Pound-to-Dollar Rate Forecast for the Week Ahead

© kasto, Adobe Stock

GBP/USD is resuming its uptrend and the next week could therefore deliver better levels for those looking to purchase Dollars.

Although Sterling suffered some weakness last week due to Brexit jitters it made a strong comeback after the Dollar continued weakening.

At the start of the new week the Pound-to-Dollar exchange rate is quoted at 1.4005, having opened at 1.4031, so we are seeing a fair pullback towards the 1.40 level taking place at the start of the London trading session.

Looking at the chart of the pair however, we note that the exchange rate is in an established uptrend and has been progressing inside a rising channel since the start of the year.

Despite selling off and correcting lower after forming a small reversal pattern at the recent highs the pair has recovered and started going higher again, and we now expect the uptrend to resume.

The four-hour interval chart below provides us with a more detailed picture of the recent pull-back and the recovery.

We next expect to see a break above the trendline joining the January and late February highs.

We would require a move above 1.4200 for confirmation of a continuation higher to the next target just beneath the upper channel line at 1.4300.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Data and Events to Watch for the Dollar

The big release for the Dollar in the week ahead are the minutes from the last Federal Reserve Open Market Committee (FOMC) meeting held on January 31.

The minutes are important because they provide a deeper insight into the thinking processes of the members of the FOMC who vote on whether to raise or lower interest rates, and interest rates are a major driver of currencies as the higher they are the more inflows of foreign capital they tend to attract.

The minutes are expected to support current expectations that the Fed will hike interest rates aggressively in the year to come.

"Fed fund futures are pricing in 100% chance of tightening in March. Next week's FOMC minutes will reinforce those expectations as the central bank upgraded their inflation outlook and touted the improvements in the economy at their last meeting," says BK Asset Management Managing Director Kathy Lien.

On the theme of the Fed and its policy outlook, the Dollar may also be impacted by Fed commentary in the week ahead as a great many members are scheduled to speak.

Fed's Quarles, Bostic, Dudley, Williams, and Mester (all voting members) are all scheduled to speak and their words could have a noticeable impact on Dollar movements.

Data and Events to Watch for the Pound

The Brexit related news will likely be the key driver of any big Sterling moves from a domestic perspective we believe.

"Faced with widespread criticism that the government’s plans for the next phase of Brexit talks are, at best, unclear, PM May and several ministers are set to deliver a series of speeches seeking to clarify the government’s position, demonstrate that the Cabinet is unified and provide some impetus to allow PM May to move forward with transitional phase talks with Brussels," says Victoria Clarke, an economist with Investec.

Clarke says we can expect a more substantial speech from May and other key Brexit ministers, probably following the planned gathering of the Cabinet at Chequers.

"For sterling and UK focused investors more broadly, that speech will be key in shaping sentiment amidst rapidly waning optimism that the UK will be able to reach a transitional arrangement deal over the coming weeks or even months," says Clarke.

© freshidea, Adobe Stock

Datawise in the week ahead December and January unemployment data is the most significant release for the Pound.

Average earnings (ex-bonuses) for the three months to January are released on Wednesday, February 21, at 9.30 GMT and are forecast to show a 2.4% rise compared to the same 3-month period a year ago; earnings including bonuses are forecast to show a 2.5% rise.

A higher-than-expected result would put upside pressure on the Pound.

Higher wages mean higher inflation which leads to central banks putting up interest rates. Higher interest rates drive up the value of Sterling because they attract greater inflows of foreign capital drawn by the promise of higher returns.

The unemployment rate in December is released at the same time and expected to remain unchanged at 4.3%.

If it drops it will be positive for the Pound as lower unemployment generally leads to higher wages as fewer job-hunters means there is less competition.

"One headwind for U.K. economic growth is that real disposable income growth weakened over the course of 2017," say analysts at Wells Fargo.

"That may be poised to change as the downward trend in the unemployment rate may eventually result in a pickup in disposable income," they continue, adding:

"That is the reason the financial market in the United Kingdom will be paying particularly close attention to the release of the latest unemployment figures on Wednesday of this coming week."

The second estimate of GDP in the last quarter of 2017 is out on Thursday at 9.30 and is forecast to slide to 1.5% compared to a year ago, from the first estimate's 1.7%.

On a quarterly basis, it is forecast to rise 0.5% from 0.4% previously.

If it falls markedly it would be negative for Sterling as lower growth generally lessens the likelihood the Bank of England (BOE) will raise interest rates. It also lessens inflows from outside investors who tend to choose to put their money in fast-growing economies.

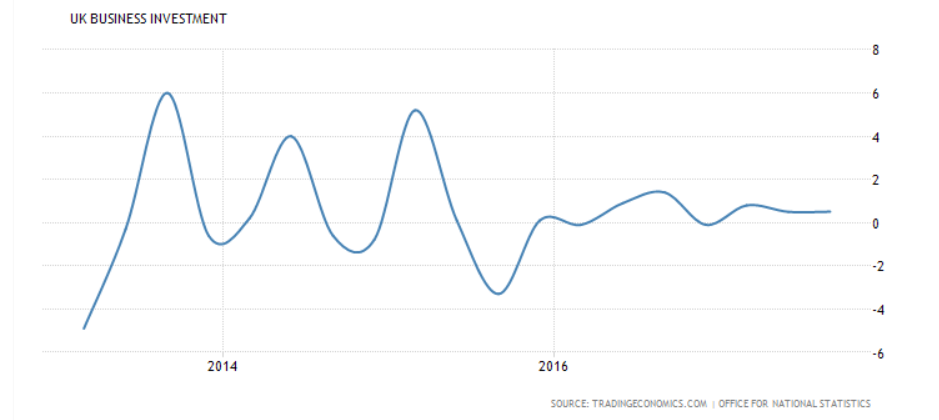

Business investment is a key gauge of confidence and growth in the economy.

Is is also extremely sensitive to Brexit politics as shown by the chart below, which shows a market slowdown post-referendum, as companies put big projects on ice until after clarification on the UK's new relationship with Europe.

(image courtesy of tradingeconomics.com)

The level of business investment in Q4 2017 will also be revealed in data out at the same time as GDP and is estimated to show continued growth of 0.5% quarter-on-quarter.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.