Pound-to-Australian Dollar Recovers Amidst Heightened Geopolitical Tensions Surrounding Hong Kong

- China moves to tighten grip on Hong Kong

- Markets nervous of U.S. response

- AUD fades recent gains in risk-off environment

Image © Adobe Images

- GBP/AUD spot rate: 1.8678

- Bank transfer rates (indicative guide): 1.8024-1.8155

- FX specialist rates (indicative guide): 1.8240-1.8510 >> more information

The Australian Dollar reversed some of its recent gains against the Pound, Euro and U.S. Dollar ahead of the weekend in response to a broad deterioration in market sentiment, as investors considered rising geopolitical tensions between the U.S. and China.

An apparent power-grab by Beijing in Hong Kong is proving to be the latest focal point for tensions, following China's move to take further direct control over the ex-British colony.

China on Thursday announced a law for the "improvement of security in Hong Kong", which will allow the mainland to tighten its grip on the semi-autonomous territory following months of anti-China protests.

A response by the U.S. is expected in light of the rising tensions between the world's largest and second-largest economies, which has in turn lead investors to pare back on exposure to stocks, commodities and any financial asset that tends to benefit when investors are optimistic.

This includes the Australian Dollar, which has benefited since a recovery took hold of global markets in March. The currency has a strong correlation with global stock market movements, tending to rise when they rise and fall when they decline.

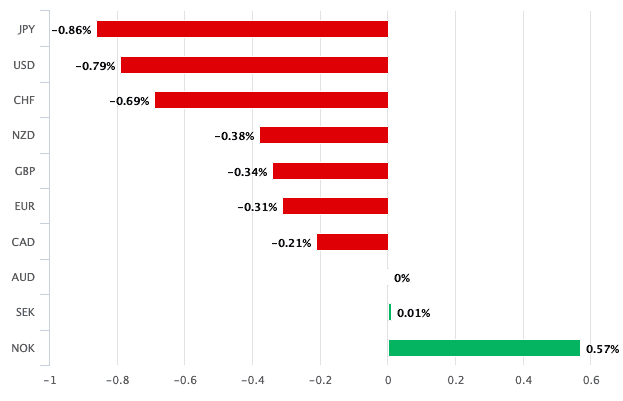

Above: The Aussie Dollar is one of the worst performing major currencies of the day

With this binary 'risk-on / risk/off' interplay still firmly in control of markets, we would expect further losses in the Australian Dollar should markets enter a new down-base.

The Pound-to-Australian Dollar exchange rate has recovered ground to trade at 1.8685, the Australian Dollar-to-U.S. Dollar exchange rate is meanwhile back down at 0.6515, having been as high as 0.66 earlier this week.

At their delayed annual congress, China's Communist Party proposed the introduction of a a law to ban "treason, secession, sedition and subversion", which could bypass Hong Kong's lawmakers.

Critics of the law say China is breaking its promise to allow Hong Kong freedoms not seen elsewhere in China.

Above: GBP/AUD rallies on rise in geopolitical tensions

It is likely to fuel public anger and may even trigger fresh protests and demands for democratic reform.

Beijing is pushing the law through to allow for "law-based and forceful measures" to prevent future protests, allowing authorities to "prevent, stop and punish" future insurrections.

Hong Kong's government said it would co-operate with Beijing to enact the law, adding it would not affect the city's freedoms.

For global financial markets it will be the U.S. response to Beijing's moves that will be key.

"It is uncertain how the US administration will react to this development. As the policies of the current US administration are not based on strategic guidelines but meander arbitrarily, everything is possible: from ignoring Beijing’s new Hong Kong policy to a resumption of the trade conflict," says Ulrich Leuchtmann, Head of FX and Commodity Research at Commerzbank.

From a currency market perspective, Leuchtmann says U.S. Dollar strength would be typically expected of any rise in tensions between the U.S. and China,

"The perceived risk of another US-China trade war is increasing, which is damaging risk appetite and fuelling investor flows into safe-haven assets like the Japanese Yen, Swiss Franc and US Dollar," says George Vessey, Currency Strategist at Western Union.

Further issues to consider is talk of the potential delisting of Chinese companies from U.S. stock markets, which would significantly hamper China's ability to raise capital.

China has meanwhile promised unspecified retaliation should the U.S. introduce further tariffs.

Amongst all this, we should not forget that trade tensions between China and Australia are also rising. "Further signs of a worsening in the relationship between Canberra and Beijing are raising concerns that more Australian exports could be at risk from tariffs or other retaliation from China," says Jane Foley, Senior FX Strategist at Rabobank.

Australia has been a leading voice in calls for an independent investigation into the origins of the covid-19 epidemic, and specifically the Chinese state's handling of the early stages of the outbreak. China has in turn warned that Australian imports into the country would be jeopardised by Australia's calls for an investigation, and it appears China is now following through with its threats.

Despite short-term weakness, the GBP/AUD daily chart shows a downtrend is firmly intact

Media reports this week have not been constructive on the matter of China-Australia trade relations, with news that China’s customs officials are set to impose new inspection procedures and rules on iron ore imports from next month.

Iron ore is Australia's main export and key foreign exchange earner, and it appears Chinese authorities are looking to add fresh lines of red tape around iron ore imports, which could be used to block or hold up Australian shipments.

"If coal or iron ore, Australia’s biggest export goods, were considered to be the subjects of Chinese retaliation, the risk to the country’s economy and to the AUD would be accentuated," says Foley.

Foley forecasts the AUD/USD 0.66 area to act as psychological resistance and look for AUD/USD to turn lower on a 1 to 3 month view as a result.

This should in turn be reflected in other Aussie Dollar pairs, which could potentially allow the GBP/AUD exchange rate to stage a recovery.