South African Rand "Risks Marked Weakness" if the SARB Doesn't Hike says Investec

- Written by: Gary Howes

Image © SARB

Rand exchange rates are settling in anticipation of this week's South African Reserve Bank (SARB) decision on interest rates, with one leading economist saying a rate hike is needed to keep the currency supported.

"The rand risks marked weakness if the MPC does not hike the repo rate this week as other EM currencies pull ahead," says Annabel Bishop, Chief Economist at Investec.

Interest rates matter for the Rand: as an Emerging Market currency it tends to embed a risk premium with global investors, but if South African interest rates are high enough relative to those in other countries investors are tempted to invest.

Underpinning the country's full suite of interest rates is the SARB's basic interest rate - the REPO rate.

Raising the REPO rate lifts the yield paid on South African financial assets and boosts the country's attractiveness to international capital, creating a bid for ZAR in the process.

But, Bishop notes the U.S. Federal Reserve is already well on the way down a path to raising U.S. interest rates, which could deprive South Africa of a relative yield advantage.

"With the US having begun tapering its asset purchase programme, the rand is at risk this week, as a slow interest rate hike trajectory in South Africa compared to other key emerging market currencies’ domestic interest rate hikes would see marked rand weakness," says Bishop.

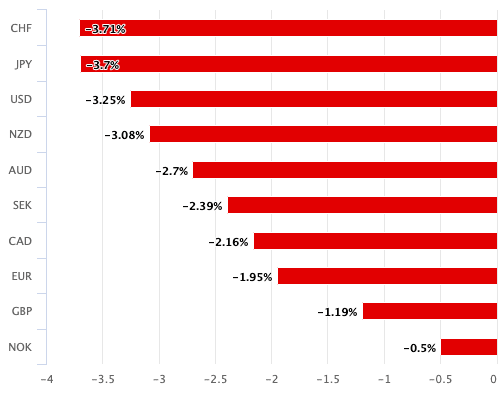

The Rand is a laggard in global FX as it has has over the course of the past month fallen in value against all the G10 majors and all of its key Emerging Market peers, apart from the highly troubled Lira:

- GBP/ZAR reference rates at publication:

Spot: 20.46 - High street bank rates (indicative band): 19.74-19.88

- Payment specialist rates (indicative band): 20.27-20.35

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

The Pound to Rand exchange rate looks to be coalescing on the 20.40 area, with daily volatility easing into the SARB decision, perhaps an indication of the weight investors are placing on the event.

The price action suggests there is little incentive to trade the Rand in either direction owing to uncertainty over the decision Governor Lesetja Kganyago and his team will take.

The Dollar to Rand exchange rate has meanwhile pulled back from recent highs to trade at 15.22 while the Euro to Rand has fallen back into its recent range and is at 17.40.

Bishop says the move lower by ZAR comes on concerns a global movement by central banks to raise interest rates is beginning, or expected to begin.

Some Emerging Markets - which South Africa competes against directly for investor attention - have already hiked their interest rates, "seeing currency gains," says Bishop.

"The rand is consequently likely to weaken quite significantly if the MPC leaves the repo rate unchanged on Thursday, with the latest Bloomberg economic consensus also showing an expected 25bp lift in the repo rate," she adds.

Investec finds the South African economy has seen a quicker than expected rebound from the harsh lockdown restrictions of last year due in large part to the revisions of the size of the economy, and inflation is quickening, "which could also tip the SARB‘s hand into delivering a rate hike on Thursday".

Investec forecasts GBP/ZAR to end 2021 at 20.48, the EUR/ZAR at 17.46 and USD/ZAR at 14.80.