Pound-to-Dollar Rate's Forecast for Week Ahead

© kasto, Adobe Stock

The Pound is expected to rise versus Dollar as corrective sequence now probably at an end while US payrolls could be the highlight of the week from a data perspective.

The GBP/USD pair has probably finished its pull-back and may be ready to rebound in the week ahead.

The exchange rate has been in corrective mode ever since rolling over after the January 25 peak of 1.4346 which then saw it fall to a low of 1.3712 established last Thursday.

We now expect the exchange rate to start recovering and probably eventually reach back up to the 1.4346 highs again, possibly even surpassing them.

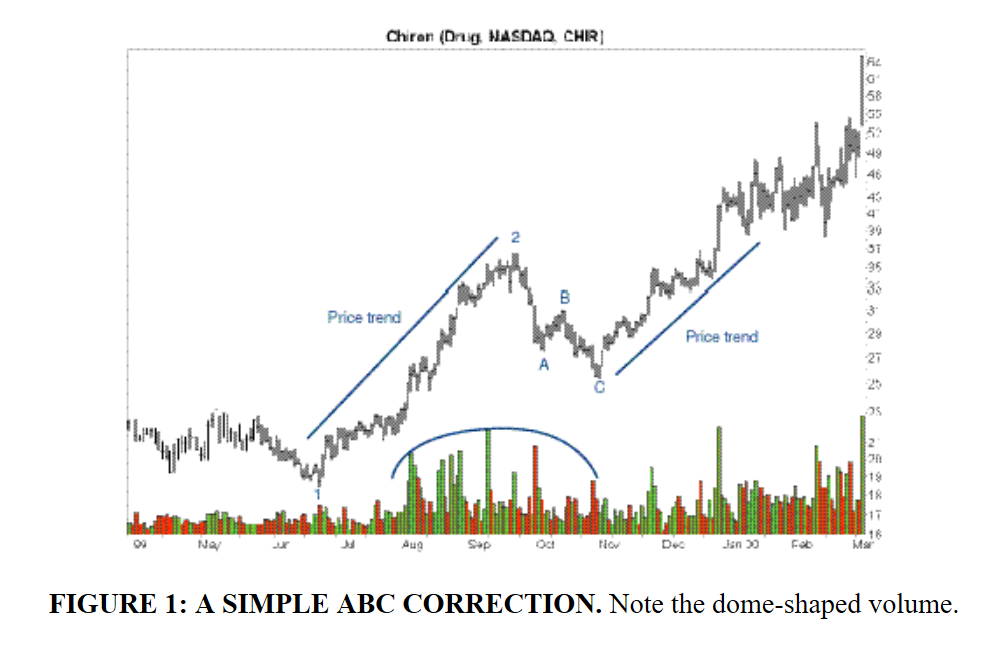

The correction has taken the form of a classic three wave ABC correction as can be seen labeled on the chart below.

These are quite common corrective patterns and the main trend usually resumes after they have completed.

Take a look at a similar ABC pattern on the stock chart below, identified by pattern expert Thomas Bulkowski, not only does it look strikingly similar to the one currently on GBP/USD but also note how the market moves substantially higher afterward.

Whilst I wouldn't go as far as forecasting a move above the January 25 highs a retouch is quite probable.

The dome-shaped volume described by Bulkowski as a key defining criteria of the pattern is also on GBP/USD if we analyse trading volume on the chart - or at least it is sort of dome-shaped. The main thing, however, is the fact that like Bulkowski's chart the volume peaks at the start of the correction and then steadily declines.

Personally, I think it's a good enough match to pass the test.

The high chance that we have correctly identified an ABC correction obviously lends the chart a bullish timbre, but those seeking more cast-iron confirmation should look for a break above the trendline for the ABC correction, which would be confirmed by a move above the 1.40ish mark.

Such a move would then see a high chance of continuation higher to a target at the 1.4346 level.

An Elliot wave analysis of the chart also seems to suggest a bullish outlook.

Such an analysis would explain the current ABC correction as a wave 4 with 5 about to start.

Wave 5 should take the trend back up to at least the 1.4346 highs of the wave 3 peak.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

US labour market data will be the key focus for markets in the week ahead, with Non-Farm Payrolls data out on Friday at 13.30 GMT and wage data at the same time.

Wage data may be more important for the Dollar as it is a more primary driver of inflation and, therefore, interest rates.

Expectations are currently for NFPs to show a rise of 204k jobs in February from 200k in the previous month, and for earnings to have risen by 0.3% in February.

January's strong earnings data led to a rally in the Dollar after it sparked concerns about accelerated pay inflation, and there is a possibility of a similar reaction from the data out on Friday.

The Dollar rose on the back of higher inflation expectations because it tends to lead to higher interest rates which is a draw to foreign capital.

There is also some important data out on Monday for the Dollar, including Services Purchasing Manager Indices data (PMI) which is forecast to show a rise in activity in the sector to 55.9 in February from 53.3 in the previous month, when it is released at 14.45.

Data will also be released from the Institute of Supply Managers (ISM) for the non-manufacturing sector at 15.00 on Monday and is forecast to show a slight slowdown to 58.9 from 59.9 in February.

Both the ISM and the PMI indices are compiled from survey responses from key procurement managers in the sector in question and are regarded as reliable leading indicators for the economy.

A positive result would therefore boost the Dollar as it would raise future interest rate expectations.

Data and Events to Watch for the Pound

The Pound was largely unmoved at the end of last week as Prime Minister May delivered her 'road to Brexit' speech which offered little fresh information to investor.

The response from Europe has been mixed and there remains a question mark over whether the EU will sanction a transitional deal at its summit on March 23. A failure would to sanction a transitional period would be negative for the Pound, but markets appear to be willing to keep Sterling and the Euro stuck in the alread mentioned tight range until they get a clear steer on how talks are progressing.

In the week ahead there are reports the Chancellor Philip Hammond will also be making Brexit speech, focusing on the subject to a bespoke deal for the UK's dominant services sector. The UK has a services sector trade surplus with Europe so this could be important for the Pound, however, whether Hammond's proposals are likely to be accepted by Brussels is a different matter.

Staying on the topic of the services sector, the data highlight of the week comes in the form of IHS Markit's services PMI for February which will give a steer as to how well the sector performed.

Markets are looking for a reading of 53.3, which would be a shade up on January's 53.0. A beat on this estimate could give Sterling a nudge higher. A miss, the opposite effect.

However with the Brexit being the key driver of Sterling at present we would expect a large deviation on expectations in the data to move the currency; particularly against the Euro.

Watch Friday's Trade Balance data for January, which is forecast to show the deficit narrowing to -12.2bn from -13.6bn previously, when it is released at 09.30 GMT.

Industrial Production is out at the same time and is forecast to show a 1.1% rise month-on-month in January.

Manufacturing Production, also out at 09.30 on Friday, is forecast to rise by 0.2% in January compared to the previous month.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.