South African Rand’s Resilience Puts GBP/ZAR Under Pressure

- Written by: James Skinner

- ZAR shows resilience amid pre-Fed USD rally

- Outperforms majors inc GBP, CAD, NOK et al

- GBP/ZAR slips, risks 19.33 on GBP weakness

- USD/ZAR charts suggest range-trade ahead

Image © Adobe Images

- GBP/ZAR reference rates at publication:

- Spot: 19.39

- Bank transfer rates (indicative guide): 18.62-18.76

- Transfer specialist rates (indicative): 19.12-19.16

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

The South African Rand has shown resilience thus far in the new week even with the Dollar in demand ahead of an important Federal Reserve policy decision, which has put a lid on USD/ZAR and helped to send GBP/ZAR sliding lower.

South Africa’s Rand resisted an advancing Dollar on Tuesday, leading USD/ZAR to rise by only around 0.18% even as many of the major developed world economy currencies saw greater losses.

This made the Rand a comparative outperformer early in the new week in a furtherance of the recent multi-month trend, with the South African unit edging higher against even the Canadian Dollar and Norwegian Krone.

“Some consolidation above the 13.4066 recent low is to ensue. Immediate downside pressure will be maintained while the cross stays below the four month downtrend line at 13.8333,” says Axel Rudolph, a senior technical analyst at Commerzbank, referring to USD/ZAR.

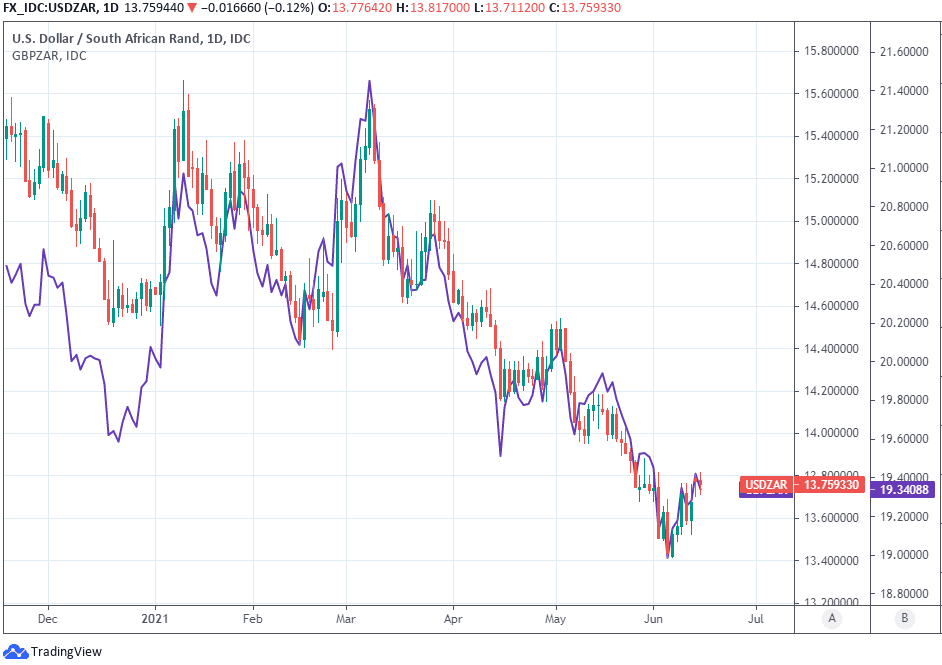

Above: South African Rand performance against major currencies on Tuesday.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“EUR/ZAR’s decline has taken it to the current June low at 16.3149 before stabilizing. Resistance now comes in along the four month resistance line at 16.7924 and between the April and May 12 lows at 16.9104/9380,” Rudolph adds.

The Rand showed almost the same resilience as the Japanese Yen, Swiss Franc and Euro, which contributed to GBP/ZAR’s soft start to the week.

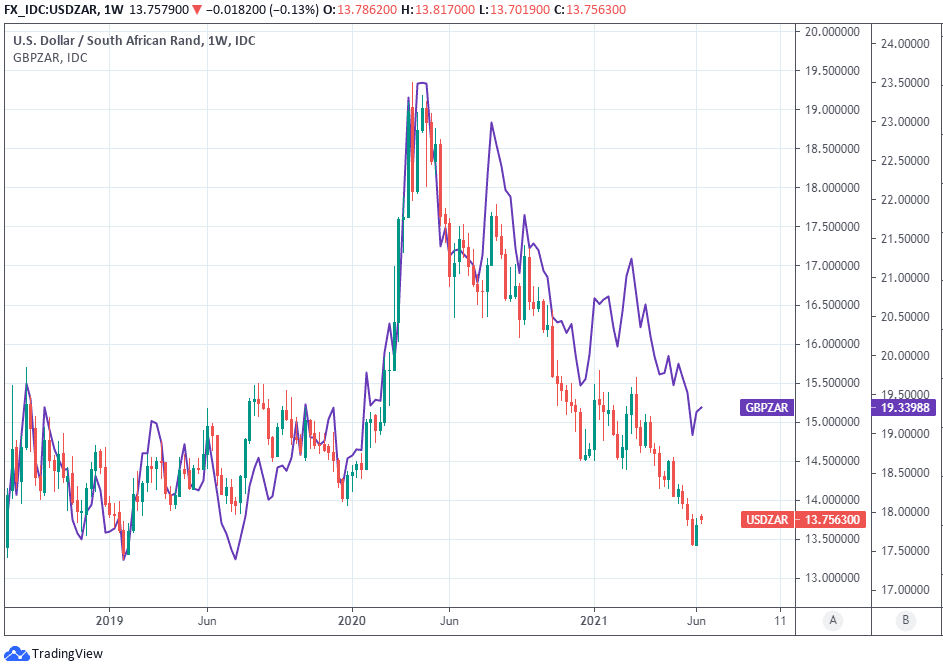

The Pound-Rand rate was -0.34% lower at 19.36 on Tuesday amid a concurrent slide in UK exchange rates, which could see GBP/ZAR falling back to 19.33 over the coming days if South African resilience endures and the main Sterling exchange rate GBP/USD continues lower.

GBP/ZAR would trade around 19.33 if GBP/USD continued to its next notable level of technical support at 1.40 and USD/ZAR edged higher to 13.80, but would fall much lower if the Rand strengthens this week rather than ceding ground to the Dollar.

Above: USD/ZAR shown at hourly intervals alongside GBP/ZAR.

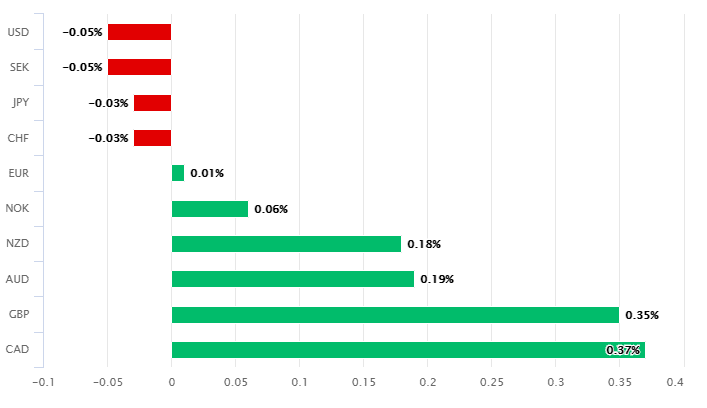

If the latest forecasts from the Goldman Sachs research team are anything to go by then the Rand could do more than simply continue to show resilience in weeks, months and quarters ahead; implying significant further downside for GBP/ZAR in the medium-term.

“As macroeconomic data have come in firm, domestic headlines around electricity regulation and air travel have also pointed towards encouraging reforms. These developments have likely played a key role in driving USD/ZAR to fresh post-pandemic lows, through our 3m and 6m forecasts of 14 and 13.75,” says Zach Pandl, co-head of global foreign exchange strategy at Goldman Sachs in a note late last week.

“Reflecting these developments, we are lowering our USD/ZAR forecasts to 13.25, 13, and 12.75 in 3, 6, and 12 months (from 14, 13.75, and 13.75 previously),” Pandl adds.

The South African Rand has all but erased the pandemic from the price charts in recent months, aided by a rally in commodity prices and economic data that has come in better than expected, with both of the latter helping to improve fundamental ‘fair value’ including by converting a long-established current account deficit into a current account surplus.

{wbamp-hide start}{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“South African Government Bonds finally gave up some of their recent gains on Monday as US Treasuries paused their rally ahead of Wednesday's FOMC,” says Michelle Wohlberg, a fixed income specialist at Rand Merchant Bank.

“Expectations are that the Fed reiterates its pace of bond purchases, but the market will be waiting for clues about a timetable for scaling back monetary stimulus,” Wohlberg adds.

For the current week however, much remains to be determined by the outcome of the looming Federal Reserve (Fed) monetary policy decision at 19:00 on Wednesday, where and when the market will listen closely for any changes to the Fed’s guidance on the future of its QE programme.

No change to either the Federal Funds rate or its $120bn quantitative easing (QE) programme is expected this month although the market will scrutinise the dot-plot of policymakers’ projections for future interest rates closely for clues as to whether higher borrowing costs and increased investor returns are likely to materialise much before the earlier indicated time of 2024.

Above: USD/ZAR shown at weekly intervals alongside GBP/ZAR.