Japanese Yen: Much More Downside in CHF/JPY than USD/JPY

- Written by: James Skinner

- JPY outperforming with rally off multi-decade low

- But drivers of JPY’s depreciation remain in place

- Risk of official interventions in USD/JPY is rising

- USD/JPY action may be felt acutely by CHF/JPY

Image © Leonid Andronov, Adobe Stock

The Japanese Yen outperformed other major currencies during the midweek session but the risk of official intervention to curb any fresh or future losses remained elevated and in any such scenario there would likely be much more downside seen in the CHF/JPY rate than in the USD/JPY pair.

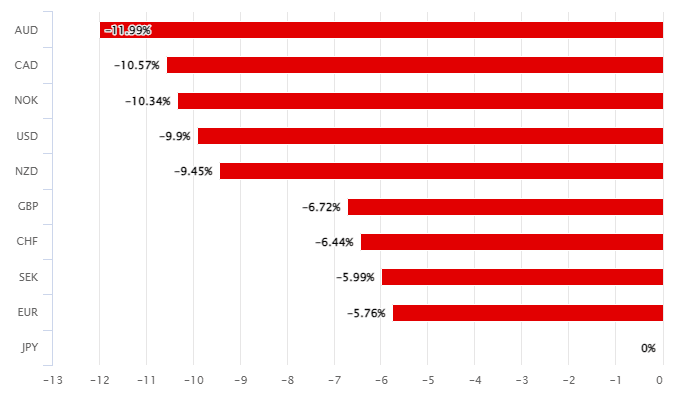

Japan’s Yen remained the standout underperformer among G20 currencies for 2022 on Wednesday having fallen further than even the Russian Rouble and Turkish Lira, although it was the outperformer by a long shot on an intraday basis Wednesday.

Price action came alongside widespread declines in Dollar exchange rates, strong gains for stock markets across the board and an uplift in commodity prices including those of crude oil, while following in the wake of further expressions of concern by the Finance Ministry about recent Yen losses.

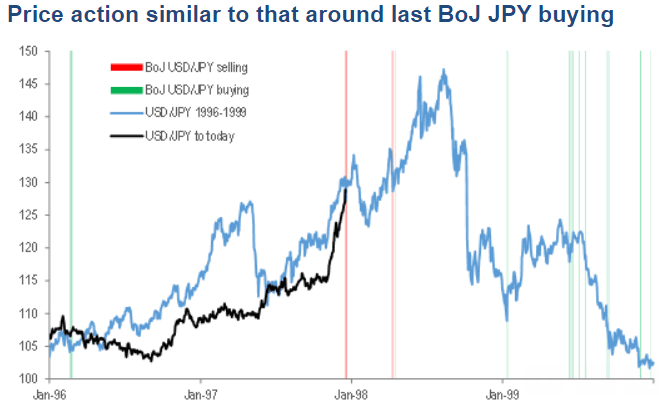

“If market participants become more confident that the Fed will need to raise rates to 3.00% and well beyond to regain control of inflation it will increase the possibility of USD/JPY retesting the highs from back in 2002 when it hit a high of 135.15 and then from 1998 when it hit a high of 147.66,” warns Derek Halpenny, head of research, global markets and international securities at MUFG.

Above: Japanese Yen’s 2022 performance relative to G20 counterparts. Source: Pound Sterling Live. Click each image for closer inspection.

While the Yen was the outperformer on Wednesday, all of the factors thought to be driving its double-digit percentage losses against other currencies remained in place and could yet exert further pressure on Japanese exchange rates in the days and weeks ahead.

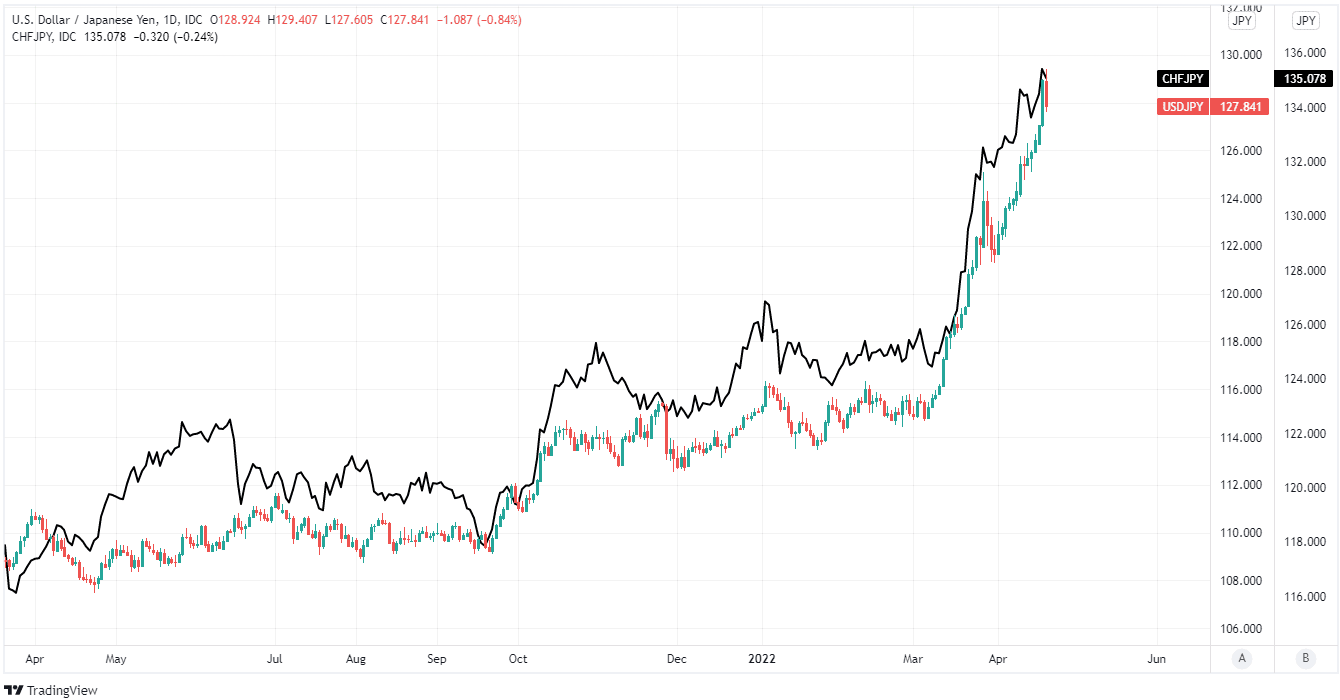

“Both the pace of JPY depreciation and the level of spot USD/JPY are very close to where they were at that time so it would not be unprecedented for the BoJ/MoF to move on from verbal to physical intervention,” says Adam Cole, chief FX strategist at RBC Capital Markets.

“The MoF/BoJ have not fully utilized their verbal intervention toolkits yet – the next phase would typically involve describing moves as “speculative” and threatening to “take decisive action,” Cole also said on Wednesday.

Yen selling and the factors behind prompted the Bank of Japan (BoJ) to announce on Wednesday a series of market operations to enforce the 0.25% upper limit for the 10-year government bond yield.

Source: RBC Capital Markets. Click image for closer inspection.

Source: RBC Capital Markets. Click image for closer inspection.

An effective upper limit on the above referenced bond yield is an important mechanism for transmitting the BoJ’s overall monetary policy to the economy but is also a source of the Japanese Yen’s losses.

“The widening policy divergence between the BoJ and the Fed that has been weighing heavily on the yen was again evident overnight,” MUFG’s Halpenny says in a Wednesday research briefing.

Deputy chief cabinet secretary Yoshihiko Isozaki was - according to MUFG - the latest in a lengthening line of officials to voice concern about the Yen on Wednesday and this growing list has made analysts increasingly mindful that there is a rising risk of official intervention to support the currency.

“Would it work in stopping JPY depreciation? Intervention could restore some short-term balance to markets and manage the pace of JPY depreciation. Longer-term, there is no prospect of the BoJ mopping up all of the JPY selling we anticipate from within Japan as the Fed hiking cycle gets properly underway,” says RBC Capital Markets’ Cole.

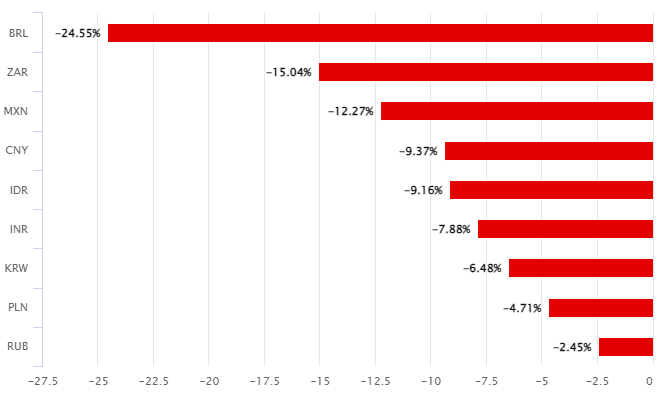

Above: USD/JPY shown at daily intervals alongside CHF/JPY. Click each image for closer inspection.

Japan has the world’s second largest chest of official foreign exchange reserves, second only to China, which were valued around $1.36 trillion at the end of March 2022, according to Ministry of Finance data.

These are a formidable tool for managing the depreciation pressure on the Japanese Yen through interventions in the international market but these would likely be aimed at the USD/JPY rate, which has been the main driver of the overall and all-round depreciation of the currency.

However, if those reserves are in any way sufficient for lifting the Yen against the Dollar, and they would be in at least the short-term, they would also be enough to buy the JPY/CHF rate a window seat on a parabolic flight to the moon.

That would be especially likely if official actions or rhetoric was to lead USD/JPY to fall at a point when the Swiss Franc is also falling against the Dollar and both of these are possible - if not likely outcomes - in any market where the U.S. Dollar has pushed Japanese government officials to intervene.

This is because JPY/CHF and CHF/JPY are both highly sensitive, in a very mechanical way, to the relative performances of both USD/JPY and USD/CHF.

But it's also because Swiss National Bank policy is in many ways comparable to the BoJ's, and the SNB is actually looking to weaken the Franc.

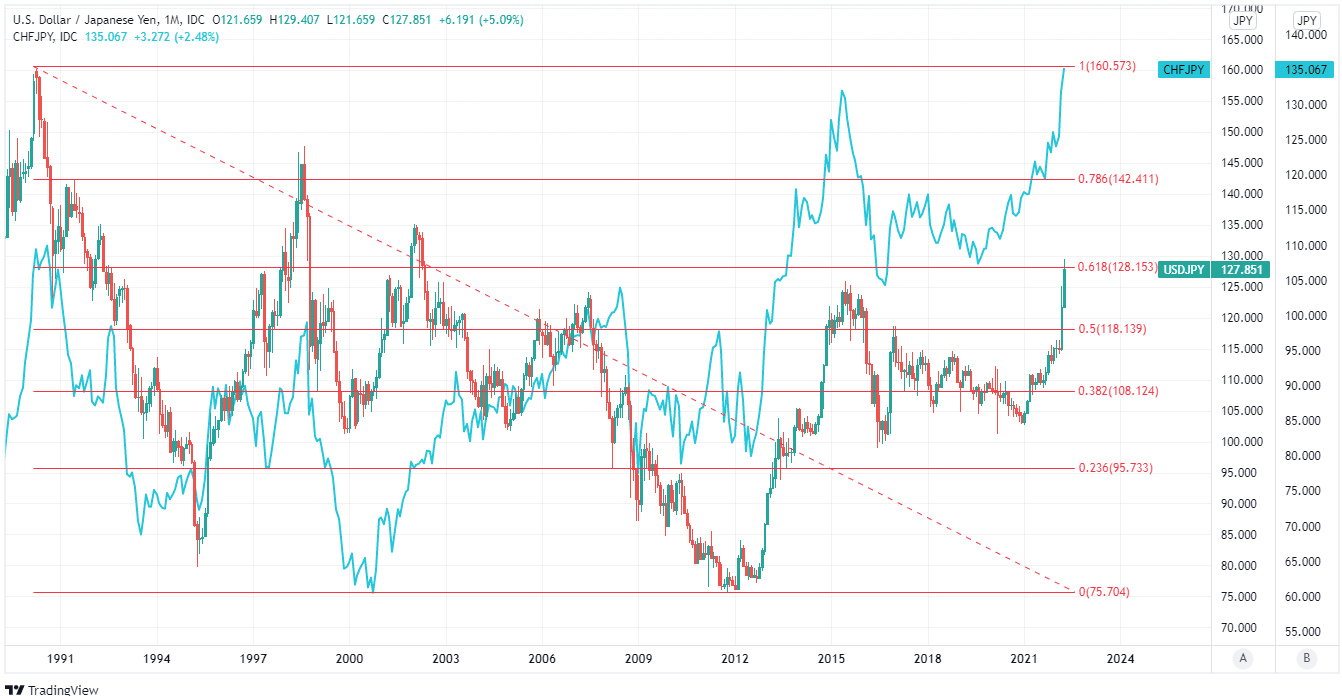

Above: USD/JPY shown at monthly intervals with Fibonacci retracements of 1991 downtrend indicating long-term areas of technical resistance for the Dollar and shown alongside CHF/JPY. Click each image for closer inspection.

Above: USD/JPY shown at monthly intervals with Fibonacci retracements of 1991 downtrend indicating long-term areas of technical resistance for the Dollar and shown alongside CHF/JPY. Click each image for closer inspection.