Pound-to-Australian Dollar Forecast: 1.8130-1.84 Range to Remain Intact Near-term

- GBP/AUD to respect August range

- AUD to be driven by equity markets

- Domestic covid-19 developments to also weigh

- GBP eyes Brexit trade negotiations, flash PMIs

Image © Adobe Images

- GBP/AUD spot rate at time of writing: 1.8202

- Bank transfer rates (indicative guide): 1.7565-1.7692

- FX specialist rates (indicative guide): 1.7770-1.8038

- Secure bank beating GBP/AUD exchange rates here

The British Pound started the new week with a half percent fall against the Australian Dollar but has subsequently found buying support around the 1.8130 area thanks to a reversal in the Australian Dollar which comes in sympathy with softer stock markets.

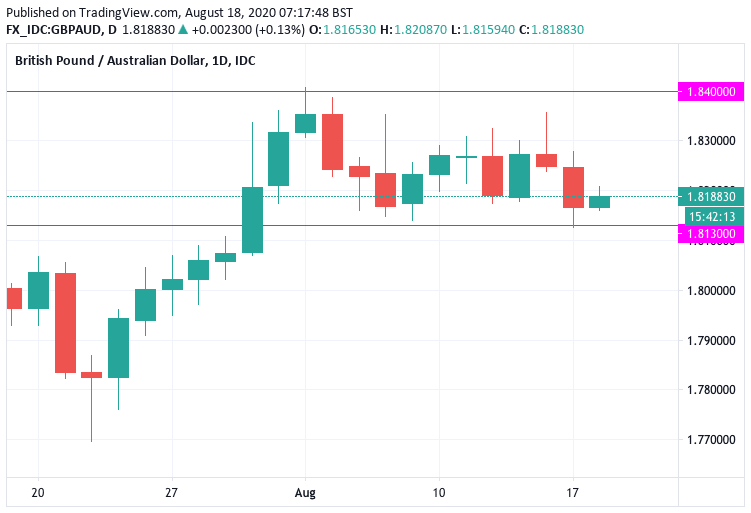

The Pound-to-Australian Dollar exchange rate saw its strong recovery fade in early August after it 'topped out' at 1.84, subsequently consolidation has set in with the pair carving out a range between 1.8130 at the bottom and 1.84 at the top:

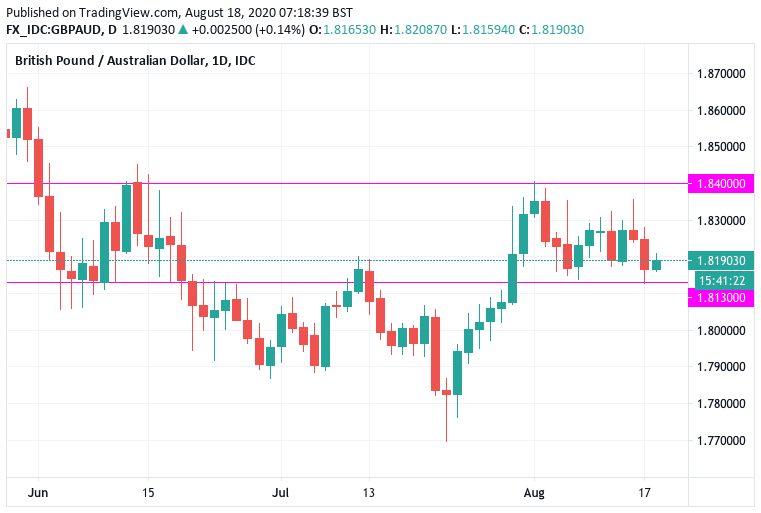

If we zoom out and look at the chart going back to June we can see the exchange rate stuck to these levels quite closely, confirming the market has a history of favouring this range:

The above charts are by no means intended to offer a precise technical analysis of the pair, instead they offer an understanding of how the exchange rate is trending, telling us that there is a high probability these levels are maintained in the absence of a major fundamental catalyst.

One fundamental driver to the Aussie Dollar's performance will be the performance of global stock markets, in particular the U.S. S&P 500 which remains the benchmark for broader investor sentiment.

"Following the bounce in economic optimism that came with re-opening, the AUD has drifted higher with risk sentiment," says Daniel Been, Head of G3 & FX Research at ANZ Bank.

However, the S&P 500 fell on Monday and this appears to have sapped some strength from the Aussie, which in turn explains why the GBP/AUD has recovered back to 1.8182. Further gains in the exchange rate could therefore depend on whether or not investor sentiment enters a genuinely new bull phase which tends to not happen in the August summer market lull.

Domestic developments however continue to be a headwind for the Aussie Dollar.

"The surge of COVID-19 cases in Melbourne and resultant restrictions carry real concern for domestic growth. Medium-term prospects are likely to hinge on how fast global activity can resume and how well economies cope with surges in case numbers," adds Been.

However Victoria recorded its lowest daily rise in new coronavirus cases in a month on Monday but the picture remains complicated as Sydney has been added to the list of Covid-19 hotspots while Tasmanian authorities confirmed their borders would be closed until at least December 01.

Francesco Pesole, FX Strategist at ING Bank N.V. says the Australian Dollar has in fact been a laggard of late, saying that this could be partly explained by concerns over the second wave of covid-19 infections in Australia.

"The Aussie dollar has held marginally below the 0.7200 mark as the antipodeans lagged other procyclicals ... despite a quite encouraging set of jobs data in Australia. Attention remains on the virus/lockdown developments in the country: Victoria appears to be showing a flattening in the contagion curve and this is starting to fuel some hopes of easing restrictions," says Pesole.

Pesole notes that Reserve Bank of Australia (RBA) Governor Philip Lowe has been watching the second wave of covid-19 infections, observing the subsequent shutdowns in Melbourne has likely erased the recovery effort in other parts of the country.

Markets will remain wary that the slowdown triggered by the Melbourne outbreak pushes the RBA to engage in more aggressive easing measures in order to support the economy. The general rule in foreign exchange is that when a central bank cuts interest rates or boost quantitative easing the currency it issues tends to fall in value.

For now the RBA looks intent with its actions and with the situation in Melbourne appearing to be under control, we would not expect any major downside in the Australian Dollar to materialise as a result of RBA dynamics.

How the Pound ends the week will likely depend on Friday's briefing from EU and UK negotiators following this week's trade negotiations. The two sides meet on Tuesday in Brussels and are expected to attempt to iron out further differences between the two sides.

We don't expect any breakthrough on the major issues but instead expect the two sides to make further progress towards such an outcome. However, any unexpected successes or obvious break down in tone would likely inject some volatility into the pair.

For now, markets continue to assume a deal will be reached, which should ultimately keep Sterling somewhat supported.

The main data release for the Pound in the week ahead ahead are the flash PMIs for August which will give a sense of how the recovery in the UK is progressing.

"Activity likely rose gradually through August as most countries continued to ease up COVID restrictions (local shutdowns excepted). We see upside risks and expect small gains across most key PMI measures, indicating recovery, but still at a relatively subdued pace," says a note from TD Securities.

The UK PMIs are out at 09:30 on Friday 21 and with relative economic performance being an increasingly important factor for foreign exchange markets to consider, a beat or miss of consensus forecasts could influence direction in the Euro and Pound.

The UK Services PMI is forecast at 57, up from the previous month's 56.5 while the Manufacturing PMI is forecast at 53.6, up from July's 53.3. The Composite PMI is expected at 56.6, down on the previous month's 57.

How the UK recovery compares to the recoveries of other economies matters when it comes to exchange rates, as we are in a world where economic outperformance is beginning to matter again.