South African Rand Seen Rising Further by Month-end but Thursday's SARB Decision a Banana Skin

- Written by: James Skinner

Image © Adobe Images

- GBP/ZAR spot rate at time of writing: 21.21

- Bank transfer rate (indicative guide): 20.88-21.03

- FX specialist providers (indicative guide): 21.32-21.45

- More information on FX specialist rates here

The Rand charged higher alongside the Chinese Yuan and stock markets Tuesday but may rise further before month-end, according to research from Investec, although Thursday's South African Reserve Bank (SARB) interest rate decision is a risk that could scupper the outperforming currency.

Rand gains built with domestic anticipation of a further significant relaxation of restrictions on acitivity in which national borders could reopen and an evening curfew be abandoned after new coronavirus infections fell to some of their lowest levels since early May and held their consistently so far in September.

Emerging market currencies were soft even though international stock markets recovered further from recent losses, the Dollar fell and China’s Yuan extended a months-long rally that seemed to provide a tailwind to only some Asian currencies while not knocking the Rand off course.

Chinese industrial production and retail sales numbers released overnight Tuesday were stronger than was expected, with retail sales having risen 0.5% in August, the first increase of 2020. Sales had continued to fall even after the country moved on from its own coronavirus epidemic, the end of which was overshadowed by the infection's spread elsewhere in the world.

"What China’s intentions are here in taking its currency so much stronger versus the greenback are tough to discern, but its commodity buying binge means that it’s paying less in CNY terms for its purchases and some tout that China is taking a tighter approach to stimulus than elsewhere to avoid bubbles in domestic asset markets," says John Hardy, head of FX strategy at Saxo Bank.

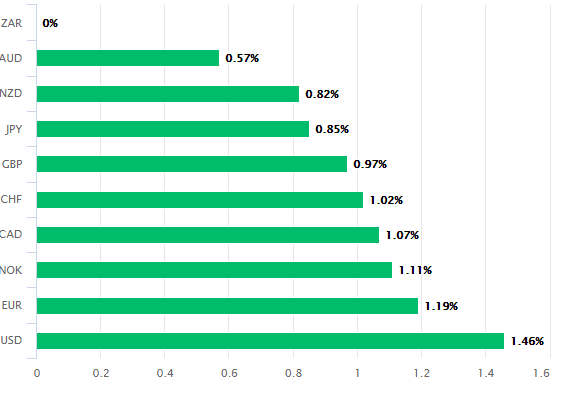

Above: South African Rand performance against major currencies on Tuesday. Source: Pound Sterling Live.

Strength in the Yuan came at the expense of the Dollar, which was lower against most major rivals on Tuesday in moves that some also attributed to repositioning ahead of the Federal Reserve policy decision due on Wednesday, the first since Chairman Jerome Powell said at Jackson Hole that the bank will shift to a so-called average-inflation-targeting regime where it keeps interest rates pinned to the floor for a period of time after inflation has risen above the 2% target.

“The interest rate decisions due from the Federal Reserve, BoE and SARB take the spotlight this week, with markets clearly preparing for further stimulus, at least from the Fed. The abundant liquidity resulting from accommodative policy is supportive of emerging markets, even though the underlying fundamentals of these risk-driven markets might be questionable,” says Bianca Botes, an executive director at Peregrine Treasury Solutions.

Rand gains may also have been bolstered by risk appetite that has stabilised this week after pharmaceutical companies pipped President Donald Trump to the post when stepping into an earlier sell-off with updates on progress toward a coronavirus vaccine and speculation about how soon one could be ready. President Trump later claimed in an interview with Fox News the U.S. will have a vaccine “within weeks,” which is something that could significantly bolster American recovery prospects if true.

“The rand has strengthened to R16.61/USD today, but with a potential interest rate cut of 25bp this week the domestic currency may battle to make substantial further gains beyond R16.61/USD, although positive sentiment in a move to level 1 this week could counter some currency weakness,” says Annabel Bishop, chief economist at Investec. “The rand continues to remain well above R16.50/USD this quarter, but could reach this level by the end of the month.”

South African gains and U.S. Dollar weakness have weighed heavily on USD/ZAR, dragging it nearly five percent lower in the last month and to its lowest level since late march, although Investec forecasts suggest it could rise further still in the next fortnight.

"The USDZAR break lower here is quite clear in tactical terms, as a clear line of support developed recently above 16.50 and the 200-day moving average is a major indicator. Some support for ZAR recently coming from platinum prices, as the country is the world’s top platinum producer. Looking back a bit further, ZAR bulls will appreciate if the next layer of post-COVID-19 wipeout range lows into 16.34, the low from July, is also taken out," says Saxo's Hardy.

Above: USD/ZAR shown at daily intervals with 200-day moving-average.

Investec’s official forecast is for USD/ZAR to end September at 17.0 before strengthening to 16.50 by year-end, and a Pound-to-Rand rate that falls to 21.70 before 20.44 respectively, although it's warned that a USD/ZAR of 16.0 could be realised before month-end if the Dollar remains on its back foot. Saxo's Hardy has flagged USD/ZAR crossing below its 200-day average as a bullish sign that doesn't challenge expectations of an extended fall.

But the bank has also flagged Thursday’s SARB decision as a possible banana skin. The SARB is expected to leave the cash rate unchanged at 3.5% Thursday at 13:00, although Investec says a surprise rate cut cannot be ruled out and that this would undermine the South African currency.

“A small, 25bp cut in the repo rate in itself will not alleviate any of the economic impact of the lockdown on GDP to a noticeable effect, but would provide some further, small relief to the indebted, although a much less severe lockdown would have been more helpful," Bishop says. “An interest rate cut would further erode the differential between SA and US interest rates, reduce the impetus somewhat for the carry trade, and so also appetite for SA bonds would be encroached on. Yields on SA government bonds have already ticked up somewhat since July, pulled higher by a slight weakening in demand, with the R2030 at 9.34%, up from closer to 9.15% in July, as investors remain concerned about the future solvency of the state."

The SARB has cut its cash rate by nearly half this year and intervened directly in the government bond market to keep the treasury funded in its hour greatest need, which was also a period of market dysfunction that saw many countries caught in the arms of their own respective central banks.

But rates have fallen amid a -51% collapse in GDP and increase in perceived credit risk, which has already undermining demand for South African government bonds. Still, not everybody has been deterred from the currency.

“Foreign investors' share of the government local currency bond market has declined from 37% in February to 30% in July. This is the lowest level since 2012. As the health situation improves, and on the back of the supporting factors mentioned above, part of these flows could return. In our view, even if the path is volatile, the ZAR could appreciate to 16.0 by year-end,” says Sebastien Barbe, head of emerging market research at Credit Agricole CIB. “ ZAR could appreciate in the coming months, benefiting from (1) its singularly high carry; (2) metal prices; (3) external assistance provided to its external liquidity profile; and (4) the currency level, particularly if President Cyril Ramaphosa’s growing grip on the ANC is confirmed in a way that leads to the intensification of reforms.”

Above: Pound-to-Rand rate shown at daily intervals.