Dollar Woes: Traders are Looking at Long-Term Yields say Nomura

© kasto, Adobe Stock

The US Dollar's weakness in late 2017/18 was due to a radical shift in investor time-horizons when it comes to US treasuries suggests new research.

Despite finding its feet more recently it was not long ago that analysts were left perplexed by the Dollar's bout of weakness at the end of 2017 and start of 2018.

The fall went against logic - the Federal Reserve was aggressively raising interest rates at the time which is normally a reason to buy a currency not sell it, but the Dollar weakened regardless; with the most telling sell-off occurring after the December Fed meeting when the central bank raised interest rates by 0.25%.

The US Dollar appeared to have completely decoupled from interest rates. Normally the one is the shadow of the other as higher interest rates - or the expectation thereof - leads to a stronger currenc as it entices greater foreign capital inflows, drawn by the prospect higher returns; yet for once this did not seem to be the case.

The market abhors a vacuum - both physical and metaphysical - so a host of theories were born to explain the inexplicable.

One was 'RoW' which is the acronym for 'Rest of the World', which describes the theory that the Dollar was weakening and would continue weakening because RoW was strengthening. Investors would be attracted to the greater potential in RoW and jettison their investments in the US.

Another theory was the 'twin deficit' model, which explained Dollar weakness as a symptom of the country having both a trade and a budget deficit at the same time, which historically, so analysts argued, tended to lead to a weaker currency.

According to Nomura research analyst Bilal Hafeez, however, the weakness was due - not so much to an uncoupling from interest rate expectations per se - but more to a change in the time-horizon in which analysts were analysing those expectations.

Instead of being concerned with the immediate future, or even the next year, investors were now focusing more on the long-term.

The theory seemed to make sense in light of the excessive concerns relating to the US's terminal rate - or the eventual peak US interest rates would reach in the cycle - and that the peak would be lower than previously.

Investors' preferred time-horizon for analysing interest rates was now between 2 and 5 years, according to Hafeez.

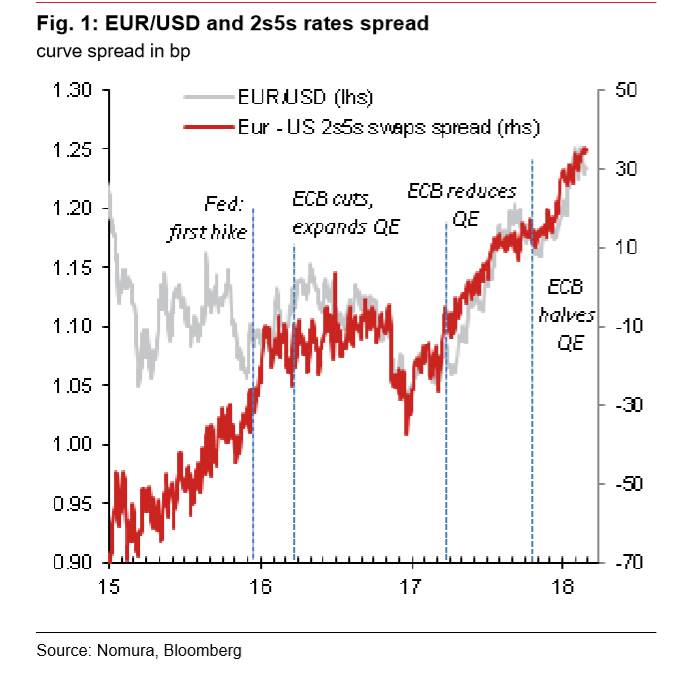

This could be modeled using the difference between two and 5 year US Treasury bond yields, which essentially results in a 2-5 year future interest rate expectation.

The difference between US 2-5 year yields and their foreign equivalents could even provide an indicator of the exchange rate since it is the difference between two interest rates which drives capital flows and affects currency valuations.

When the yield differential is overlaid on charts of EUR/USD it correlated extremely closely with the exchange rate (see below), apparently providing verifiable proof of Nomura's interest rate time-horizon dependent exchange rate theory.

It also explains why the Euro has risen so sharply versus the Dollar despite interest rates not budging in Europe compared to the US: the market is looking between 2 and 5 years ahead, which is when the ECB is expected to be raising interest rates at its most aggressive rate, and the Fed conversely will probably have stopped raising rates, having perhaps by then reached the terminal rate.

"FX markets seem to have become very forward-looking, shrugging off near-term hikes and instead focusing on hikes further down the line," says Hafeez.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here