South African Rand Outperforms in Strong Start to 2022

- Written by: James Skinner

- ZAR leading developed & emerging market FX

- Strong start partially reverses year-end losses

- Omicron fears ebb, market eyes central banks

Image © Adobe Images

The South African Rand extended gains over the Dollar, Pound and others in the final session of the week, cementing its position as the top performer among large developed and emerging market currencies following a strong start to the new year.

South Africa’s Rand was on course for a hat-trick of gains over Sterling and the Dollar on Friday in price action that had reversed around half of the losses sustained in illiquid trade during the final week of 2021.

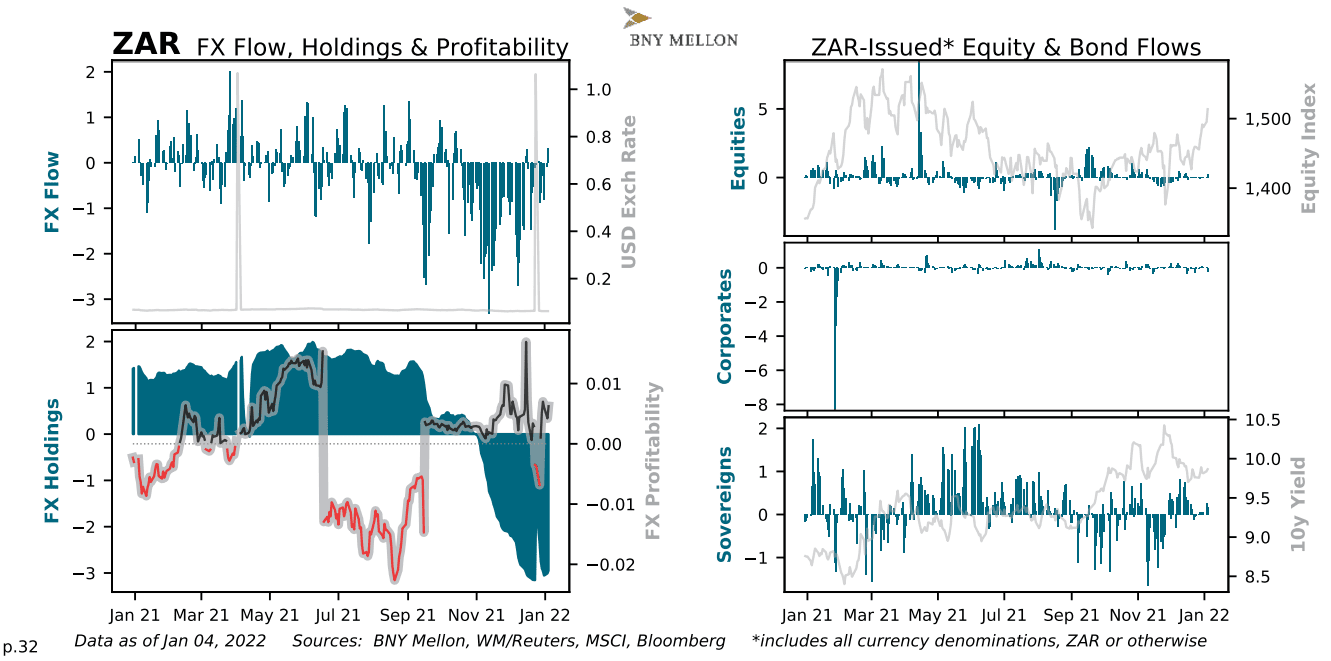

“Selling on the omicron news took rand exposures from small overheld to large underheld,” says Daniel Tenengauzer, head of markets strategy at BNY Mellon.

Above: Flows into and out of South African Rand and denominated assets. Source: BNY Mellon.

- GBP/ZAR reference rates at publication:

Spot: 21.17 - High street bank rates (indicative): 20.43-20.58

- Payment specialist rates (indicative): 20.98-21.07

- Find out about specialist rates, here

- Set up an exchange rate alert, here

Year-end losses had deprived the Rand of gains that accrued to other currencies in late December when a series of international studies provided further evidence to support South African scientists’ initial findings that the Omicron coronavirus strain is a lesser threat to public health than its predecessors.

But the Rand had previously been one of the most heavily sold when local officials first detected and announced to the world the emergence of Omicron, meaning the currency’s strong start to 2022 could potentially reflect the subsequent easing of market concerns about the new strain.

“The ZAR resisted hawkish FOMC minutes very well and eked out small gains vs the USD,” says Kenneth Broux, a strategist at Societe Generale.

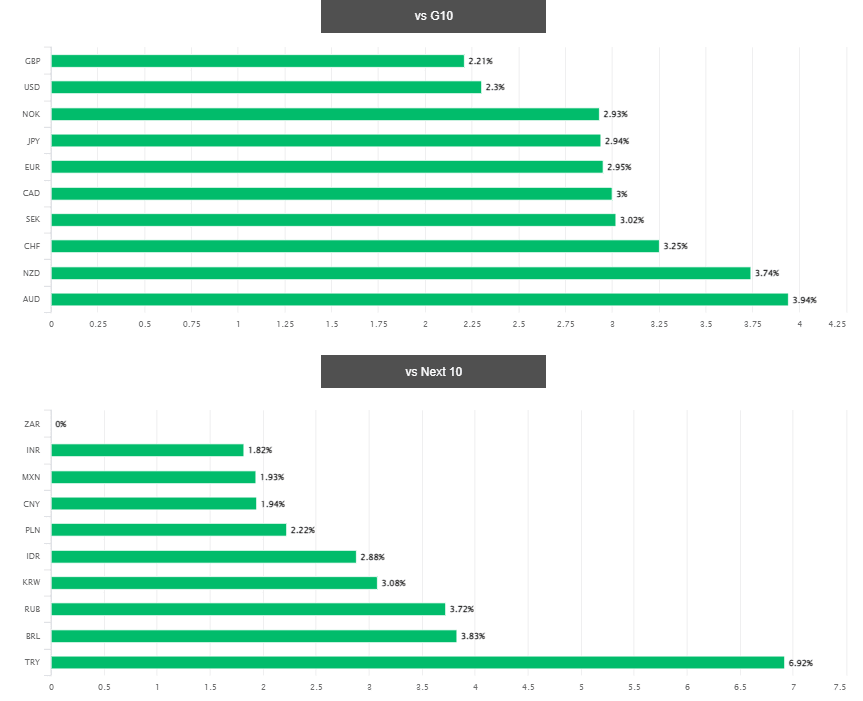

Above: South African Rand’s 2022 performance against major counterparts. Source: Pound Sterling Live.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The Rand’s three day rally continued through Thursday and into Friday even after minutes of the December Federal Reserve (Fed) meeting appeared to confirm there’s a prospect of U.S. interest rates rising as soon as March.

They also revealed for the first time that American policymakers could also commence a process intended to steadily shrink the Fed’s $8.8 trillion balance sheet within relatively short order after any increase in interest rates.

“2022 has started off with heightened interest rates expectations, both in the US and in SA,” says Annabel Bishop, chief economist at Investec.

“While the USA rate hikes signalled by the FOMC’s dot plot graph of members assessments of appropriate future monetary policy do not exceed 0.75-1.00% on average, some are suggesting more than three hikes, and 2022 looks set for some volatility,” Bishop also said.

Above: GBP/ZAR rate shown at daily intervals alongside USD/ZAR.

One factor that may have helped the Rand withstand a widespread strengthening of the U.S. Dollar in the wake of this Wednesday’s Fed minutes is the market’s recently increased confidence that the South African Reserve Bank (SARB) could be likely to lift its own interest rate as soon as January 27.

Much about January’s interest rate decision from the SARB could depend, however, on the outcome of December inflation figures due to be published on January 19 because so far South African inflation has remained close to the bottom of the SARB’s three-to-six percent target band when changes in international energy prices are overlooked.

This potentially creates scope for the SARB to be patient before lifting interest rates further although the bank’s quarterly projection model did prescribe following its last review in November that interest rates be raised once per quarter up until 2024, potentially making January’s decision a close call.

“The FRA (Forward Rate Agreement) curve is currently anticipating JIBAR close to 6% by year end, and closer to 7.0% by the end of next year (2023). While SA’s FRA total projections are likely overdone across its twenty-four month curve, the SARB is quite likely to hike the repo in Q1.22,” Investec’s Bishop wrote in a research briefing on Thursday.