Pound-Australian Dollar Exchange Rate Breaks Lower as Aussie Rides Risk Recovery

- Written by: Gary Howes

- What is the outlook for the Pound against the Australian Dollar?

- Technical charts suggest further losses

- AUD moves higher in line with improving risk sentiment

- Consensus GBP/AUD forecasts post-covid 19 now available for download at Global Reach

Image © Adobe Images

- GBP/AUD market rate at time of writing: 1.9517

- Bank transfer rates (indicative): 1.8833-1.8970

- FX specialist rates (indicative): 1.9068-1.9340 >> more information

The Pound-to-Australian Dollar exchange rate appears to have decidedly turned trend and looks set to head lower in the short-term, following a break below a temporary resistance area located in the 1.9579-1.9598 region on the charts.

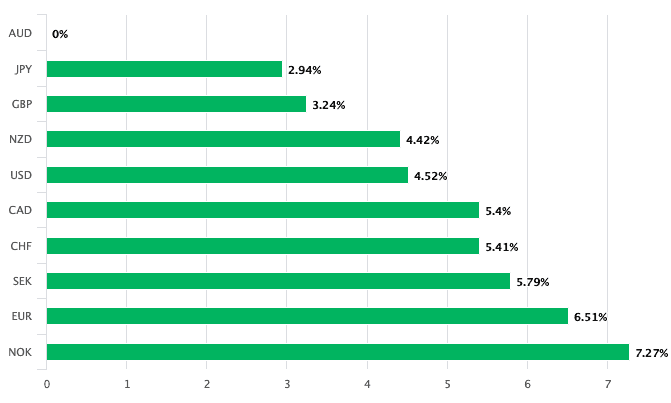

Sterling has now lost 3.24% of its purchasing power against the Australian Dollar over the course of the past month amidst a broad-based improvement in global risk sentiment that tends to aid the Australian Dollar against the majority of its peers.

We had been watching for an area of support to kick in and arrest Sterling's declines, but we warned that a break below this 1.9579-1.9598 region would add to an increasing conviction that Sterling is poised for further losses against its Australian counterpart.

Over the course of the past 48 hours this break lower has indeed materialised and we would expect for it to advocate further short-term losses.

The key fundamental driver for GBP/AUD remains the steady improvement in broader investor appetite, linked to the view that the global economy has now witnessed the peak of the coronavirus outbreak which will allow for countries to press ahead with strategies to exit lockdown.

The Australian Dollar has a tight correlation with global investor appetite, falling when markets fall and rising when they recover.

"The broader market risk mood has improved overnight, leaving European stocks in the green and lifting US futures," says Shaun Osborne, Chief FX Strategist at Scotiabank. "The AUD is leading the G10 pack".

"The driver behind the improvement in risk appetite was the same which was responsible for the risk aversion in the last couple of days, and this is oil. With no clear catalyst behind the move, oil prices rebounded yesterday, with WTI and Brent gaining 37.66% and 5.38% respectively. The recovery continued during the Asian session today as well," says Charalambos Pissouros, Senior Market Analyst at JFD Group.

The broad-based improvement in sentiment is reflected on the lift in global stock markets and in Australia's currency: if we look at the relative performance of the currency against the other G10 majors over the course of the past month we can see that it is outperforming:

We see little indication that the relationship between the broader Aussie complex with global factors will break anytime soon, and we therefore remain fixated on broader investor sentiment.

This week saw some investor nerves return following a sharp slide in oil prices, which was symptomatic of the substantial economic slump underway owing to coronavirus shutdowns. However, since late March investors have tended to look through bouts of weakness and continued to increase exposure to stocks which has in turn aided Australian assets.

This trend of gradually improving investor appetite appears to be intact for now.

"Stocks have recovered some of their lost ground from yesterday’s session, as indices continue to shrug off bad news and focus on what positives can be found. Tentative moves towards the easing of lockdown restrictions continue, while it looks like investors are still keen to buy stocks, especially tech ones, after Netflix’s earnings last night. From the general tone of markets and news updates, it looks like this rally is still being greeted with a healthy degree of scepticism, with a steady flow of predictions that a fresh decline is just around the corner. But when everybody is looking for it, such an eventuality is unlikely to occur," says Chris Beauchamp, Chief Market Analyst at IG.

While stock markets are higher, there remains a degree of caution to sentiment that should ultimately keep the pace of any further Aussie Dollar appreciation in check.

The first real data that fully covers the lockdown period is starting to filter throug, and we remain wary that it could have the potential to shift market sentiment.

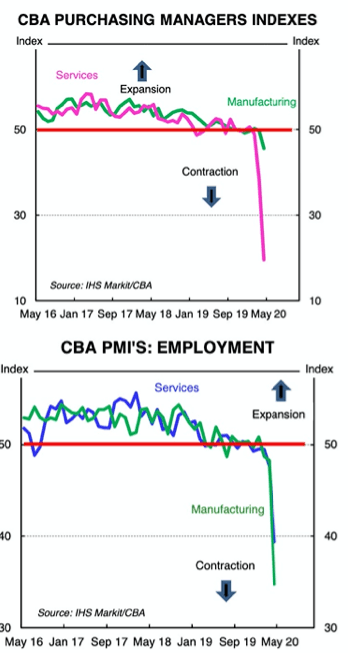

Australian data could offer a flavour of what other countries could soon experience, with the CBA Flash Composite PMI collapsing in April – the index plungedby 17.0 to sit at just 22.4.

The PMI is a survey of economic activity and gives economists an idea of how the economy performed in a given month. Any reading below 50 suggests contraction while a reading above 50 signals expansion.

22.4 therefore confirms a significant plunge in the Aussie economy.

The deterioration in Australian Composite PMI reflected a substanital fall in the Services PMI (down by 18.9 to 19.6) and a smaller contraction in the Manufacturing PMI (down by 4.1to 45.6).

"The profound negative impact of the COVID-19 pandemic on the Australian economy has been reflected in the incredible collapse in the CBA Flash Composite PMI over April. Indeed the overall result is simply astonishing," says Gareth Aird, Head of Australian Economics at Commonwealth Bank of Australia. "Company shutdowns, government restrictions and steep falls in customer demand haveeffectively seen private demand collapse over April. The services sector has been hit a lot harder than the manufacturing sector as evidenced by the disparity between the overall levelsof the Manufacturing PMI (45.6) compared to the Services PMI (19.6)."

According to the report, new orders decreased substantially and the shock to global demand was reflected in a big fall in new orders from foreign customers.

"The pace of job shedding evident in the April PMIs is concerning though not surprising given the large number of Australian businesses that remain shut. Both the services and manufacturing employment indexes plunged," says Aird.

Based on this data, Aussie Dollar bulls are lucky the currency is focussed on the bigger picture rather than domestic developments, but should this kind of data be reflected in other larger economies it could trigger a shift in investor mood as they realise stock markets are far too richly priced given the state of the underlying economy.

This could in turn result in the heat being turned up on the Australian Dollar.