Further CNY Weakness Could Send USD/CNY Above 7.00

Image © 孤飞的鹤, Adobe Stock

- USD/CNY keeps rising despite lower fix

- Monetary policy divergence favours USD over CNY

- Low hedging costs and option market gauges suggest further upside for pair

The Yuan continued its downtrend on Thursday despite the Peoples Bank of China (Pboc) ostensible attempts to support it using their daily 'fix'.

The Yuan is not a completely free-float currency as the Pboc fixes its rate at the start of each day at a level called the 'midpoint' around which it can only fluctuate by +/-2% for the rest of the day.

On Thursday the Pboc fixed the USD/CNY exchange rate lower at 6.766 compared to the previous day when it fixed the USD/CNY at a higher rate of 6.804. This represented an attempt to fix the Yuan higher against the US Dollar.

The move was the first time the Pboc lowered its fix for the pair in three weeks, during which time it consistently set its fix higher in conjunction with the market which kept bidding the pair up as the US Dollar appreciation vs the Yuan on differing central bank outlooks.

Yet despite the unusually lower fix on Thursday, USD/CNY drifted higher anyway as bullish traders continued to bet on the Dollar rising.

"China's Yuan eased against the U.S. Dollar on Thursday despite a firmer official midpoint, reflecting unflagging expectations of continued depreciation in the currency which has been heavily sold in recent months on worries about the economic outlook," says Winni Zhou and John Ruwitc, correspondents for Thomson Reuters.

A contributing factor to the rise may have been further reports of the Pboc easing monetary policy - actions which would be expected to depreciate the Yuan.

In another report from Reuters it was stated that the Pboc was relaxing capital requirements from banks in order to encourage more lending to businesses. Capital requirements are minimum levels of capital a bank must have before it can lend.

The trend is not likely to end anytime soon shows analysis from Singapore-based Asian lender UOB.

UOB note the US Federal Reserve is on a path to lifting interest rates and tightening monetary conditions as the economy continues growing, which should support USD; whilst the the Pboc is expected to continue loosening policy to encourage more borrowing as the economy slows down and to make exports more competitively priced should the trade war with the US intensify.

Further reasons are to do with broadly lower export growth from Asia and the Asian FX index, which is expected to drift lower in line with a "weaker yield spread".

Technical considerations have also biased OUB to forecasting a weaker Yuan (higher USD/CNY).

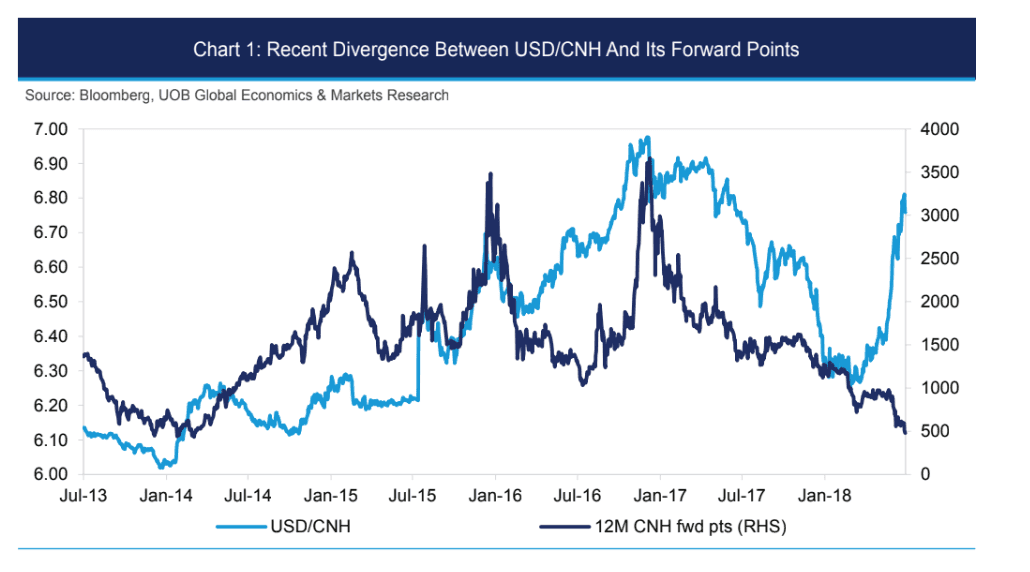

These include the low cost of hedging any further upside in USD/CNY using forwards.

Forwards are priced in basis points, and the cost of forwards versus the spot rate is shown on the chart below which highlights how they are diverging. This is unusual as it actually means the cost of hedging against more upside is falling.

This will probably result in more hedging, which involves investors in buying the Dollar to hedge against their long Yuan. Therefore, more hedging will actually probably add fuel to the already steep uptrend.

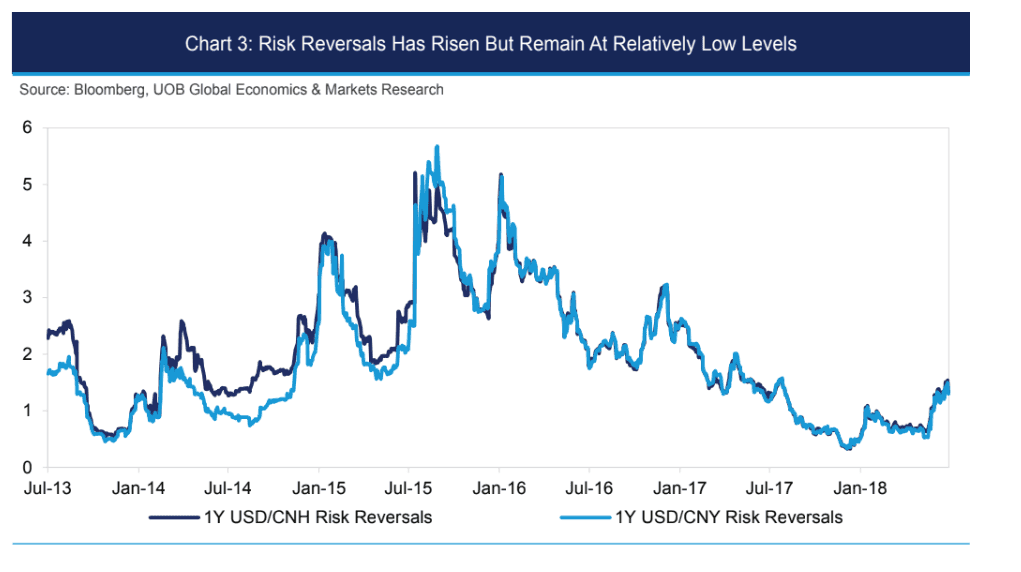

The rising cost of what are called 'risk reversals' - complex option hedges which involve simultaneously buy an option and writing an option contract in the opposite direction, also suggests more upside for USD/CNY.

"A positive risk reversal means the volatility of calls is greater than the volatility of similar puts, which implies more market participants are betting on a rise in the currency than on a drop, and vice versa if the risk reversal is negative," explain Investopedia on the subject of rising risk reversals.

"Rising risk reversals suggest an increasing preference for further USD/CNY’s upside, but it remains at relatively low levels when compared to the past five years," says Peter Chia, an analyst at OUB.

A sizeable proportion of options traders are also betting on the pair actually going above the 7.00 handle according to recent option's exchange data.

"Recent DTCC data (week starting 16-Jul) showed a marked increase in USD/CNY options volume for strikes above 7.00 just as spot broke above 6.70," adds Chia.

The main reason for the bullish forecast, however, comes from the divergences in central bank monetary policy between the two countries, with US policy suggesting further tightening which is good for the Dollar and Chinese policy, as well as trade war strategy, recommending loosening, which is negative for CNY.

"Overall, looser monetary conditions are likely to bias towards a weaker CNY. As such, we forecast USD/CNY rising further to 6.95 by end of this year and 7.10 by mid-2019," concludes Chia.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here