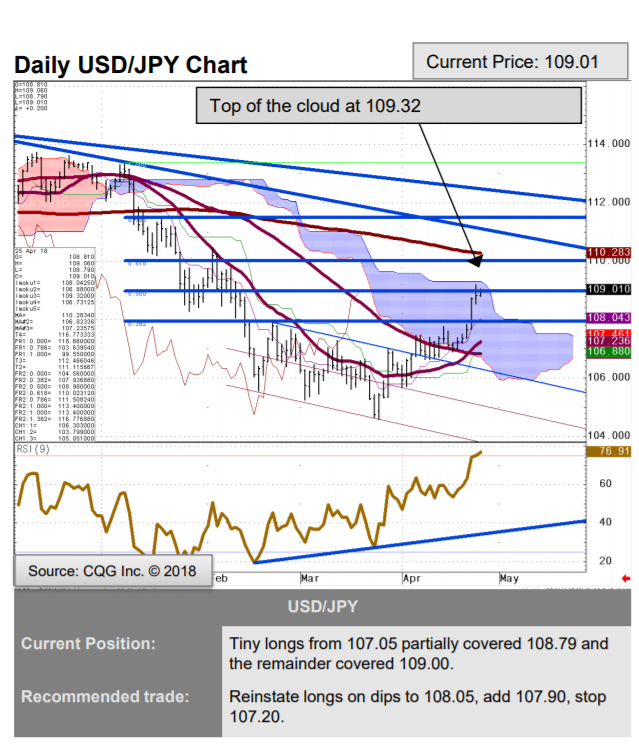

USD/JPY Could Break Through Cloud as BOJ Meeting Provides Catalyst For Yen Weakness

- USD/JPY is giving off bullish signals despite overhead chart resistance

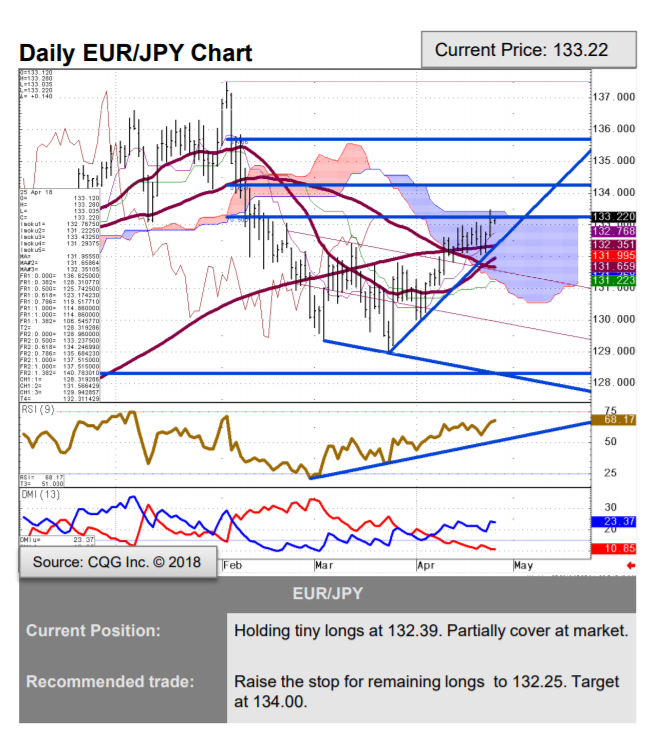

- EUR/JPY has reached the top of the Ichomoku cloud; GBP/JPY is already above

- BOJ rate meeting could be catalyst for more Yen weakness

© Kasto, Adobe Images

The Dollar-Yen pair may be subject to further upside despite tough resistance directly above the spot price.

USD/JPY may ignore the tough 'glass-ceiling' right above its current spot price and break higher, according to Karen Jones, a technical analyst at Commerzbank.

The pair has reached a critical inflection point.

"USD/JPY has reached the 50% retracement at 108.98 and directly above here lies the top of the cloud at 109.32," says Jones.

The 50% retracement and the top of the 'Ichimoku' cloud - a traditional method of Japanese chart analysis - are strong barriers to further upside progress, yet despite these there is still a strong probability the exchange rate will simply continue trending right through them.

Jones sees a higher-than-usual chance of continuation higher and although the levels "may hold the initial test/provoke some consolidation... beyond this there is scope for the 200-day ma at 110.28."

Our own technical analysis further supports the probability of an extension higher, especially if today's price action ends on a fairly bullish note.

The pair has formed a three-bar continuation pattern on the daily chart and combined with a rising ADX indicator value of 24.6 (circled) this strongly favours an extension higher, probably to as high as the 200-day MA at 110.25, as noted by Commerzbank's Jones above.

The only condition for the continuation pattern to remain valid would be a relatively bullish close today (Wednesday) defined as a close at or above 109.03 (current level 109.22).

The bullish view is held despite the EUR/JPY daily chart also showing the pair having met the same glass-ceiling level at the top of the Ichimoku cloud.

The fact both EUR/JPY and USD/JPY have reached the top of the cloud would normally reinforce the bearish potential for a reversal at the level.

GBP/JPY appears to be an anomaly in that it has not reached the top of the Ichimoku cloud (see chart below), unlike EUR/JPY and USD/JPY.

One potential catalyst for Yen weakness on the horizon is the meeting of the Bank of Japan (BOJ) on Friday, April 27.

Recent still-low inflation readings in Japan appear to suggest the central bank will probably keep its monetary policy expansive, and this is likely to have a negative impact on the Yen.

An expansive monetary policy usually means lower interest rates and, in the case of Japan, continued use of quantitative easing (QE) to keep borrowing costs down. Both are negative for the currency as they reduce foreign investment inflows which tends to prefer jurisdictions offering higher - not lower - interest rates, all other things being equal.

In a preview of the meeting, Bjørn Tangaa Sillemann, an analyst at Danske Bank says he does not expect the BOJ meeting to end in a vote for a change of policy in either direction.

The new deputy Wakatabe is seen as "super dovish" but Danske does not expect this to influence the board to change policy which would require a majority vote.

Rather, he sees a chance that, along with another dove Kataoka, the two together will "pull board consensus slightly more dovish."

Growth in Japan has been driven more by exports than domestic demand which remains anemic, but the stronger Yen is likely to have limited export growth too more recently.

"Growth is primarily driven by foreign demand whereas private consumption is still looking weak. As growth in Japan’s most important export markets is becoming slightly more subdued and exporters now have to deal with a stronger JPY, we expect the economic upswing to lose some momentum," says Sillemann, who also notes a worsening in Q1 data.

"Currently we consider the probability of further easing to be at least as high as the probability of tightening, but we do not see any changes to policies within a one-year horizon," says Danske's Sillemann.

"We expect USD/JPY to continue to trade mostly sideways within 105-110 in the near term, targeting 108 in 3M. In our view, it would require a substantial dovish shift in the Bank of Japan's rhetoric for USD/JPY to settle above 110," concludes the analyst.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.