South African Rand Boosted by SARB Rate Hike

- Written by: James Skinner

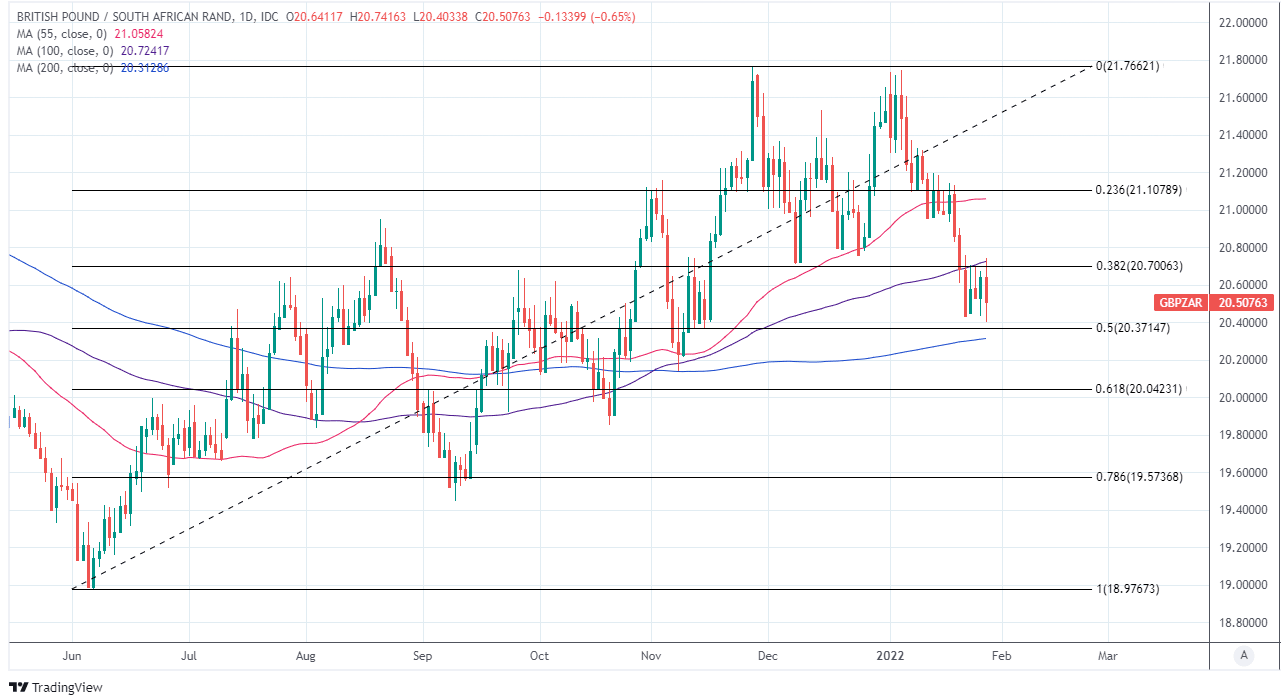

- GBP/ZAR trades heavy near 20.40 & 2022 low

- After SARB lifts cash rate, says more to come

- Further “gradual” steps to keep lid on inflation

Image © SARB

The Pound to Rand exchange rate reached a new 2022 low and remained under pressure on Thursday after the South African Reserve Bank (SARB) raised its benchmark interest rate for a second time and warned that further gradual increases in borrowing costs are likely ahead.

South Africa’s Rand stood out for its resilience in the face of a resurgent U.S. Dollar during much of the Thursday session with a strong performance that helped push GBP/ZAR back to 20.40 and its lowest since the early days of November last year.

The Pound to Rand rate remained heavy near that level after the SARB lifted its cash rate from 3.75% to 4%, in line with consensus among economists, and warned that further increases in the benchmark could be necessary in order to keep a lid on inflation over the coming years.

“Given the expected trajectory for headline inflation and upside risks, the Committee believes a gradual rise in the repo rate will be sufficient to keep inflation expectations well anchored and moderate the future path of interest rates. However, economic and financial conditions are expected to remain more volatile for the foreseeable future,” Governor Lesetja Kganyago said in a statement.

Above: GBP/ZAR shown at daily intervals with major moving-averages and Fibonacci retracements of June 2021 recovery indicating possible areas of support for Sterling.

- GBP/ZAR reference rates at publication:

Spot: 20.52 - High street bank rates (indicative): 19.80-19.54

- Payment specialist rates (indicative): 20.34-20.42

- Find out about specialist rates, here

- Set up an exchange rate alert, here

The rate rise came after the SARB revised its forecast for inflation in 2022 from 4.3% to 4.9% and projected that South Africa’s core inflation rate would rise from 3.1% to 3.8% this year, leaving each measure near to or above the midpoint of the bank’s three-to-six percent target band.

Further modest increases in the cash rate were advocated by the SARB’s quarterly projection model for the years ahead, which are expected to pull the headline rate of inflation back to 4.5% in 2023 and 2024, although the core inflation rate was seen as likely to inch higher to 4.5% by 2024.

The difference between the two measures of inflation is in the recognition of price changes for energy, food and some regulated price items like alcohol and tobacco as these are all omitted from the core inflation rate, which is often viewed as a better reflection of domestically generated inflation.

“This afternoon’s Monetary Policy Committee speech saw the ZAR trading sideways as the governor highlighted the upward risk to inflation whilst subdued growth (the GDP forecast was adjusted downward) would remain a theme. Commodity exports have been strong and are expected to continue to balance this out,” says Ryan Bootsen, managing director of DG Capital Forex in Johannesburg.

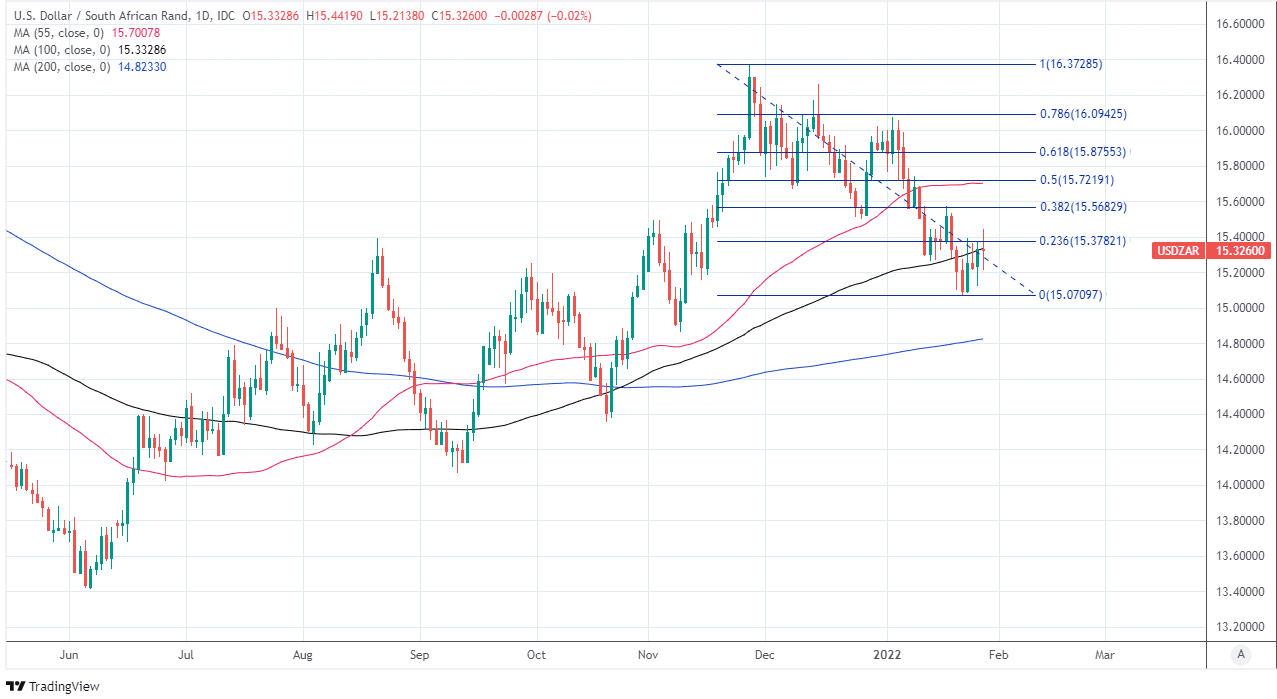

Above: USD/ZAR shown at daily intervals with major moving-averages and Fibonacci retracements of June 2021 recovery indicating possible areas of support for U.S. Dollar and resistance for the Rand.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Economists were anticipating a rate rise on Thursday and prices in parts of the financial markets have recently indicated that investors are wagering heavily that rates will rise by as much as two percent this year and next.

“The FRAs [forward rate agreements] anticipate a 25bp lift in July and September, and are building one in for December as well. The start of the normalisation of monetary policy in the US has a substantial impact on SA interest rate expectations,” says Annabel Bishop, chief economist at Investec. “While the MPC often follows the FRA curve at a meeting, FRA curve expectations are volatile and change often,” Bishop warned.

Thursday’s rate rise and resilience in Rand exchange rates came after the Federal Reserve provided an advanced warning that its interest rate could be lifted in March, in line with market expectations.

The Fed also suggested that further increases could be quicker to materialise this year than in the last U.S. monetary policy tightening cycle.

The Fed waited a full year between December 2015 and December 2016 before lifting its interest rate for the second time in what was its first tightening cycle since before the 2008 financial crisis.

Financial market pricing shows investor expectations for around four increases in the Federal Funds rate and the Bank’s own dot-plot of policymakers’ forecasts had suggested in December that around three could be likely.