South African Rand Slows but Emerging Market Rally Intact and Seen Enduring

- Written by: James Skinner

© Lefteris Papaulakis, Adobe Images

- GBP/ZAR spot rate at time of writing: 20.52

- Bank transfer rate (indicative guide): 19.91-20.06

- FX specialist providers (indicative guide): 20.33-20.45.

- More information on FX specialist rates here

The South African Rand slowed in its advance on major emerging and developed world rivals Thursday but remains on course to recover further previously lost ground over the coming months, as the global economy recovers while the Dollar declines and U.S. interest rates remain pinned to the floor.

South Africa's Rand was still an outperformer on Thursday, with only the Turkish Lira having gotten the better of the currency, but with stock markets softening in Europe and North American gains for emerging market currencies in general were less than those seen earlier in the week.

"The broader picture, however, is that the environment for EM currencies appears to be brightening," says Jonas Goltermann at Capital Economics. "We think that the global economy is at the beginning of a recovery cycle and that demand for commodities will pick up. In our view, monetary policy in the US will remain accommodative for some time, and the risks around US trade policy have diminished."

U.S. stocks slipped at the North American open, following European counterparts in a pullback from recent highs with little by way of a catalyst except for profit-taking in wake of earlier explosive gains that saw some European benchmarks rise by high single digit percentages for the week.

Despite tamer price action, the Rand remained the best performing major emerging market currency for the last month and is widely tipped to advance further in the months ahead due to a range of international factors, but also the sheer scale of its earlier losses.

Above: USD/ZAR shown at daily intervals alongside Pound-to-Rand rate (black line, left axis).

"Taken alongside virus concerns, signs of overheating equity markets have dampened risk sentiment. To be clear, investors are deterred, not defeated. Equities are still in vogue as fixed income securities offer little to no return," says Nema Ramkhelawan-Bhana, head of research at Rand Merchant Bank. "The rand’s divergence from its peer grouping is still apparent, highlighting the potential of the spot unit to overshoot index moves in either direction."

The outcome of the U.S. election and this week's announcement from Pfiizer suggesting it's coronavirus vaccine candidate offers a high degree of protection from the disease have been gamechangers for the global economic outlook, but especially for growth prospects in emerging markets.

An equitable distribution of a vaccine could enablemore countries to reopen borders, facilitating a recovery of global tourism and a return to more normal levels of interaction and economic activity.

"A comprehensive vaccination program will take many months, supporting our view that a permanent and substantive removal of pandemic restrictions globally will only begin in mid-2021," says Ben May at Oxford Economics.

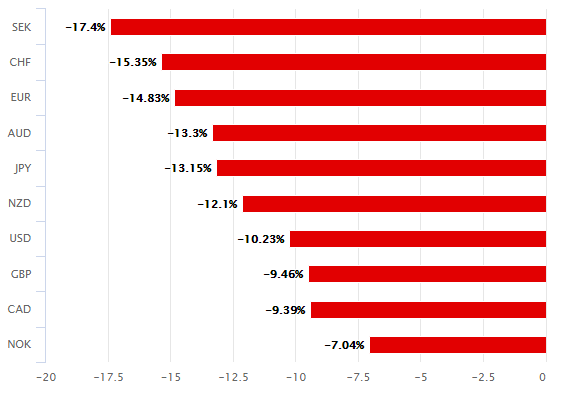

Above: Rand performance against major currencies in month (20 trading days) to Thursday. Source: Pound Sterling Live.

Meanwhile, a likely Democratic Party-led White House in the U.S. potentially means tensions between the world's two largest economies will be less than under the leadership of incumbent President Donald Trump and with China making South Africa's largest export market, the currently-contested election result is a boon for the Rand.

In addition, Federal Reserve (Fed) monetary policy has pushed U.S. government borrowing costs to new lows and with it, eased the burden of financing costs for many emerging markets while also making riskier assets like stocks more attractive to investors. Stocks in higher yielding emerging markets have been no exception.

Demand for higher yielding bonds and stocks is expected to be an important factor driving returns for emerging market currencies in the months and even years ahead, although the Rand's earlier underperformance leaves it ideally positioned to lead the pack in any continued recovery.

"EM currencies, especially those in EMEA and Latin America, have fallen a long way over the past few years. While we doubt that commodity-dependent currencies will recover all that ground, as we do not expect commodity prices to regain their 2014 levels soon, we think that there is ample scope for many EM currencies to rally further over the next year or two," Goltermann says.

Before 2020 many emerging market currencies had been weighed down by damage done to China's economy by U.S. trade policy as well as the burden of rising interest rates at the Fed, which impact on financing costs for emerging markets as well as the appeal of their currencies to investors.

Above: Rand performance against major currencies in 2020 to Thursday. Source: Pound Sterling Live.

But with the extraordinary fiscal costs of the pandemic, not to mention damage done by containment efforts expected to keep the Fed's interest rate pinned to the floor at least for the next two years, emerging market currencies could have scope to recover more of their earlier losses over the coming years.

Risks remain however, not least of all in the final stages of the vaccine development, manufacturing and distribution processes, but also in disputes over the U.S. election. President Donald Trump has refused to concede day and is contesting the results of several key swing states where he alleges that declared outcomes were swayed by fraudulent or otherwise illegal votes.

It remains to be seen if the incumbent can prove his case in the courts, although Trump's personal lawyer Rudy Giuliani claimed this week that he has evidence of foul play in Pennsylvania and Michigan, insisting that his client still has an albeit narrow "path to victory".

"Moreover, there will be a run-off between Democrats and Republicans for two Georgia seats in the Senate on 5 January. If the Democrats win both seats, Democrats and Republicans will hold the same number of seats. In such a situation the vote of the Vice-President will decide. This would essentially give Democrats a majority in the Senate," says Georgette Boele, a senior FX strategist at ABN Amro. "Currency markets have shrugged off this uncertainty so far. The conviction is high that the presidential election result will not change. But if the situation remains politically tense for long, investors could become risk averse. It is likely that they will then close part of their open positions; sell the euro and buy the dollar. We think that such a move would be temporary."

Above: USD/ZAR shown at weekly intervals alongside Pound-to-Rand rate (black line, left axis).