USD/JPY Back in the Buy-Zone say T.W.P.

- USD/JPY back in buy-zone as it consolidates following latest rally

- Pair continues to show bullish potential

- Though gains likely to be capped in 110s by 200-day moving average

© moonrise, Adobe Stock

The USD/JPY is said to be back in the 'buy-zone' by analysts, after negative data out of Japan and changes made by the Bank of Japan (BOJ) to their forward guidance applied further pressure on the struggling Yen.

The four-hour chart of the USD/JPY pair is indicating that the exchange rate has pulled back into the space between the 10 and 20 moving averages, commonly known as the 'buy-zone' by trading experts Trade With Precision (TWP) as it presents traders with an optimum level at which to join the uptrend

"USDJPY is also in a strong long trend and after breaking through 108.500, looks set for a potential test of the 110.000 area," say TWP in a recent analysis.

"The mid-time frames are looking particularly nice with clean optimal trend structure and geometry. On the 4-hour chart price has recently retraced back the buy zone and is currently forming a bullish candle. We are looking for long opportunities as long as the trend stays intact," they add.

The call came after last Thursday night's Japanese 'data dump' revealed cracks in the economy and dampened the outlook for the Yen.

The April meeting of the BoJ meanwhile saw the governing council decide to remove a key sentence from their policy guidance. The deleted sentence contained a specific target date for the economy achieving the Bank's 2.0% inflation target in "fiscal 2019".

It was removed for reasons of communication, according to governor Kuroda, rather than because it was not achievable. By setting a concrete data it implied "immediate policy change, which is not the case" according to Kuroda, and that "the focus on the timeframe was not good for communication."

Yet shrewd observers were more sceptical, seeing the removal of a commitment to a specific date in the future as an admission of failure.

"Even as the BoJ believes that CPI inflation “is likely to continue on an uptrend and increase toward 2 percent, mainly on the back of an improvement in the output gap and a rise in medium-to-long-term inflation expectations”, the central bank removed the timeline to achieve the 2% inflation target (which was previously “likely be around fiscal 2019”).

"Importantly, BoJ Governor Kuroda sees larger downside risks on prices than upside risks," says Alvin Liew, Senior Economist at UOB.

The implications are negative for the Yen because continued low inflation means interest rates will remain lower for longer, which are positively correlated to the exchange rate.

Higher interest rates support a currency by drawing greater inflows of foreign capital seeking a lucrative place to park, and vice versa for lower rates; thus the admission rates might remain low was negative for the Yen.

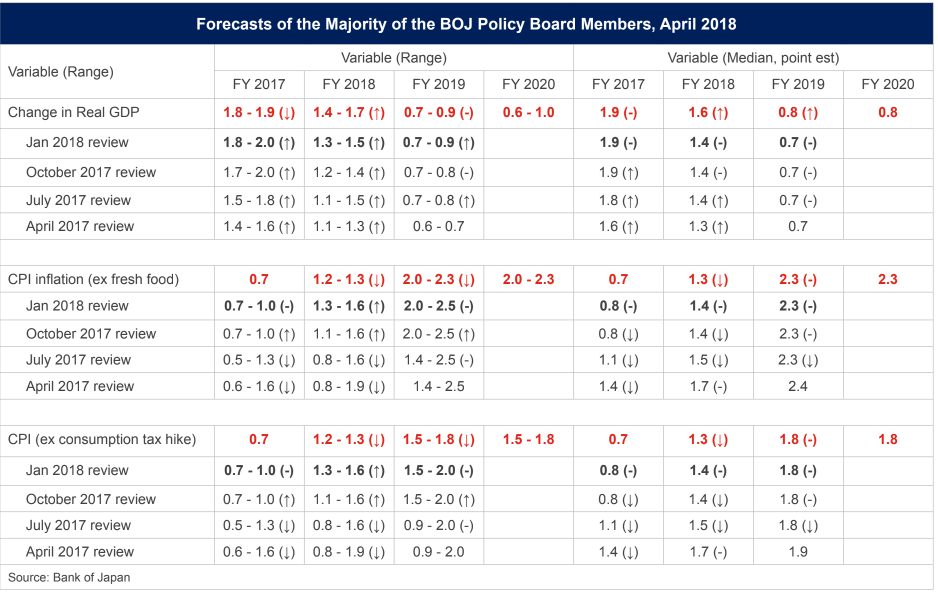

The change to the BoJ's language was not the only alteration, the Bank also lowered their inflation forecasts in 2018 from a 1.3-1.6% band down to a 1.2-1.3% band and from a 2.0-2.5% to 2.0 to 2.3% band in 2019.

"Thus, we do see indication that BoJ is less upbeat about the price outlook, at least from the forecast table," says Liew.

Other data released towards the end of the previous week was not particularly positive either.

The Tokyo inflation gauge came out well below expected at 0.5% in April when analysts had forecast 0.8% from 1.0% in March, although Freya Beamish chief Asia economist at Pantheon Macroeconomics makes the point that Tokyo inflation is quite volatile and often undershoots broader inflation.

"The Tokyo gauge often diverges from the national gauge on the downside, generally due to food prices, so the national headline won’t fall by as much," says Beamish.

On the labour front, the Job-to-applicant ratio edged up to 1.59 from 1.58 and the unemployment rate stayed at 2.5% - which whilst low - suggested a plateauing after the recent steeper fall from 2.7% in January. Although a rise in part-time workers to the detriment of agency temps was seen as positive for wage growth, full-time employment remained worryingly subdued.

Retail Sales in April produced another data miss after printing -0.7% drop in March, which was well below the consensus estimate of 0.0% from a positive result in February.

Finally, the one positive release was industrial production, which rose 1.2% month-on-month (mom) in March, after a 2.0% increase in February, and above the consensus 0.5%.

The quarterly data was not so good but in line with expectations. Industrial production fell 1.4% quarter-on-quarter in Q1, after the 1.6% jump in Q4. A decline was to be expected, however, after "temporary factors boosted growth at the end of last year," says Beamish.

Our own outlook for the Yen remains short-term negative. We stick with our view that USD/JPY will continue rising after forming a high probability pattern on the daily chart at the end of last week. This combined with the TWP buy call strongly suggests an upside bias. The 200-day moving average situated at 110.25, however, is likely to act as an obstacle to further gains.

Large moving averages often stall or even reverse trends as they are popular indicators, used by private and institutional investors alike. They are therefore subject to much higher levels of buying and selling around their vicinity which can lead to volatile changes in price direction.

For the uptrend to extend above the 200-day we would ideally wish to see a clear break above, confirmed by a move above 111.00.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.