GBP/USD Rate Eyes 1.30 Next

The next stop for the GBP/USD exchange rate is likely to be the big resistance level located around 1.30 we are told.

The call comes as we see Pound Sterling surge higher against the majority of major currencies on news the UK will witness a general election on June 8.

In an unexpected move Prime Minister Theresa May said the time was right to go to the country and ask for a firm mandate to push through her vision of Brexit.

Most commentators see it as a way of cementing her legitimacy AND gaining the upper hand against those 'hard-Brexiteers' within her own party.

Markets have bid up the Pound on the view that May can dispense with those seeking a hard-Brexit should she secure a landslide win.

“Next stop 1.30,” says Aurelija Augulyte, an analyst with Nordea Markets in relation to the Pound’s potential next steps.

Our most recent technical studies confirm GBP/USD to be still rising towards the upper border of a large symmetrical triangle which has been forming since the rebound off the October lows.

It is probably completing its ‘e’-wave, which could be its final wave as triangles have a minimum of five waves (a-e) and rarely more.

A symmetrical triangle is one in which both the borders are angled and contrasts with a right-angled triangle.

Unlike right-angled triangles symmetrical triangles give no hint as to the eventual direction of the breakout, so we cannot be sure whether it till breakout higher or lower.

The exchange rate will encounter tough resistance if it rises to touch the upper borderline and it will probably stall, if not rotate.

"The market continues to trade very well, after holding support in the 1.2350 region a week or so ago. We do still need to push through triangle resistance around 1.2625 to open a shift up to re-test more important resistance in the 1.2800-1.3000 region," says Robin Wilkin, a technical analyst with Lloyds Bank.

Additional resistance to further upside is expected to come from the 200-day moving average which is at the same level as the borderline.

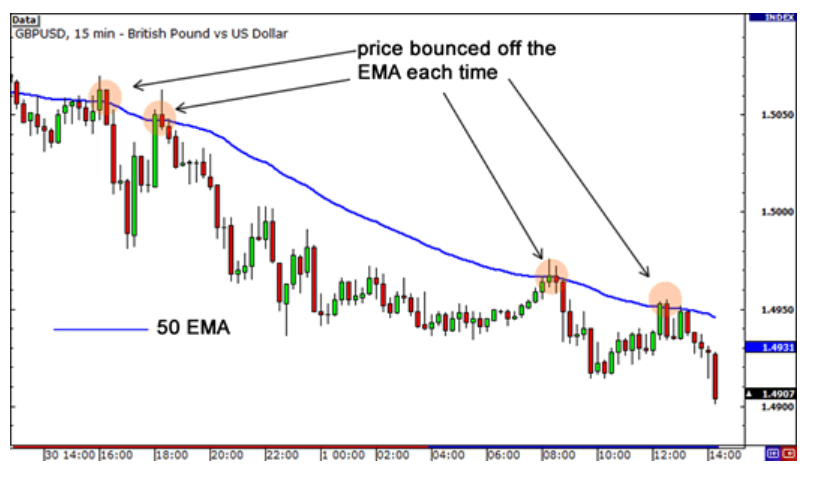

Large moving averages like the 200-day often repel exchange rates offering support and resistance contrary to the direction of the trend – they can, in fact, be difficult to overcome.

Note, for example, in the picture below how a form of weighted moving average called an exponential moving average, or EMA, repels successive recoveries in GBP/USD.

As such it may be difficult for the pair to rise above the upper borderline and MA and breakout of the triangle, and there is a possibility it could fall back lower.

Today’s gap higher is probably due to a lack of liquidity during the low holiday trading volume, although it is also a positive sign for the pair.

Only a break clearly out of the triangle and through the 200-day MA could confirm a bullish breakout, however.

A move above 1.2700 might provide the necessary confirmation, and lead to a rally, initially to 1.2900, although eventually possibly as high as 1.3200, since the triangle is large and the breakout should also travel fairly far too.

Data Ahead for the Dollar

Housing is said to ‘lead the economy’ so economists watch it closely – a strong rise or fall will be weathercock for the trajectory of the overall economy.

During this week Housing data plays a big role, starting with both Building Permits and Housing Starts, for March, out on Tuesday, April 18 at 13.30 GMT.

Building Permits are forecast to rise to 1.245 million from 1.216, and Housing Starts fall to 1.264m from 1.288.

Existing Home sales is then out on Friday, April 21 at 15.00 GMT, and is forecast to show a 2.0% rise in March from February.

Another major release will be the Philadelphia Fed Manufacturing Index in April, out at 13.30 on Thursday, April 20. It is forecast to fall to 26.9 from 32.8.

The Dollar has lost ground on a combination of falling Retails Sales – which showed a decline for the second month in a row, dropping -0.2% in February, last Friday, Trump’s negative Dollar rhetoric and geopolitical risk aversion.

These, especially the slower Retail Sales - which is expected to lead to a lower GDP result for Q1 – will now probably make the Federal Reserve delay raising interest rates in June.

“Friday’s reports pretty much guarantee that the next Fed move will be in September and not June as the weakness of spending will weigh on first quarter GDP growth. Fed fund futures are currently pricing in a 56.7% chance of a rate hike in June and a 76.3% chance of a hike in September,” said Kathy Lien, managing director of BK Asset Management.

As such any commentary from Fed officials adding evidence to Lien’s hypothesis of a delay in raising rates might weigh even more on the Dollar.

Retail Sales Data Dominates Weekly Agenda for Sterling

The main data release for the Pound this week will be March Retail Sales, on Friday, April 21 at 9.30 GMT.

Expectations are not optimistic about the result after recent data from the British Retail Consortium (BRC) disappointed.

Analysts forecast headline sales to fall -0.2% compared to the previous month but to rise by 3.6% from the previous year.

Core retail sales expected to fall -0.3% from February and rise 4.0% year-on-year.

“U.K. retail sales are scheduled for release in the week ahead and while the uptick in wages points to a potential upside surprise, the British Retail Consortium reported weaker spending and after last month’s healthy rise, a pullback is expected. There’s significant resistance for GBP/USD between 1.25 and 1.2630,” says Kathy Lien, managing director of BK Asset Management.