds of maturities of around 5 to 10 years over the next six months," to reduce borrowing costs for government, companies and households.

Unlike other developed market central banks such as the Federal Reserve and Bank of England, the RBA had never before involved itself in the domestic bond market in the same way as it has does since the March implementation of a maiden quantitative easing programme that saw it succesfully crush the three-year government bond yield with little fanfare or effort. The bank said in March that it would buy enough government bonds to reduce the three-year yield to 0.25% but did not specify the value or duration of its transactions, which helped to make for a short-lived intervention until last week's policy meeting and the resulting decision to expand the bond buying programme.

"For much of 2020 the RBA’s balance sheet growth languished well behind peers. Even after their recent policy shift the outright size of their balance sheet will still be dwarfed by others. But pace is key, and by mid-2021 the post-Covid increase in the RBA’s balance sheet could overall be approaching 20ppts+ of GDP, closing the gap somewhat with G10 peers," Franulovich says.

A second coronavirus wave that prompted renewed lockdowns of people, companies and economies in Australia as well as Europe was a key driver of the decision to add $100bn of government bonds to the RBA balance sheet over a six month period. But as necessary as the decision may or may not have been, it could have consequences for the relative performance of the Australian Dollar, likely limiting if not preventing its ascent against other currencies.

Above: AUD/USD rate shown at daily intervals alongside S&P 500 index futures (black line, left axis).

The Aussie itself received scrutiny last week with Governor Philip Lowe followed in the footsteps of the Reserve Bank of New Zealand when he said the bank would intervene directly in the market under certain circumstances to prevent it from rising, almost echoing the RBNZ's threat to carry out foreign asset purchases that would inevitably result in large sales of Kiwi Dollars.

Both have grown concerned this year about the impact that rising exchange rates will have on the inflation outlook over the coming years given the two antipodean units had rallied more than 30% against the U.S. Dollar between March and early September. They've advanced by less than that over other currencies however, and may even be set for declines against some in the months ahead. Although many firms including Westpac and Commonwealth Bank of Australia tip further gains for AUD/USD.

"The more favourable global economic outlook, negative US real yields and the US unfavourable balance of payments backdrop suggest the USD downtrend is intact. In our view, USD will fall mostly against commodity sensitive currencies," says Elias Haddad, a senior FX strategist at CBA. "AUD/USD is firm around 0.7300. We expect AUD/USD to rally near 0.7500 in the next month or so."

The performance of Pound Sterling on the other hand, will be determined in substantial part over the coming weeks by progress in the Brexit trade negotiations, or a lack of it.

The British currency was resilient on Wednesday, though it ceded ground to the Australian and New Zealand Dollars, amid reports suggesting the UK and EU will miss a mid-November deadline for a trade deal to be done.

"Though its faded, the general trend in currency markets this week is still to sell safe havens and buy riskier, higher yielding currencies. Hence the biggest losers so far are the JPY, CHF and USD, whilst the Scandinavian and Antipodean currencies and even the British Pound are benefiting from the risk rally,” says George Vessey, a currency strategist at Western Union Business Solutions.

Above: Pound-to-Australian Dollar rate at daily intervals with 21 (light bluie), 55 (orange) & 200-day (black) moving-averages.