South African Rand: Worst-Performing Major Currency of the Past Month, Outlook Suggests Little Respite

- ZAR doing worse than peers in emerging market bracket

- Eskom wage negotiations a focus for FX markets

- Commerzbank say foreign investor confidence must return if the Rand is to find support

Image © Daniel Sky Photo, Adobe Stock

The South African Rand once again posted greater losses than its peers in the emerging market bracket midweek, a suggestion that the currency's ongoing weakness cannot be blamed solely on external drivers.

Indeed, ZAR underperformed the Argentinian peso and the Turkish lira on Wednesday while losses against the G10 were also pronounced with losses of 2.31%, 1.51% and 1.5% being recorded against the Greenback, the Euro and the Pound Sterling.

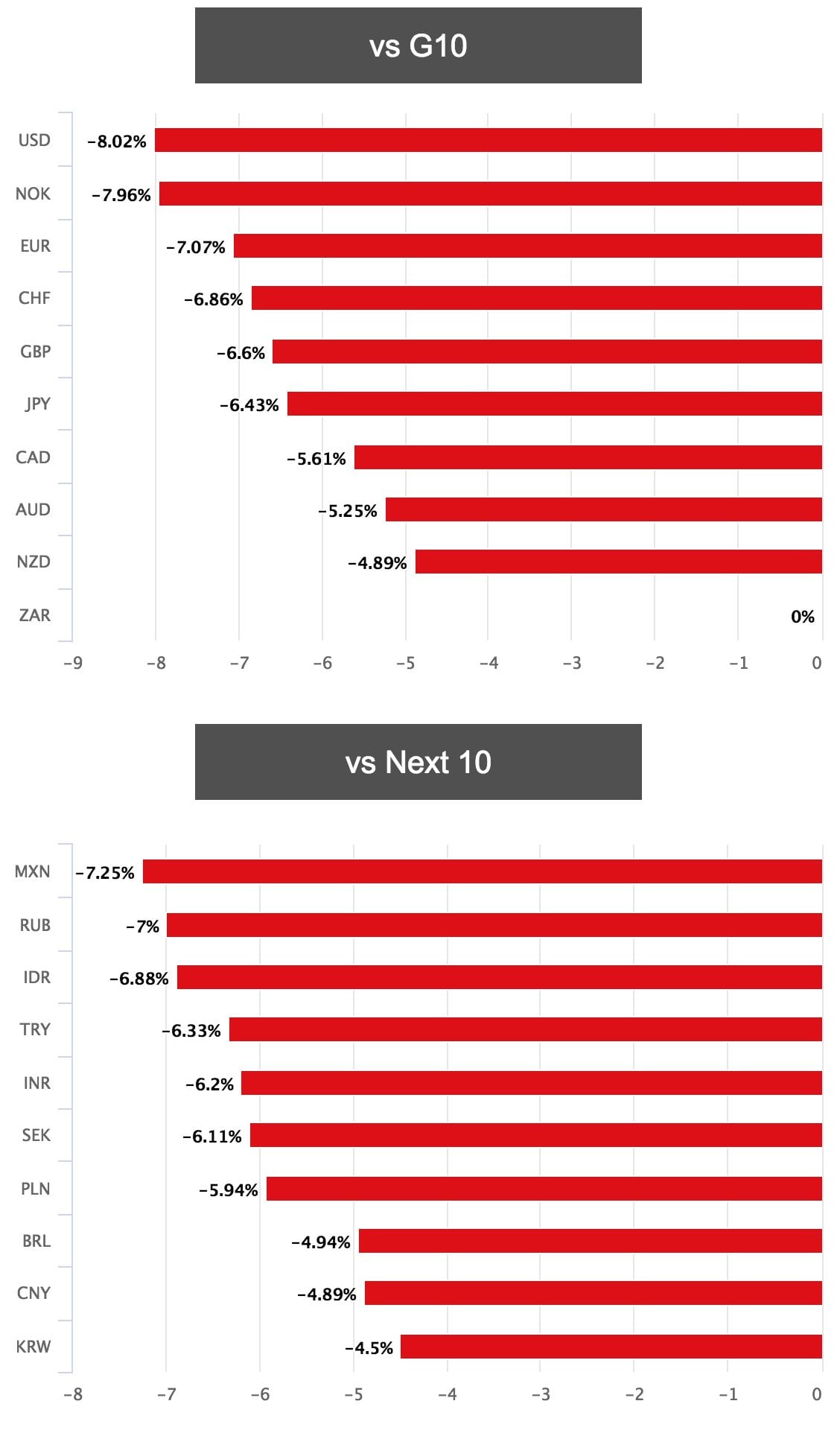

Perhaps the most effective method of summing up the currency's broad-based underperformance is by presenting the below graphic which shows the Rand to be the worst performing of the world's top 20 freely-exchange currencies over the past month:

Global factors are certainly weighing on the Rand with a strengthening US Dollar pushing up the cost of fuel imports for the South African economy, while the rising Dollar also pushes up the cost of servicing South African debts that are denominated in foreign exchange.

"The South African Rand came under notable pressure yesterday and USD-ZAR rose to 13.90 after a rating agency had published a report on the risks of EMs and their susceptibility in case of significant USD strength," says analyst Thu Lan Nguyen with Commerzbank. "The critical factors are seen to be high current account deficits and high foreign debt levels, above all in foreign currencies. Moreover the risks of an escalating trade conflict were stated."

Global trade war rhetoric is not helping either with US administration's desire to reshape global trade dynamics drawing questions as to the future profitability of South Africa's raw material exports which are a major foreign currency earner for the country.

"It seems that the market is not yet comfortable with the direction of the threat of a global trade war. EM, including SA assets, will remain on the backfoot due to soft market sentiment. For SA, this has been exacerbated by weak economic fundamentals relative to peers," says Zaakirah Ismail with Standard Bank in Johannesburg.

ZAR appears to be doing worse than its contemporaries that are also subject to global concerns stemming from a stronger Dollar and a deteriorating outlook for global trade. Therefore, domestic developments are affording ZAR an edge when it comes to earning 'wooden spoon' status.

"What compounded the weakness in the Rand was the rejection of the 5% wage offer by Eskom by three unions and month-end, quarter-end and half-year momentum-driven US dollar-buying," says Isaah Mglanga at RMB.

Eskom - South Africa's power supply parastatal - is set to again meet with trade unions for another round of wage negotiations on Thursday morning following a deadlock in mid-week negotiations with the unions rejecting an offer for a 5% wage hike.

Eskom has reportedly offered above inflation increases for 2019 and 2020 but Unions are demanding a 9% pay hike. The Eskom pay issue serves as a sign of the inherent difficulties of doing business in South Africa in the current environment and confirms President Ramaphosa's intentions to turn around the country's highly inefficient parastatals will be incredibly difficult.

Ramaphosa's intent to deliver efficiencies were one reason ZAR shot higher on his ascent to the top office and it appears markets are now fast erasing the Ramaphosa premium.

Commerzbank's Nguyen adds that a further concern for markets is the South African government’s plans for land expropriation without compensation "which might put off foreign investors".

"The risks are not new. South Africa has learned from former shocks. Foreign currency debt has been reduced. However, the country continues to depend on external capital investors," says Nguyen.

Commerzbank will be watching the country's current account position - i.e. the state of South Africa's 'bank account' with the rest of the world.

The current account deficit eased notably until year-end 2017 but more recent data for Q1 2018 signals a surprising strong rise again confirming the country remains dependent on foreign capital inflows in order to plug the deficit and keep the currency stable.

A supportive factor that could limit ZAR downside does however come in the shape of the South African Reserve Bank which Commerzbank continue to see as a beacon of stability for the economy and the currency.

"It is keeping a close eye on the currency related inflation risks and has signalled its willingness to act should the inflation outlook deteriorate," says Nguyen. "The Rand is nonetheless likely to remain under pressure in the current environment," says Nguyen.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.