South African Rand Finds Feet after Dollar's Inflation Acceleration Reverses

- Written by: James Skinner

"The Medium-term Budget Policy Statement (MTBPS) on 26th October is expected to see a further improvement in the fiscal metrics as Finance Minister Godongwana continues the focus on fiscal consolidation," - Investec

Image © Adobe Images

The South African Rand fell to a fresh two-year low against the Dollar before recovering sharply on Thursday following another surprisingly strong set of U.S. inflation figures, although domestic factors may best explain the underperformance against other currencies this week.

South Africa's Rand fell more than one percent against the U.S. Dollar during Thursday trading before reversing its losses entirely in price action that left it holding a small intraday gain toward the close of the European trading session.

It wasn't immediately clear what caused the sudden reversal although the Dollar had been quoted more than one percent higher against most currencies in the hours immediately after the release of official data revealing a further acceleration of the core U.S. inflation rate for September.

Economists reiterated or otherwise upgraded forecasts for November's Federal Reserve (Fed) decision for which the market now appears to be anticipating that Federal Open Market Committee members will vote to lift interest rates by three quarters of a percentage point for a fourth consecutive occasion.

"The Federal Reserve is doing the right thing by raising interest rates to tackle hot inflation, even as this strengthens the dollar and has spillover effects for other nations, South Africa’s central bank chief said," according to a Thursday report from Bloomberg News.

Above: USD/ZAR shown at hourly intervals and alongside USD/JPY, USD/CHF, USD/CNH and USD/BRL.

Above: USD/ZAR shown at hourly intervals and alongside USD/JPY, USD/CHF, USD/CNH and USD/BRL.

While the Rand was quick to reverse Thursday's losses it remained a bit of a G20 underperformer for the week overall and some analysts say this is reflective of economic risks stemming from an ongoing industrial strike action that has paralysed commercial rail and port facilities for seven days.

"The longer the strike lasts, the greater the economic costs. ZAR continues to underperform its high beta FX peers. The costs of the strike extend beyond South African assets with benchmark European coal prices rising Wednesday, reflecting tightening global coal supply," says Eimear Daly, an emerging market macro strategist at Natwest Markets.

The disruption to rail and port facilities hampers key South African industries including exporters of commodities, making it an obstruction of the overall economy and a burden for public finances that have been on an improvement trajectory in the last couple of years due partly to increased commodity prices.

Strike action continues barely more than a fortnight out from National Treasury's October budget statement, which is always an important event for the Rand.

"Falling rail and TPT (Transnet Port Terminal) export performance also weakens Transnet’s finances, increasing the burden on the state for providing financial assistance and bailouts, with the State’s finances not recovered from the damage of years of state capture. Reliable private sector service and infrastructure provision on rail and port services is needed," says Annabel Bishop, chief economist at Investec.

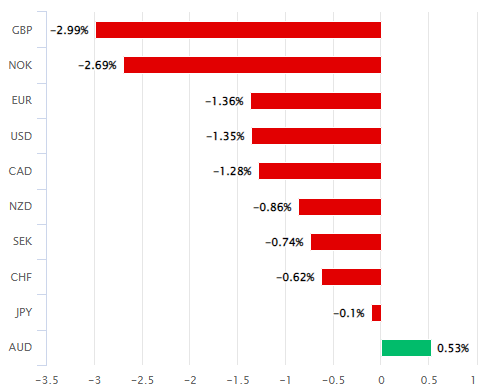

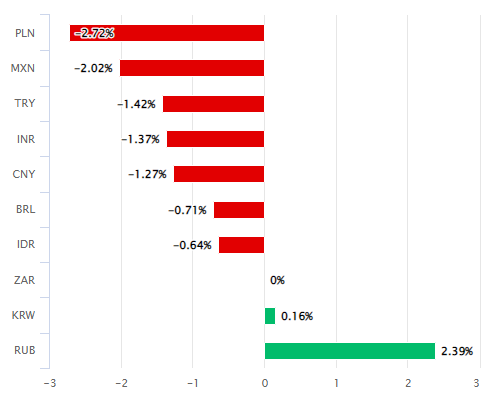

Above: Rand performance relative to G20 currencies over the five trading days to Thursday. Source: Pound Sterling Live.

"The Medium-term Budget Policy Statement (MTBPS) on 26th October is expected to see a further improvement in the fiscal metrics as Finance Minister Godongwana continues the focus on fiscal consolidation," Bishop wrote in a Wednesday research briefing.

While local analysts see the budget as less of a headwind for the Rand than in prior years, many do cite Fed policy and the U.S. Dollar as risks that are likely to haunt the South African currency and many others through year-end.

The Rand also potentially faces risks associated with the slowdown in China's economy, a key trade partner, while December's leadership contest for the African National Congress (ANC) party has also been cited by some as a possible source of market noise.

"We are not looking for a top in the dollar until 1Q/2Q next year, meaning that USD/ZAR still risks pushing up to 18.50 and possibly 19.00," says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

"The rand is a high beta on Chinese growth and EM prospects in general – neither of which look compelling this year. South Africa’s current account has moved a little deeper into deficit, earlier than expected (1.3% of GDP in 2Q) and the central bank will likely have to keep hiking (now 6.25%) to stabilise the rand," Turner also said this week.

Above: USD/ZAR at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance and shown alongside GBP/ZAR.

Above: USD/ZAR at weekly intervals with Fibonacci retracements of 2020 downtrend indicating possible areas of technical resistance and shown alongside GBP/ZAR.