South African Rand Forecasts Warn of Diverging Paths for USD/ZAR and GBP/ZAR

- Written by: James Skinner

- ZAR eases from highs on USD rally & risk aversion

- As domestic data flags soft economy, lower surplus

- USD/ZAR seen slipping toward 15.3500 at Investec

- But GBP/ZAR seen rising back above 22.00 in 2022

Image © Adobe Images

The Rand’s fortnight long rebound stalled in the penultimate session of the week as the Dollar began to find its feet and risk assets came off the boil although forecasts from Investec warn of diverging paths for USD/ZAR and GBP/ZAR during the months ahead.

South Africa’s Rand had been quick to rebound through early December from late losses inspired late last month by the renewal of curbs on travel between parts of Africa and the Northern Hemisphere, although the rally was fading by Thursday.

The Rand eased lower from the week’s highs on Thursday as the Dollar lifted from its lows for the week against most currencies amid signs of a cooling in international inventors’ appetites for risk assets, enabling even a recently beleaguered GBP/ZAR to stabilise.

Stock and commodity markets were lower at the international level while the Rand was softer on Thursday, with the currency easing further after Statistics South Africa noted that the country’s lucrative goods trade surplus retreated from its own recent highs in the third-quarter.

The data followed other figures confirming a retrenchment of the overall economic recovery last quarter, which many economists have connected to July’s civil unrest, although international factors are tipped by Investec to hold as much sway over the Rand in the months ahead.

“The rand’s ability to strengthen substantially further is limited by the slow pace of the SARB’s interest rate increases to date in the current cycle, compared to other EMs that started hiking much earlier this year. Markets are differentiating between EMs, with perceived less riskier emerging markets, such as China, benefiting from inflows while others such as SA see clear sell-off,” says Annabel Bishop, chief economist at Investec.

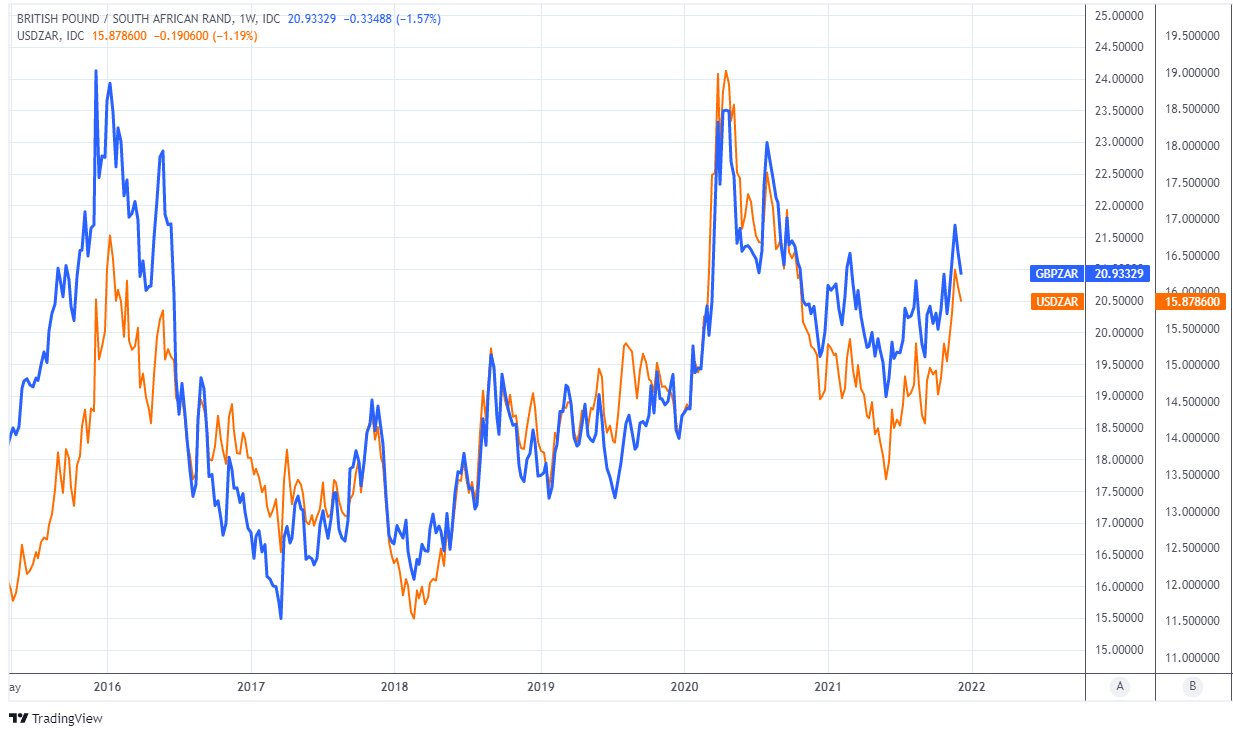

Above: USD/ZAR and GBP/ZAR shown at daily intervals.

- GBP/ZAR reference rates at publication:

Spot: 20.95 - High street bank rates (indicative): 20.22-20.36

- Payment specialist rates (indicative): 20.70-20.84

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The Rand pulled USD/ZAR back below 16.00 in its recovery from November’s rally above 16.30 while GBP/ZAR had slipped beneath 21.00 by Thursday, although Investec’s latest forecasts suggest its recovery may be near its end.

Bishop warned this week that the Rand is likely to struggle to advance much further against the greenback over the coming months and tipped USD/ZAR to bottom around 15.25 early in 2022 before rising back to 15.70 by the end of summer.

However, the likely setback against the Pound is expected to be steeper, with GBP/ZAR seen rising from this week’s 20.85 in the final quarter to 22.71 by the end of next year, driven in part by an expected recovery for Sterling against the U.S. Dollar.

“The recent US jobs figures, while disappointing in the headline payrolls data, show on deeper analysis strengthening in some areas of the jobs market, and so lower unemployment. The Fed is likely on track for quickening the pace of QE tapering, which would provide an underpin for rand weakness into H1.22,” Bishop wrote in a Wednesday forecast review.

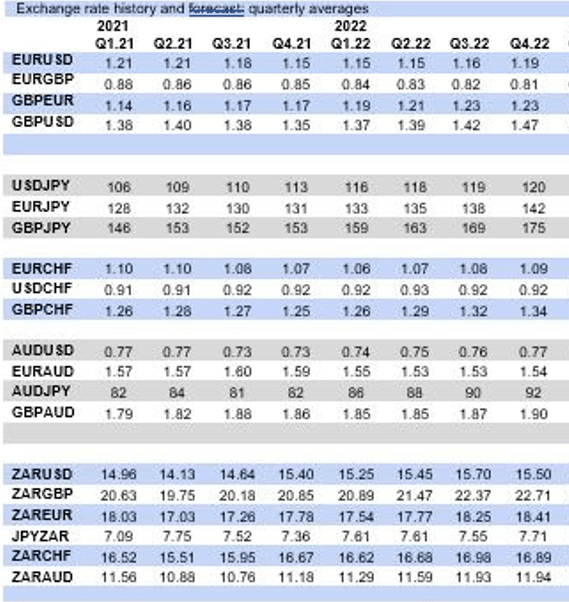

Above: Investec FX forecasts.

While USD/ZAR’s November rally back to 16.30 and above was connected to the discovery of a new strain of coronavirus, the South African currency had been in retreat alongside others for months already as a result of the increasingly hawkish shift in policy stance at the Federal Reserve.

The Fed is now widely expected to accelerate the pace at which its quantitative easing programme is wound down from December with the effect that new purchases of government bonds may be likely to end along with the first quarter of next year.

That would leave the bank in a position to begin raising its interest rate from the second quarter of 2022, with possible consequences for other currencies that will in the interim enhance the U.S. Dollar’s sensitivity to inflation data like that which is set to be released this coming Friday.

“The bias remains for rand gains but markets have stalled this morning. Caution ahead of tomorrow’s US CPI print will weigh. USD/ZAR starts at 15.72,” warns John Cairns, a client strategist at Rand Merchant Bank.

The Rand remained only a short distance away from 2021’s lows on Thursday and could be vulnerable to U.S. Dollar strength if Friday’s data shows U.S. inflation pressures building further last month, although the bar for this to happen is set at a high level with the consumer price index having risen by more than six percent and at its fastest pace for three decades already during October.

Above: USD/ZAR and GBP/ZAR shown at weekly intervals.