South Africa's Rand "Too Expensive" says Bank of America

- Written by: Sam Coventry

Above: Ramaphosa was officially sworn-in as the new President of the Republic of South Africa following his re-election by Parliament on Friday, 14 June 2024. Photo: GCIS

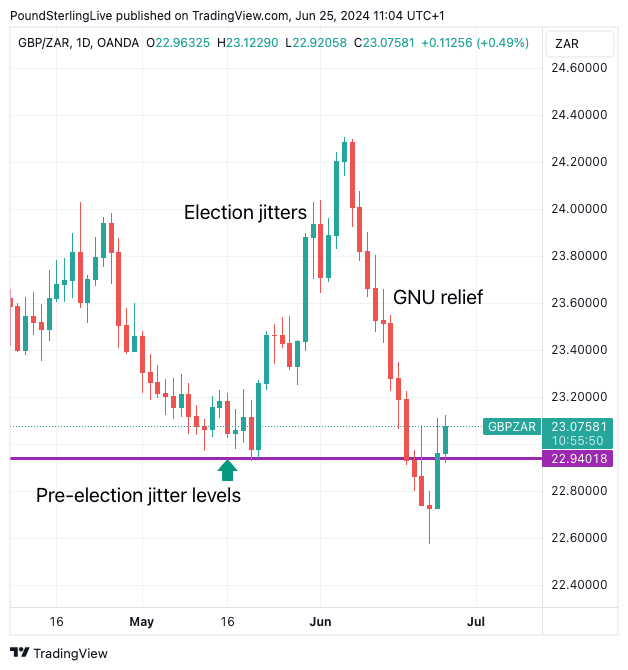

Bank of America says the Rand could be overvalued to the tune of 4% as the supportive news from the recent elections and agreement of a Government of National Unity (GNU) has run its course.

"Global and local stories are turning against the ZAR: the ANC/DA coalition is less stable than expected and the U.S. Presidential debates on 27th June increase the risks for EM FX," says Mikhail Liluashvili,

EEMEA Local Markets Strategist at Bank of America.

The call comes at a sensitive time for the fledgling administration, with political parties jockeying for cabinet positions.

The second-largest party in the GNU, the Democratic Alliance (DA), wants the position of deputy president and at least nine other cabinet portfolios.

Some reports suggest the DA has also targeted 11 ministries, including Mineral Resources, Transport, Home Affairs, Public Works, and Higher Education.

At least ten political parties have joined hands with the ANC in constituting the Government of National Unity. Together, the parties secured over 70% of the vote in the 2024 elections.

The Rand fell into the election as investors saw a risk the ANC would partner with radical far-left parties. It recovered after it became clear South Africa was headed for a GNU, which investors consider a market-friendly outcome. However, the stability of the GNU will be the next consideration for markets and the Rand.

"The rand still looks around 4% too strong relative to the usual drivers," says Liluashvili. "We think strong ZAR outperformance of EMFX is unlikely to continue even if the DA/ANC noise dies down."